S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

30 Nov, 2023

By Samantha Lipana

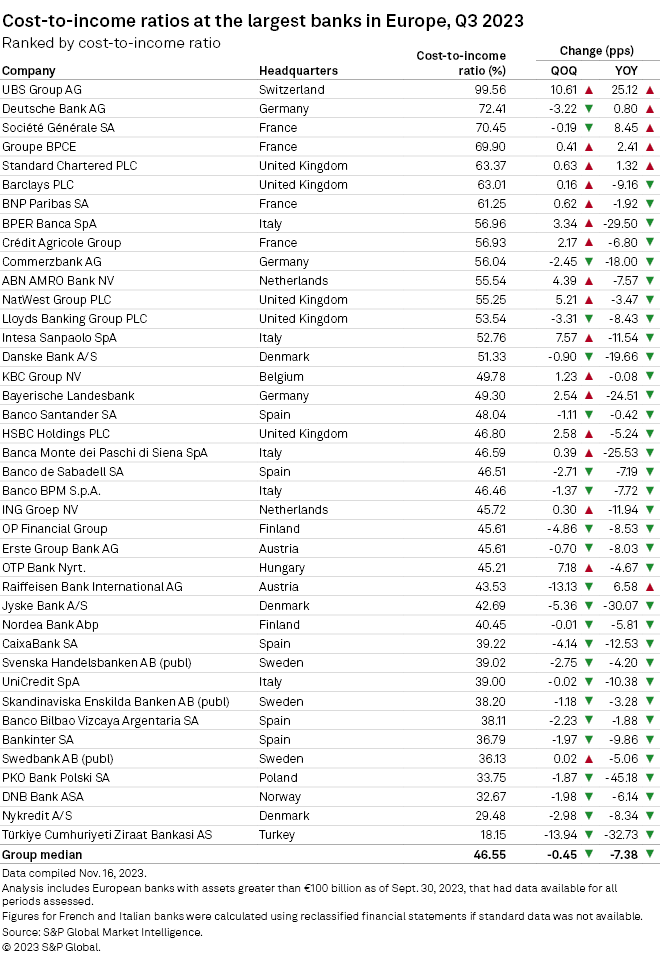

UBS Group AG emerged as the least cost-efficient European bank in the third quarter of 2023, S&P Global Market Intelligence data shows.

The Swiss bank recorded a third-quarter cost-to-income ratio of 99.56%, representing a 10.61-percentage-point increase from the previous quarter.

UBS posted a third-quarter net loss attributable to shareholders of $785 million, compared to a $1.73 billion profit booked a year ago. Operating expenses surged 91% to $11.64 billion due to the ongoing integration of Credit Suisse, which the bank is aiming to complete and transition to a single US intermediate holding company by the first half of 2024.

Deutsche Bank AG, the largest lender in Germany, recorded a 72.41% cost-to-income ratio during the quarter. The lender, which was the second quarter's least cost-efficient bank, improved its ratio by 3.22 percentage points despite logging an 8% drop in its third-quarter net profit attributable to shareholders to €2.95 billion.

French banks Société Générale SA and Groupe BPCE took the third and fourth spot in the rankings with ratios of 70.45% and 69.90%, respectively.

UBS had the highest quarterly increase in cost-to-income ratio among banks in the sample, followed by Italian lender Intesa Sanpaolo SpA with a 7.57-percentage-point increase and Hungary's OTP Bank Nyrt, which posted a 7.18-percentage-point increase in its ratio to 45.21% despite booking an almost 50% increase in third-quarter net profit.

Most of the 40 European banks sampled improved in terms of cost efficiency quarter over quarter. Of the total, 16 banks underperformed in efficiency, including four of five UK banks on the list.

Türkiye Cumhuriyeti Ziraat Bankasi AS was the most efficient lender among the sampled banks with a 13.94-percentage-point decline in its third-quarter efficiency ratio to 18.15%.

Austrian-based Raiffeisen Bank International AG had the second-highest quarterly decline in the ratio of 13.13 percentage points to 43.53%.

On a national scale, banks headquartered in France and Turkey recorded higher average cost-to-income ratios in 2023 than in 2022.