S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Aug, 2021

By Molly Christian and Zack Hale

A huge bipartisan infrastructure bill under consideration in the U.S. Senate was deemed by the White House to be the largest single investment in clean energy transmission in American history.

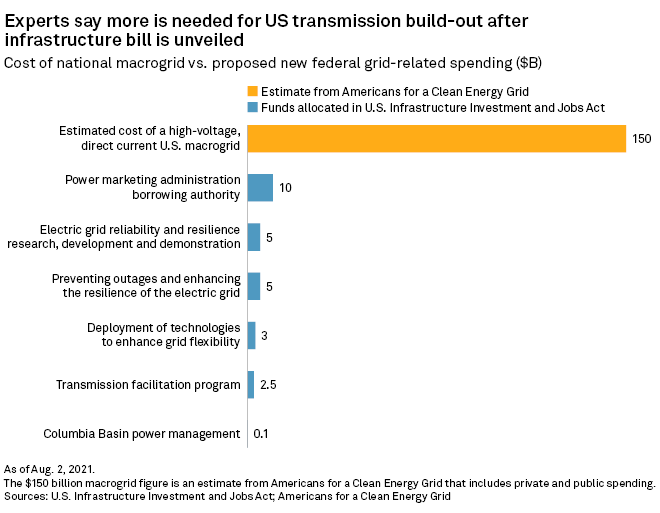

But electric transmission advocates are already looking to the federal rulemaking process and Democrats' pending $3.5 trillion budget reconciliation measure for more support after the bipartisan package authorized just $28.8 billion in grid-related spending out of an overall $73 billion for power infrastructure.

The bipartisan Senate legislation, dubbed the Infrastructure Investment and Jobs Act, seeks to ease development of long-distance transmission lines viewed as crucial to clean energy deployment.

The bill proposed to clarify that the Federal Energy Regulatory Commission can override state objections to major transmission projects in some instances. It would also allow the federal government to act as an "anchor tenant" for new transmission projects before transferring its share of capacity to private entities, and the bill would enhance the U.S. Department of Energy's authority to designate national interest transmission corridors.

"The transmission provisions in the Bipartisan Infrastructure Deal are critical steps to accelerate critical investment in an expanded and more resilient grid," said Jesse Jenkins, an assistant professor of mechanical and aerospace engineering at Princeton University and head of Princeton's Zero Carbon Energy Systems Research and Optimization Laboratory.

Jenkins said the anchor tenant provisions "will help break the chicken-and-egg problem of transmission expansion: It's risky to build a big transmission line until there are generators to use it, and it next to impossible to build a new wind or solar project without transmission access to bring your power to customers."

By allowing the DOE to be an initial owner in transmission projects, the bill "helps cut that Gordian knot," Jenkins said.

But many transmission advocates criticized the bill's proposed funding for such infrastructure. The bill would expand the federally owned Bonneville Power Administration's borrowing authority by $10 billion and allow the DOE to allocate $5 billion in assistance for new electric transmission projects.

Many of the bill's other grid investments are aimed at reliability and resilience improvements rather than expanded transmission capacity. With President Joe Biden pushing to decarbonize the U.S. power sector by 2035, and congressional Democrats pursuing an interim goal of 80% emissions-free power by 2030, the Senate bill's transmission proposals are only a start to achieving those targets.

"For power system reliability and climate goals, over this decade we need about $150 billion for an interregional macrogrid," said Rob Gramlich, executive director of Americans for a Clean Energy Grid, a coalition of transmission owners and clean energy groups promoting the integration and expansion of the North American high-voltage grid. The $150 billion figure would include both public and private investment, according to Gramlich.

Fully decarbonizing the grid would be even more costly. To achieve net-zero emissions by midcentury, high-voltage transmission capacity would need to expand by about 60% by 2030 and triple through 2050, according to a 2020 study from Princeton that Jenkins co-authored. That growth would require total capital investment of $360 billion through 2030 and $2.4 trillion by 2050, the report said.

"I don't think this legislation will significantly move the dial on the bulk of the transmission that will be needed in the coming decades," said Larry Gasteiger, executive director of transmission planning advocacy group WIRES.

