S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Sep, 2022

By Sanne Wass

Transaction banking revenues have reached their highest level since the global financial crisis, as the industry benefits from rising interest rates and huge corporate demand for financing.

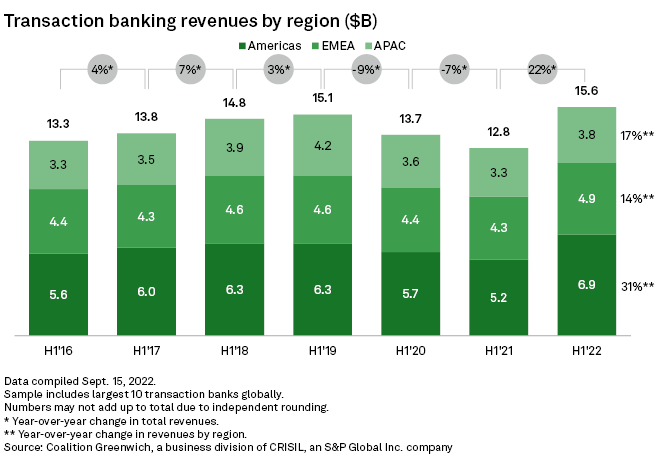

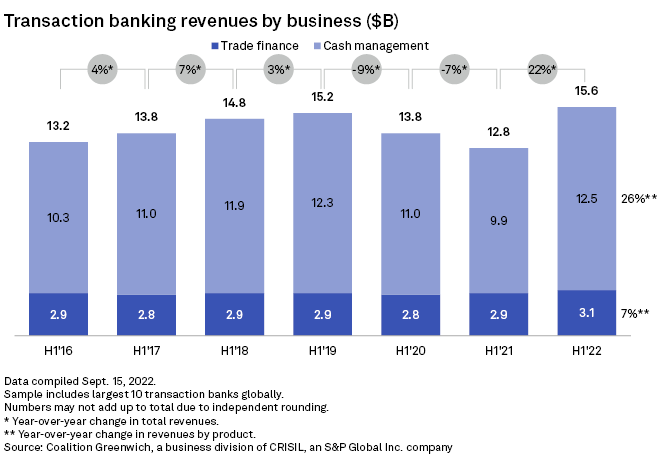

The world's 10 largest transaction banks posted a combined revenue of $15.6 billion from cash management and trade finance in the first six months of 2022, according to new data by Coalition Greenwich. That represents a 22% rise from $12.8 billion in the same period last year.

Coalition Greenwich, an S&P Global-owned company, tracks transaction banking revenues at Bank of America Corp., Barclays PLC, BNP Paribas SA, Citigroup Inc., Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Société Générale SA, Standard Chartered PLC and Wells Fargo & Co.

Second-quarter revenues drove most of the growth, according to Eric Li, research director at Coalition Greenwich. During the period, revenues from both cash management and trade finance reached their highest level since the global financial crisis of 2008, he said in an interview.

"This is a record quarter in terms of the performance of the banks. Every single bank we track had record volumes across their businesses in trade and cash," Li said, adding that rapid interest rate rises have also driven up margins in particular within banks' liquidity business.

Revenues from cash management, which covers products within payables, receivables, liquidity and balances, rose 26% in the first half of 2022 compared to a year earlier, according to the data. Revenues for this line of business took a significant hit from the coronavirus pandemic and interest rate cuts in 2020.

Transaction banking revenues rose across all regions in the first half of 2022, with the Americas growing at the highest rate, driven partly by the strength of the U.S. dollar, according to the research.

Coalition Greenwich expects the second half of 2022 to be similarly strong, if not stronger, as more interest rate hikes kick in, Li said, although he noted that a potentially severe recession could cause a slowdown in activities.

Supply chain disruption drives growth

Trade finance grew 7% year over year, as the financing demand from corporates "has gone through the roof," Li said. Supply chain disruptions within sectors such as agricultural commodities and energy as a result of Russia's invasion of Ukraine have led to a greater corporate need for supply chain finance and commodity trade finance. Revenues from both products were up more than 20% in the first half of 2022, according to Li.

Revenue growth in supply chain finance may slow, however, as competition in the market intensifies, Li said.

A supply chain finance program is typically set up by a large corporate buyer with its bank to allow its suppliers to be paid early and benefit from the buyer's credit rating. New and existing lenders have been ramping up their capabilities in this space, defying concerns that the collapse of supply chain finance provider Greensill last year would derail the market.

Supply chain finance has now become a mature product in developed markets, said Jonathan Lonsdale, head of trade and working capital solutions at Banco Santander SA, speaking at the International Trade and Forfaiting Association's annual conference in Porto Sept. 7. As more banks are entering the business, the pricing has become "very thin," he said.

Banks' next opportunity is to export the supply chain finance model to emerging markets and to take advantage of the cross-selling opportunities that the product offers, Lonsdale said.

"Supply chain finance puts you in touch with a lot of counterparties; you've got the buyer and you've got all of the sellers. So you're meeting a lot of new potential clients in whichever market you're opening up," he said.