Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2022

By Karin Rives

|

The $1 billion Petra Nova carbon capture project received $195 million in federal funds and has been idle since 2020. |

In early 2019, the city manager of Farmington, N.M., delivered exciting news about the San Juan power plant, which at the time was set to retire in 2022. The city had hired a Washington law firm to market the aging coal-fired facility and within weeks, a little-known New York City hedge fund, Acme Equities, was chosen to transform and revitalize the plant.

The plan drew support from the federal government. Former U.S. Deputy Secretary of Energy Mark Menezes traveled to New Mexico to talk about the San Juan carbon capture project at a roundtable discussion with the hedge fund's development firm, Enchant Energy, and staff of the city Farmington, which is southeast of the power plant.

"This would absolutely be a game changer, propelling them to world leadership in [carbon capture, utilization and storage] application," Menezes said in October 2020. "It is our hope that Enchant Energy gets the green light to activate its plans."

But less than two years after the meeting, that optimism has largely fizzled out. San Juan's majority owner and operator, PNM Resources Inc. utility subsidiary Public Service Co. of New Mexico, is planning on closing the last operating unit, the 507-MW Unit 4, by the end of September and is taking steps to demolish the facility as required by a 2021 county ordinance. The San Juan mine, which served the coal plant, stopped production earlier in September and is also set to close.

The San Juan plant is not the only carbon capture project receiving funds from the federal government that has struggled to become operational. With a lot more money coming, how the U.S. government allocates it will be critical.

A question of accountability

A 2021 report from the U.S. Government Accountability Office found that the federal government has invested $1.1 billion on carbon capture and storage demonstration projects at coal-fired power plants since 2009, but with little success.

At the San Juan plant, the U.S. government provided $25 million in grants to study the feasibility of transforming the plant into a carbon capture project and exploring wells in northwestern New Mexico where the carbon would eventually be injected.

The U.S. Energy Department initially committed to eight coal projects, mostly new power plants with carbon capture equipment. But seven were never built, largely due to factors that made coal-fired generation less economically viable. The DOE also spent nearly $300 million more than planned on four facilities that were never built after senior management directed the department to bypass some cost controls, according to the GAO audit.

With the passage of recent federal legislation, a lot more federal money is on the way to study and test carbon capture technology, including at several other coal-fired plants.

On Sept. 23, the DOE announced $4.9 billion in new carbon capture project funding, $2.5 billion of which is earmarked for demonstration projects "at fossil energy power plants and major industrial sources." In all, Congress approved $12.1 billion over five years for the agency's carbon management program under the bipartisan 2021 Infrastructure Investment and Jobs Act.

All that potential spending has led to calls for more accountability when the projects do not pan out.

"The government must be pushed to learn lessons from prior spending programs," Simon Nicholson, director of American University's Institute for Carbon Removal Law and Policy, wrote in an email. "In this case, that means being highly skeptical about investments attached to fossil fuel facilities that are nearing the ends of their working lifespans."

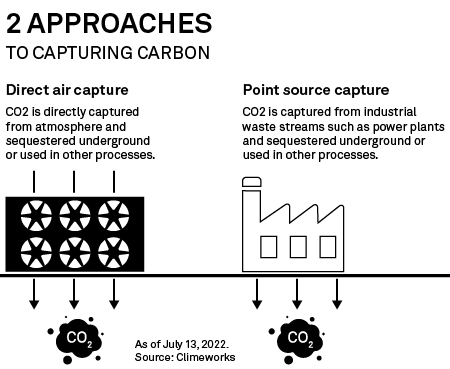

Nicholson said a far better use of the money would be to spend it on projects that can remove carbon from the atmosphere, known as direct air capture, and storing it underground.

Technology needed, according to some

But proponents of carbon capture said continued and large investments in the technology are needed to rein in emissions from power plants that must continue to operate in a net-zero carbon emissions world. Top candidates include industrial manufacturing facilities and natural gas-fired power plants.

Both the United Nations' Intergovernmental Panel on Climate Change and the International Energy Agency have argued that carbon capture technologies must be part of the solution if the world is to avoid catastrophic climate change.

|

However, questions remain over the economic viability of installing carbon capture at power plants, with critics pointing to the cost of building and operating such installations.

The flagship U.S. project to date, NRG Energy Inc.'s $1 billion Petra Nova project in Houston, netted $195 million in federal funding before shutting down in 2020. The project, which supplied carbon for enhanced oil recovery, closed after low oil prices rendered the plant uneconomical.

NRG earlier in September sold its 50% stake in the project to its Japanese partner JX Nippon Oil & Gas Exploration Corp. for only $3.6 million. Local media reports indicate that the plant is expected to start back up in 2023.

As for new projects, the proposed Project Tundra in North Dakota is expected to cost $1.45 billion to construct. It has thus far received at least $27 million in grants from the DOE, along with a $100 million loan and a $5.4 million grant from the state.

Is the money being spent wisely?

In response to the December 2021 GAO study, the DOE said it was acting on the recommendations for more stringent oversight of carbon capture demonstration projects.

The DOE's new Office of Clean Energy Demonstrations is now "incorporating lessons learned and allowing adequate time for due diligence of and negotiations with applicants prior to entering into cooperative agreements," the GAO reported.

As for the San Juan plant, progress on the project was slow and negotiations over the plant ownership did not deliver the results that Enchant Energy and the city of Farmington hoped for. On Sept. 21, the city sued PNM and the plant's other owners for breach of contract, asking a New Mexico district court judge for an injunction to halt the "irreversible" shutdown and decommissioning of the plant. The city has thus far spent $2 million on legal bills associated with the carbon capture project, a Farmington spokesperson said.

Farmington, which currently owns an 8.48% interest in San Juan unit 4, has the right to take over full ownership of the plant under its shared ownership agreement with PNM, Tucson Electric Power Co., Los Alamos County, N.M., and the Utah Associated Municipal Power Systems. It planned to exercise that right and transfer the remaining ownership to Enchant, But such a transfer can only happen if all other owners sign off on the deal, which they have refused to do.

"We say, 'If you're going to take over the plant, you have to give us some assurances,'" PNM Vice President of Generation Tom Fallgren said in an interview. "They have no coal, no equity, no transmission and there's a new environmental law going into effect in January [prohibiting the plant from operating]. Enchant has not been able to supply the necessary elements to secure a transfer."

Investor Acme Equities has not been seen in Farmington for several months, according to Mike Eisenfeld, energy and climate program manager for San Juan Citizens Alliance, a local watchdog group. Peter Mandelstam, Enchant Energy's COO, also left in early summer, Eisenfeld said. As of Sept. 28, however, Mandelstam's LinkedIn page still identified him as COO of Enchant Energy.

As for the $25 million in DOE grants, Enchant's front-end engineering study is expected to be finalized by Sept. 30 after a two-year delay, according to the company's latest update to the DOE. The original plan for a storage site in northwestern New Mexico was abandoned a month earlier after the DOE raised objections over the scope of the project, according to William Ampomah, an assistant professor of petroleum and natural gas engineering at the New Mexico Institute of Mining and Technology, known as New Mexico Tech.

New Mexico Tech is now working on a new agreement with Enchant Energy to explore a different site and expects to submit new permit applications within a few months, Ampomah wrote in an email. Enchant Energy's timetable for the carbon capture retrofit, now with an estimated price tag of $1.6 billion, has been revised from 2022 to 2027.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.