S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Jun, 2021

By Stian Overdahl

A new capital rule for banks incorporated in the United Arab Emirates will likely add pressure on smaller banks and may drive further consolidation in a market seen as overbanked, say analysts.

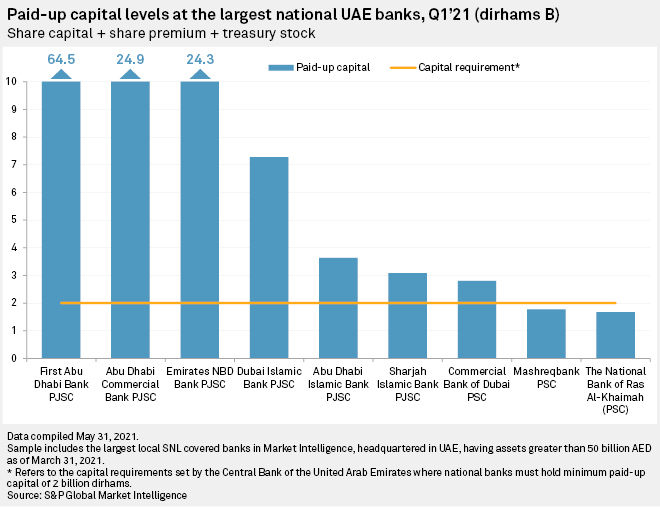

The new rules, which come fully into force by 2023-end, will require local banks to have a minimum of 2.00 billion dirhams of paid-up capital. Banks designated as specialized lenders, which can offer a restricted range of services and have total assets capped at 25 billion dirhams, will only need 300 million dirhams.

The rules do not affect existing risk-weighted capital requirements. Banks incorporated in financial freezones such as the Abu Dhabi Global Market, or ADGM, will not be impacted by the new rules, according to a representative.

While most of the country's larger banks will easily meet or exceed the 2.0 billion dirham requirement, some smaller banks may struggle, including some that have recorded significant losses or declining profitability over the past year.

"We consider that the increase in minimum paid-up capital by the UAE Central Bank is adding another layer of pressure on banks to build scale and to continue the consolidation trend of the past years," said Aurelien Vincent, a partner at Strategy&, part of PwC.

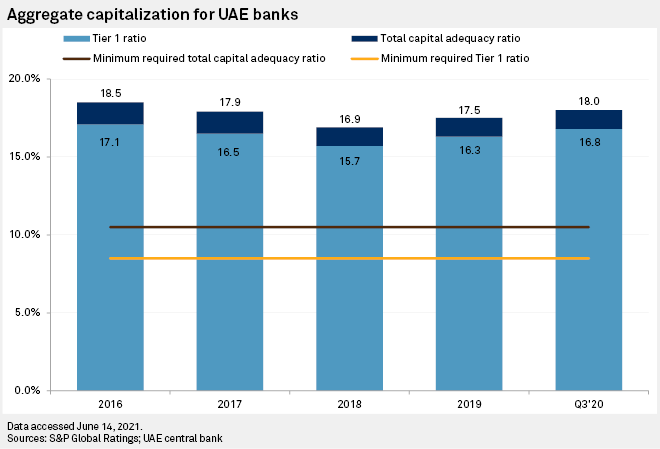

Overall, "[the] UAE banking industry has demonstrated a high level of resilience since the beginning of the COVID-19 crisis, with very solid capitalization and healthy liquidity ratios," said Vincent.

Nevertheless, profitability has been hit by almost half — with a couple of banks in the red in 2020 — on the back of rising cost of risk, he said. "We believe [this trend] may accelerate further in 2021 for the most exposed players."

The ways that banks in other markets have responded to similar rules hiking paid-up capital may provide a clue to how UAE banks are likely to respond.

"What we have seen in other countries where the minimum capital has been increased are measures such as transferring capital from retained earnings to the share capital to increase it, or it may push some movement for consolidation among smaller banks in the banking system," said Mohamed Damak, global head of Islamic finance at S&P Global Ratings in Dubai.