Although the proposal to strengthen FERC's backstop siting authority could help with permitting and siting challenges, "what's really needed to boost transmission investment is a consistent commitment by FERC to provide regulatory certainty, adequate, stable returns on investment, and incentives to spur a moonshot effort to build out the grid to meet the nation’s clean energy and resilience needs," Gasteiger said.

FERC is in the midst of a proceeding (RM20-10) launched by former Chairman Neil Chatterjee that would boost financial incentives for transmission projects that have significant economic and reliability benefits. However, a supplemental proposal favored by current Chairman Richard Glick as part of that proceeding would effectively end a regional transmission organization adder used by FERC to encourage wholesale power market expansion.

Consumer advocates supported the proposal to phase out the adder for a utility's regulated return on investment three years after the company joins a regional transmission organization. But transmission groups and investor-owned utilities argued it could chill investment in the nation's aging grid at the wrong time.

Nina Plaushin, vice president of regulatory and federal affairs for transmission developer ITC Holdings Corp., agreed that most of the work to smooth transmission development lies with FERC. Plaushin hopes the commission will help regional grid operators update transmission planning processes in competitive markets to better reflect the "full array of benefits transmission provides and the full scope of mandates and drivers necessitating new investment."

But in terms of money allocated in the Senate bill, the government "should leverage and encourage private investment and not supplant it," Plaushin said. While some small public utilities may need financial assistance for transmission projects, "there is no lack of capital in the transmission space," Plaushin asserted.

Furthermore, Plaushin expressed concern with the bill's anchor tenant provisions. "ITC would also caution against open-ended financial commitments to private entities without clear rules for eligibility and a solid plan to ensure federal recovery of monies spent," the executive said. "The anchor tenant provisions in the legislation are an area where this is a concern as the risk of stranded investment appear high."

The Senate is debating its bipartisan infrastructure bill this week, including considering amendments. If the upper chamber passes its bill, the legislation will head to the U.S. House of Representatives for consideration.

Hopes for reconciliation bill

Although the bipartisan infrastructure bill extends support to transmission, industry advocates hope a budget reconciliation package in the works from Senate Democrats will do more.

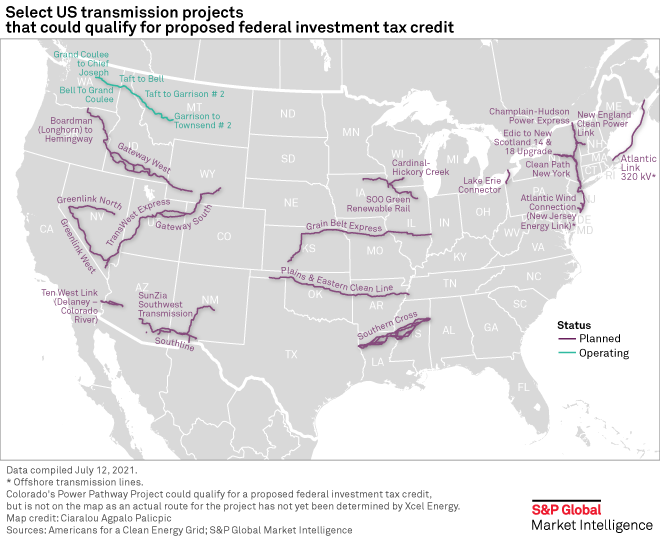

The reconciliation measure, which Democrats could pass through the Senate without GOP support, could incorporate tax-related provisions that directly benefit the electric grid. Both Plaushin and Gramlich have supported an investment tax credit for large transmission projects, which could be a candidate for inclusion in the budget bill.

The provision could mirror legislation from U.S. Sen. Martin Heinrich, D-N.M., and U.S. Rep. Steven Horsford, D-Nev., that would create a 30% ITC for "regionally significant" new transmission lines.

"A provision like the investment tax credit matters because it drives investment toward the transmission sector and, in many cases, lowers rates for customers," Plaushin said.

Gramlich, who is also president of consulting firm Grid Strategies LLC, did a recent study that estimated a 30% ITC for transmission would add another 30 GW of renewable energy capacity across the U.S.

The study determined that 22 transmission projects across the country would likely be eligible for a targeted investment tax credit. Of those projects, a little less than half were expected to start construction and qualify for the credit, "mostly due to remaining permitting risks and the challenge of finding buyers and sellers to purchase capacity on the transmission lines," the report said.