S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Apr, 2022

By Nathaniel Melican and David Hayes

The financial success of recent de novo banks could encourage new bank formation in 2022.

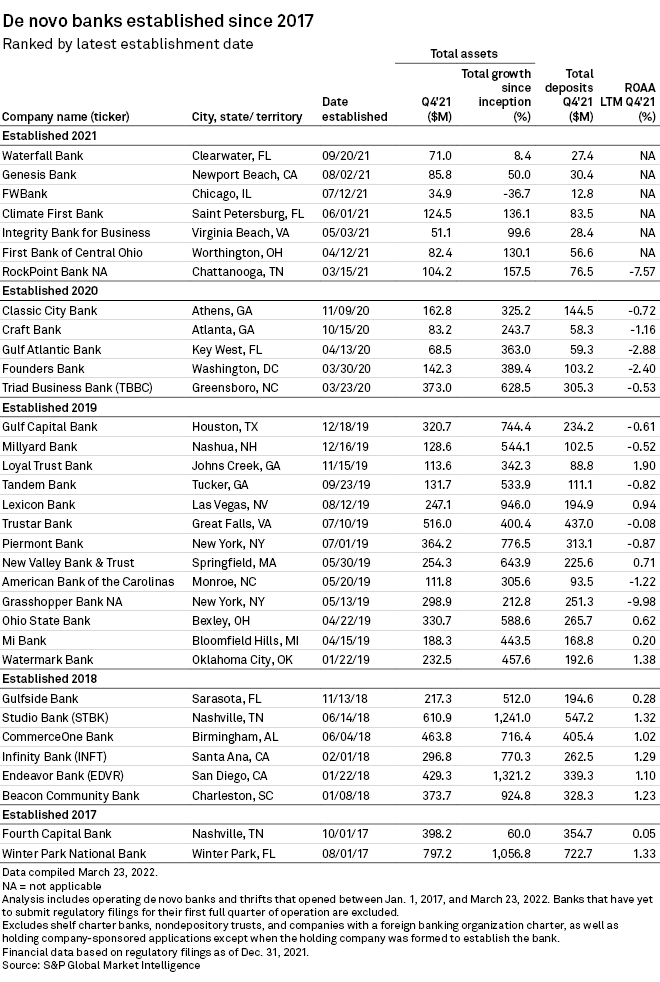

For this analysis, S&P Global Market Intelligence looked at all operating de novo banks established between 2017 and 2021, excluding shelf charter banks, nondepository trusts, companies with a foreign banking organization charter and newly formed holding companies, unless the company was formed to establish the bank.

De novo activity in recent years

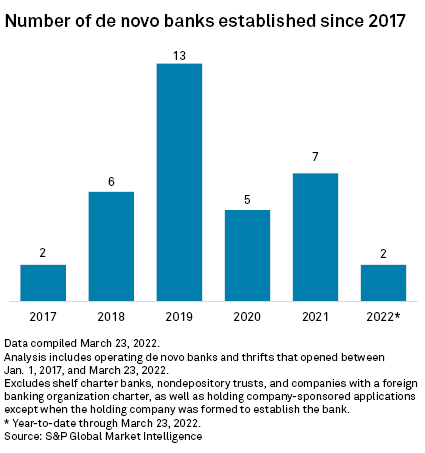

De novo activity dropped in 2020 due to the uncertainty induced by the onset of COVID-19 but has since trended higher and is off to a strong start again in 2022.

Of the 33 de novo banks established between 2017 and 2021, 27 have been open for at least 12 months. Fourteen of those 27 banks were profitable in 2021.

|

De novo profitability

Not surprisingly, the newest banks were the least profitable. None of the banks established from 2020 onwards were profitable in 2021, but all eight of the banks established between 2017 and 2018 were in the black. Meanwhile, six of the 13 banks established in 2019 were profitable in 2021.

Established in November 2019, Johns Creek, Ga.-based Loyal Trust Bank reported a 1.90% return on average assets in 2021, making it the most profitable de novo bank in this analysis. At the end of 2021, slightly more than two-thirds of Loyal Trust's loans were concentrated in nonfarm/nonresidential commercial real estate, while another 25% were commercial and industrial loans.

Another member of the class of 2019, Oklahoma City-based Watermark Bank, posted the second-highest ROAA at 1.38%.

Winter Park, Fla.-based Winter Park National Bank, which was both the oldest and the largest bank in this analysis by assets, came in third with an ROAA of 1.33%. With $797.2 million in assets at year-end 2021, Winter Park is already the 36th-largest bank among Florida's 94 commercial banks or thrifts headquartered in the state.

In contrast to Loyal Trust Bank, Winter Park's loan portfolio is more geared toward residential housing. At the end of 2021, one- to four-family mortgages accounted for roughly 31% of Winter Park's loan portfolio while construction and land development loans accounted for another 13%.

At the other end of the spectrum, New York-based Grasshopper Bank NA's -9.98% ROAA was the largest loss among the 27 banks analyzed. Established in May 2019, Grasshopper is a digital bank focused on small businesses, startup companies and "investors in the innovation economy."