Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Apr, 2021

By Zack Hale

|

U.S. President Joe Biden's proposed infrastructure package includes a huge investment in the nation's electric grid. |

A package of far-reaching reforms to expand the nation's high-voltage electric transmission system is coming into focus as congressional Democrats begin drafting legislation in line with U.S. President Joe Biden's $2 trillion infrastructure vision.

The suite of policy proposals is largely centered on a new investment tax credit for regionally significant transmission lines and potentially two new grid-focused offices housed within the U.S. Department of Energy and the Federal Energy Regulatory Commission.

Transmission buildout at the speed and scale needed to achieve Biden's goal of decarbonizing the U.S. power grid by 2035 will also require major revisions to FERC's rules for interregional transmission planning and its financial incentives for new power lines and other grid-enhancing technologies, industry experts told S&P Global Market Intelligence.

"2035 is 14 years from now, so if we assume it takes 10 years to build stuff, that gives me a four-year window to get everything together," said Nina Plaushin, vice president of regulatory and federal affairs for ITC Holdings Corp., the nation's largest independent electric transmission company.

The transmission blitz comes amid a wave of recent in-depth reports highlighting the benefits associated with expanding and upgrading the nation's regionally siloed electric grid to accommodate increasing levels of variable renewable energy penetration.

Fifteen states between the Rocky Mountains and the Mississippi River account for 88% of the nation's potential wind capacity and 56% of potential solar capacity, according to the Macro Grid Initiative, a group formed last year with help from Microsoft Corp. co-founder Bill Gates' Breakthrough Energy venture. But those states are only projected to account for about 30% of nationwide electricity demand by 2050, a study commissioned by the Wind Energy Foundation found.

Meanwhile, the U.S. National Renewable Energy Laboratory's long-awaited "Seams Study," released in October 2020, noted that only seven high-voltage direct-current, or HVDC, lines link the U.S. Eastern and Western Interconnections. The lines offer just 1,320 MW of transfer capacity, while 700,000 MW of generating capacity exist in the Eastern Interconnection and 250,000 MW exist in the Western Interconnection.

Moreover, the Seams Study found that that the long-term benefits associated with $46.8 billion in grid investments, including multiple new interregional lines, could outweigh the up-front costs by nearly three times.

Other studies have estimated the U.S. will need to double or even triple its transmission capacity to decarbonize its economy by midcentury, a target that scientists warn must be met to avoid the worst effects of climate change.

Tax credit, new offices

Biden's infrastructure plan released March 31 includes $100 billion in power infrastructure spending, with a "targeted" investment tax credit aimed at incentivizing at least 20 GW of high-voltage transmission lines.

The plan would also establish a new Grid Deployment Authority within the DOE to leverage existing rights-of-way along roads and railways. The DOE's new grid office would be responsible for harnessing "creative financing tools" to support high-voltage transmission lines capable of moving large amounts of renewable energy from remote locations to population centers.

Rob Gramlich, executive director of Americans for a Clean Energy Grid, singled out the investment tax credit as particularly consequential. The White House's proposal is in line with legislation reintroduced on March 25 by U.S. Sen. Martin Heinrich, D-N.M. Text for Heinrich's latest bill is not yet available, but a previous iteration would establish a 15% investment tax credit for "regionally significant" overhead transmission lines with voltage levels of least 345 kV and a 25% credit for lines that run underground or underwater.

The investment credit is "super important because right now it's so hard to reach voluntary agreements on allocating the cost of large-scale transmission," Gramlich said in an interview. "Basically, a [hypothetical] 30% tax credit makes the cost allocation problem 30% easier. It doesn't eliminate it, but it sure helps a lot."

Jon Wellinghoff, a former FERC chairman during the Obama administration, said the proposal to create a new grid-focused office within DOE to oversee loans makes sense. But Wellinghoff also questioned whether that office should take the lead on siting and permitting, noting that a separate proposal in House Democrats' CLEAN Future Act would also establish a new Office of Transmission within FERC.

