S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Mar, 2021

By Mohammad Abbas Taqi and Matt Smith

YapıKredi and Deniz are among the privately run Turkish lenders with foreign ownership.

Non-state Turkish lenders are better placed than state banks to navigate 2021 as they are less sensitive to interest rate fluctuations and have built up significant cushions to protect themselves from loan losses resulting from the pandemic, analysts said.

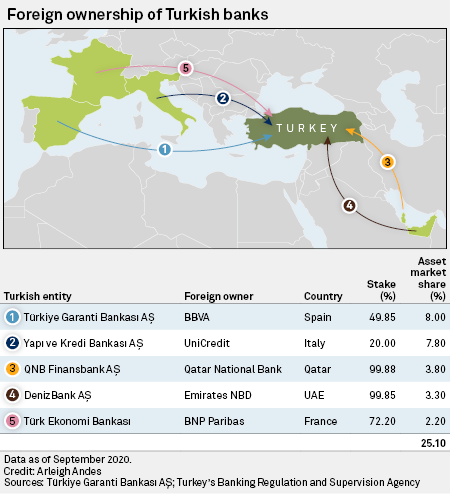

Turkey is an attractive market for several large European and Middle East lenders, which have a presence in the country through subsidiaries. Spanish bank Banco Bilbao Vizcaya Argentaria SA, for example, generated 16% of its total gross income through its Turkish operation, Türkiye Garanti Bankası AŞ. Other foreign lenders with units in Turkey include Italy's UniCredit SpA and the Middle East's largest bank by assets, Qatar National Bank (QPSC).

The four largest non-Turkish-state lenders, or privately run banks, by assets in Turkey are Garanti BBVA, Akbank TAŞ, Yapı ve Kredi Bankası AŞ and QNB Finansbank AŞ, and they hold more than a quarter of bank sector assets, according to a Garanti presentation. The three biggest state-owned banks — T.C. Ziraat Bankası AŞ, Türkiye Halk Bankası AŞ and Türkiye Vakıflar Bankası TAO — have a combined 37.1%.

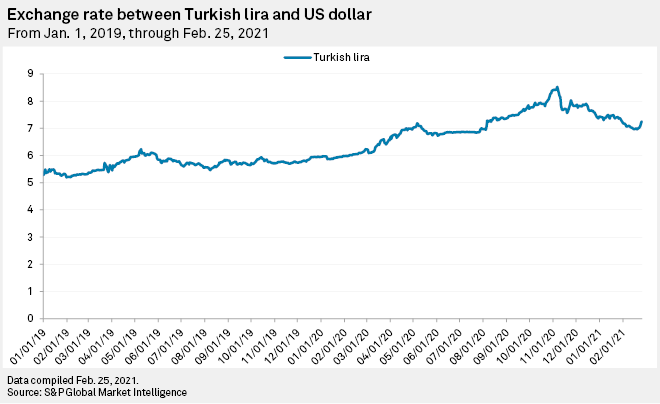

In response to the pandemic, Turkey's central bank slashed interest rates to around 8%, extending cuts from mid-2019's peak of nearly 25% and introduced various measures to better support an economy. But sustained hikes in interest rates — the benchmark rate is now 17% — has sapped demand for new loans.

"We're seeing a significant deceleration in lira lending growth — all banks are seeing less demand for borrowing because of high interest rates," said Sevgi Onur, vice president and banking analyst at Seker Invest in Istanbul.

The first quarter of 2021 will be banks' weakest this year in terms of their net interest margins, she said.

"We favor private banks in 2021 because they are more resilient to interest rate sensitivity," said Onur, predicting private banks net interest margins will shrink 50 basis points, while those of state banks will contract 100-120 basis points in 2021.

"This is a major differentiating factor. In terms of profitability, private banks are in better shape because they built up huge provisions prudently last year and so could reverse some of these in 2021."

Interest rates

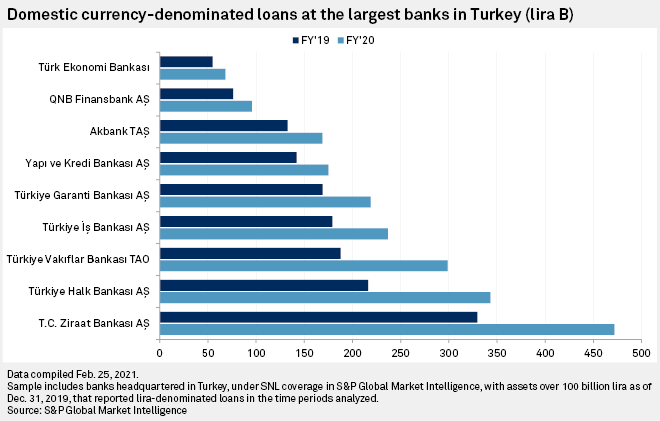

Lower interest rates in 2020 prompted corporate and individual customers to increase their borrowing, with state banks especially aggressive in expanding their loan books.

The contrasting profit performance was largely due to differences in net interest income, said Onur. State-run banks enjoyed lower deposit costs than their privately owned rivals, but she said this advantage is not sustainable.

"Compared with other emerging markets, Turkey's banks did very well last year despite setting aside huge provisions," said Övünç Gürsoy, research director at Istanbul's Oyak Securities.

State-run banks were the main cause of this earnings surge as their annual profits grew by a combined 57% in 2020, according to Seker Invest.

Foreign-owned banks underperformed in comparison; Garanti BBVA made an annual net profit of 6.31 billion lira, up 2.3% on 2019. QNB Finansbank, a unit of QNB, reported a 5% decline in annual net income to 2.49 billion lira. YapıKredi reported a 41% rise in annual net profit to 5.1 billion lira.

Turkey's major banks expanded their local-currency lending year over year in 2020, according to S&P Global Market Intelligence data, while lending in foreign currencies shrank over the same period.

Garanti forecasts its lira-denominated loans will increase by around 15% in 2021, although foreign-currency lending will contract further. These estimates are based on Turkey's GDP increasing 5% and inflation rising 10.5% over the course of 2021.

"Corporate clients don't want to borrow in foreign currencies anymore. Many changed their borrowings to lira," said Gürsoy.

The lira's volatility prompted this switch so that companies could reduce their risk, especially with little need for them to source project financing this year. Gürsoy expects banks' combined foreign-currency loan book to shrink 1% to 2% in 2021, following a 3.2% contractionin 2020.

"There's not much demand, but if there's a good spread of course banks are still interested in [foreign exchange] lending," said Gürsoy.

"Bank sector loan growth will return to normal — about 15% to 20% in 2021 — with state banks' loans to grow less than that after such a huge increase last year."

Double-digit loan growth is typical in Turkey, where over 40% of Turkey's population remains unbanked and more than half the population is under 35.

As of March 5, US$1 was equivalent to 7.55 Turkish lira.