Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jul, 2022

Twitter Inc. and Snap Inc. are facing operational and legal risks that make the social media companies more vulnerable to a weakening digital advertising market, analysts said.

Despite attempts to innovate in their product offerings, Wall Street analysts say stumbles with monetization and execution are weighing on the revenue growth of both companies, as demonstrated in recent lower-than-expected second-quarter earnings. Twitter faces the additional challenge of a high-profile legal battle with Elon Musk over the tech billionaire's proposed — and then rescinded — $44 billion offer to buy the microblogging platform.

"We're hearing the same story from everybody, that engagement continues to grow," said Robert Cantwell, founder and portfolio manager of Upholdings and Compound Kings ETF, a private equity fund. "A lot of them built engagement before they built monetization … That's why their stock swings so radically. Investors have an incredibly hard time valuing a business like that, that doesn't make any money."

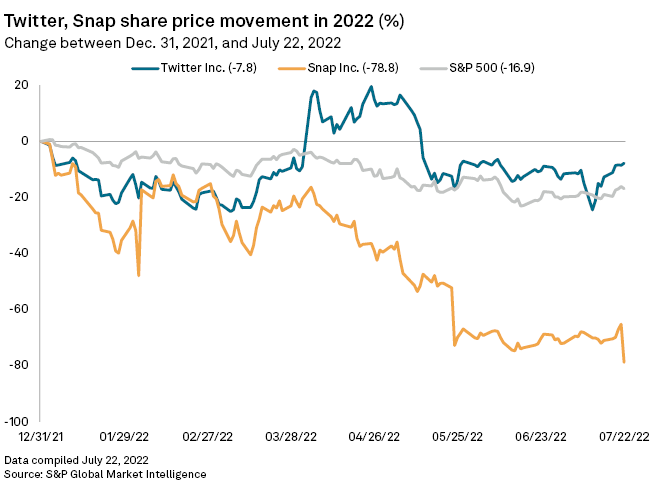

Shares in Twitter ended trading July 22 down 7.8% for the year to date, which still reflected some of the gains it saw earlier in the year following the Musk deal announcement. Snap, meanwhile, was down 78.8% over the same period, well below the performance of the S&P 500.

Show me the innovation

Snap is experimenting with several new product offerings as it looks to grow revenue and engagement. The company launched a subscription plan, Snapchat+, on June 29. Snapchat+ charges users $3.99 per month for access to expanded features like custom app icons and story replay metrics.

While it is important for Snap to find additional revenue streams, the effort is not without risks.

"They're adding unnecessary friction, perhaps, as they try to broaden their user base and increase engagement," said Scott Kessler, global sector lead for technology, media and telecommunications at Third Bridge. The analyst noted that rival platforms including Meta Platforms Inc.'s Instagram and Beijing Byte Dance Telecommunications Co. Ltd.'s TikTok Inc. have succeeded without a subscription model.

A Snap spokesperson declined to answer written questions in an email to S&P Global Market Intelligence and instead included details from a news release about the company's new desktop app, Snapchat for Web, which debuted July 18. Snapchat for Web will be available to Snapchat+ subscribers initially before it is released to all users.

Snap is also working with brick-and-mortar retailers on an augmented reality shopping platform.

Even before TikTok, Twitter attempted to launch its own video offerings, but the efforts to date have not succeeded. Twitter bought short-form video app Vine in 2012 and shut it down four years later. Similarly, Twitter acquired live-broadcasting app Periscope in 2015 and shut it down in 2021, citing declining engagement.

"I think that, as a microcosm, speaks to what some of the challenges have been for the company," Kessler said. "They have a lot of the right instincts, they make a lot of the right initial moves, and then they get distracted, or execution becomes a problem, and, they abandon something that may have eventually turned into something big."

Advertising woes

For the second quarter, Snap said revenue increased 13% to $1.11 billion, the slowest growth rate in its history as a public company. Snap also reported a net loss of $422.1 million, versus a prior-year net loss of $151.7 million.

"While the continued growth of our community increases the long-term opportunity for our business, our financial results for Q2 do not reflect the scale of our ambition," company executives said in a July 21 letter to investors. "We are not satisfied with the results we are delivering, regardless of the current headwinds."

Snap depends on a smaller pool of advertisers than its competitors, and its advertisers are concentrated in consumer packaged goods and native applications in gaming, streaming, cryptocurrencies and gambling.

"When 1-2 key categories pull back ad spending, pricing and ad auction dynamics lead to a more rapid deterioration in ad revenue growth," Morgan Stanley research analyst Brian Nowak wrote in a research note following the company's quarterly results.

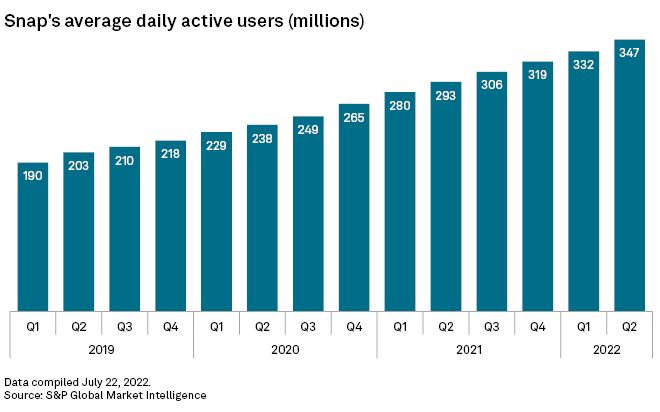

Snap added 15 million daily active users worldwide during the second quarter and 59 million year over year, or a growth rate of 18%.

For some analysts, this continued user growth offers a silver lining.

"We believe an ad recession is largely priced in the stock," wrote Bank of America equity research analysts Justin Post and Nitin Bansal in a research note. "We remain constructive on the stock given Snap's leading user growth, under-monetized surfaces, and long-term ARPU expansion opportunity."

Twitter's Musk dilemma

As for Twitter, the company's biggest overhang is its pending $54.20-per-share sale to Musk. The Tesla Inc. CEO announced his intention to terminate the deal agreement in July. The company is fighting the termination, and a judge granted Twitter's request for an October trial. Twitter's stock was down almost 43% for the 12 months ended July 22.

"While it is impossible to decipher the exact impact Musk's actions have had on Twitter," CFRA Research senior equity analyst Angelo Zino wrote, "we think results do provide additional support that [Musk] has had a notable detrimental impact on the company's fundamentals, which should provide greater leverage for Twitter in court."

Twitter reported $1.18 billion in second-quarter revenue, a 1.7% decrease from the previous quarter and a 1% year-over-year decline. The company attributed ad industry headwinds and uncertainty surrounding Musk as factors that led to Twitter's subpar results in a July 22 news release. Twitter reported almost 238 million monetizable daily active users worldwide, a 15.5% year-over-year increase.

Notably, analyst target prices remain well below the per-share value of Musk's initial offer.

After Twitter reported earnings, Zino maintained his "hold" rating on the stock while raising his 12-month target price on the stock to $42 from $33. Wedbush Securities analyst Dan Ives kept his "neutral" rating for Twitter, with a 12-month target price of $30.

Moffett Nathanson analyst Michael Nathanson dropped his 2022 ad revenue projection by 7% to $4.98 billion, with a target price of $34. Nathanson's target price would dip to $14, he wrote, if the Musk deal were to fall apart.