Wellinghoff suggested a new transmission office at FERC could be better positioned to help with siting and permitting given that the commission's Office of Energy Projects already does that for natural gas pipelines and hydropower-related transmission projects.

Planning, cost-allocation

Richard Glick, a Democrat named FERC chairman by Biden in January, has also expressed a desire to revisit Order 1000, a decade-old rule that sought to encourage a greater buildout of interregional transmission.

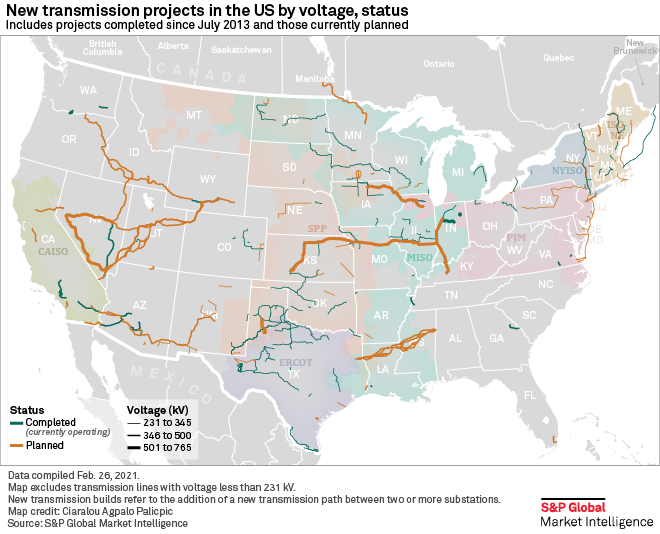

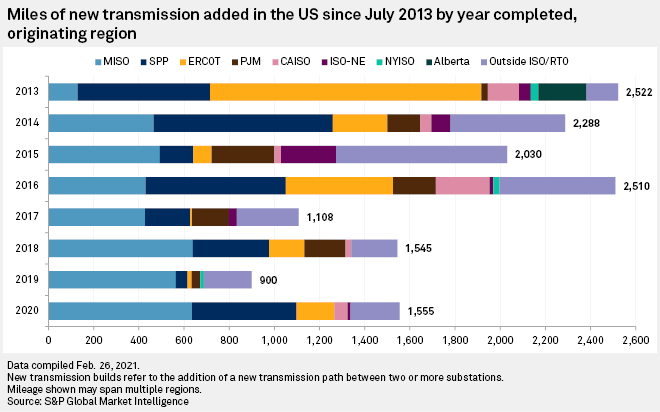

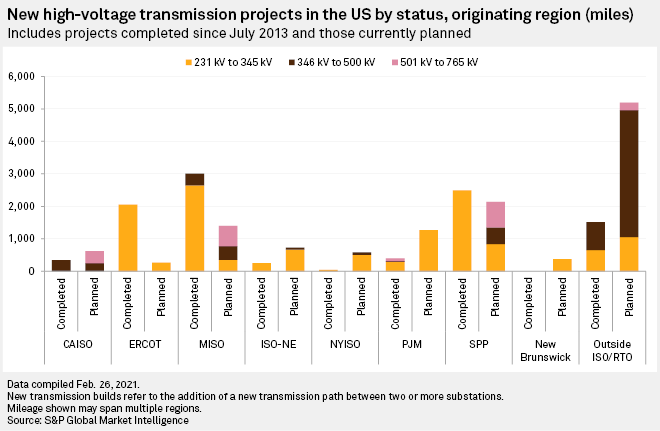

The order required FERC-jurisdictional grid operators to coordinate on interregional planning, but most projects have focused on addressing local reliability needs since the regulation became fully effective in July 2013. The vast majority of those projects have also been shielded from competitive bidding. Notably, no interregional transmission lines selected through an Order 1000-mandated transmission plan have been completed to date.

Wellinghoff, who helped finalize Order 1000 as chair, said the rule's interregional planning requirements need to be strengthened. "I think FERC has complete authority over, and should really be in charge of at least overseeing, the actual planning being done down at the [grid operator] levels," Wellinghoff said in an interview.