Despite significant mergers already having taken place in recent years, the UAE remains overbanked with around 48 commercial banks serving a population of about 9.5 million, said Damak.

In a report in April, Ratings said expected lower profitability and even losses for some banks with high-risk exposures "could provide the impetus for further banking system consolidation."

Vincent identifies two types of M&A transactions that are likely.

The first are "large mergers driven by top country leadership aiming at building regional or international champions, capturing efficiency improvements and growing profitable scale."

Secondly, "smaller acquisitions of disruptive, innovative players in niche areas as a result of the pressure from fintechs on incumbents to protect market share and invest for growth, for example in the open banking space," he said.

Overbanked but well capitalized

A number of banks that list paid-in capital below the threshold nevertheless have total equity well above 2.00 billion dirhams. This includes Mashreqbank PSC, with a total capital of 21.69 billion dirhams, The National Bank of Ras Al-Khaimah (PSC) at 7.96 billion dirhams, and the National Bank of Umm Al-Qaiwain (PSC) at 4.42 billion dirhams.

Examples of banks below the 2 billion dirham mark include Emirates Investment Bank PJSC, with share capital worth just 70 million dirhams and total capital of 493 million dirhams at 2020 year-end. Invest Bank PSC, which despite having 3.3 billion dirhams in share capital reported a net equity position of 909.82 million dirhams at the end of 2020, with accumulated losses totaling around 1.75 billion dirhams.

Banks in the UAE are already required to bolster their balance sheets with a legal reserve equivalent to 50% of the bank's paid-in capital, which it must add to at a rate of 10% of net profits per year if the reserve falls below 50% of paid in capital.

Foreign banks will also be required to hold fully paid-up capital of at least 100 million dirhams at the level of the branch, and eligible capital of least 2 billion dirhams or equivalent at the entity level. There are 27 foreign banks registered in the UAE, according to central bank data published in April.

A representative for the UAE Central Bank described minimum level of capital set as "carefully balanced, taking into account the objective to ensure banks operating within the sector are strong and resilient, at the same time, ensure new entrants can enter the market and enhance competition in the sector."

"In developing this new regulation, we carried out a comprehensive regulatory impact assessment on the sector and the individual banks. For those small number of banks that may need to increase their paid-up capital to meet the new requirements, the CBUAE has provided a long transition timeframe of three years to facilitate this," a central bank representative told S&P Global Market Intelligence.

New digital banking entrants

The new regulations also provide additional requirements for new licensing of banks, including the potential for higher minimum capital requirements for new players.

While new digital banks have sprung up in major banking markets around the world, in the UAE neobanks created by established players such as Emirates NBD Bank PJSC and Mashreq are the most visible digital banking brands, though a number of startups have also made inroads, some even signing partnership deals with traditional banks.

That may be set to change, with at least two new stand-alone digital banks having declared they expected to begin operations once they receive full approval: In 2020 First Abu Dhabi Bank PJSC sold a legacy banking license to ADQ, an Abu Dhabi investment firm that announced plans to launch a stand-alone digital bank — FAB will own 10% with the option for an additional 10% stake if the outfit goes public.

In April 2021 Emirates NBD announced the sale of a controlling stake in one of its legacy outfits, Dubai Bank, to Eradah Capital LLC, the company behind Zand Bank, which intends to offer retail and commercial banking services as a stand-alone digital bank, headed by Dubai businessman Mohamed Alabbar.

It comes as incumbents have accelerated their digital investments in the past 18 months "to cope with both bold, quick competitors' and pure players' moves and rapidly evolving customers' expectations," said Vincent.

"If very few of the new entrants in the UAE banking industry, including neobanks or more niche players, have been able to prove their ability to last in a sustainable way in the UAE financial services landscape, most of them have been able to disrupt the industry and force incumbents to innovate, invest and build relevance in fast-growing, digital-savvy customer segments," he said.

UAE banks currently have capacity to protect their base business and capture future growth opportunities "as long as they adapt their organization, culture and way of working to cope with the fast-changing customer expectations and competitive pressure," he added.

As of June 15, US$1 was equivalent to 3.67 United Arab Emirates dirhams.