Gramlich, a former FERC adviser, added that revisions to the rule should require grid operators to account for factors such as utilities' decarbonization goals and state policies.

"Nobody has a crystal ball, but we estimate load growth," Gramlich said. "Why don't we include electrification, utility decarbonization, and other things for which one can make a reasonable estimate about the system?"

In addition to interregional planning, FERC also needs to address cost allocation for large-scale transmission projects, ITC's Plaushin said.

Order 1000 reflected cost-causation principles, meaning those who either caused a transmission need or stood to benefit from a proposed solution were required to pay for it. "To some extent that works great, except that no one can agree on what model to use to measure that," Plaushin said. "No one can agree on what a benefit is, so you know, it quickly deteriorates."

Progress in MISO, SPP

Meanwhile, two of the nation's largest grid operators in terms of geography and renewable energy potential — the 15-state Midcontinent ISO and 14-state Southwest Power Pool — are not waiting on Congress or FERC to act. In September 2020, MISO and SPP launched a yearlong study aimed at identifying potential transmission opportunities along the neighboring systems' seams.

Part of the reason why Order 1000 has failed to produce more interregional transmission within their respective footprints is that it was issued around the same time MISO's board of directors approved $6.5 billion in new transmission projects through 2021, said Aubrey Johnson, MISO's executive director of system planning. That plan included 16 "multivalue" projects, whose $5.1 billion in expected costs were eligible for regional cost-sharing, a novel development at the time.

"We're coming back to a point in time, now, where we do have to do that all over again," Johnson said in an interview.

|

LineVision Inc.'s unique V3 sensors collect real-time data on critical parameters of overhead power lines including line temperature, sag, horizontal motion, and anomalies. |

Antoine Lucas, SPP's vice president of engineering, added that the joint study "isn't just an exploratory exercise."

"We really want this to be an actionable study, as well, that produces some projects that we have an opportunity to move forward into actual construction," Lucas said.

Grid-enhancing technologies

More interregional transmission is sorely needed, but new large-scale grid projects will also trigger the need for upgrades to smaller power lines, experts noted. That is where companies like LineVision Inc., can play a crucial role, said CEO Hudson Gilmer.

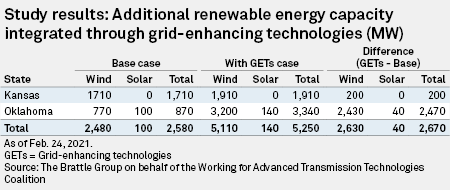

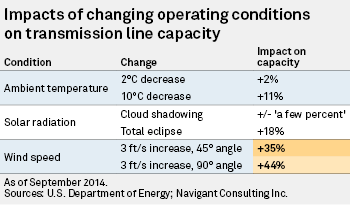

In an interview, Gilmer pointed to a recent study his company helped commission that found a combination of grid-enhancing technologies, including what is known as dynamic line ratings, can boost an existing power line's transmission capacity by up to 40%. The payback period on a $90 million initial investment in a collection of grid-enhancing technologies, including dynamic line ratings, would be about half a year in the wind-rich states of Oklahoma and Kansas, the study found.

LineVision is one of several companies urging FERC to require dynamic line ratings where appropriate, such as wind-rich service territories, in a proposed rule (RM20-16) that stopped just short of doing so.

In a separate pending proceeding (RM20-10) that would revamp FERC's incentives for transmission projects, then-commissioner Glick penned a partial dissent expressing concern by a proposed rule's "seemingly tepid enthusiasm" for incentivizing grid-enhancing technologies.

Traditionally risk-averse electric utilities have already started embracing those technologies.

Since it was founded two years ago, LineVision has signed deals with National Grid USA, Dominion Energy Inc., Xcel Energy Inc. and the Tennessee Valley Authority. On April 7, the company announced it raised $12.5 million through a Series B financing round, with National Grid subsidiary National Grid Partners among its newest investors.