S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Jun, 2021

By Bill Holland

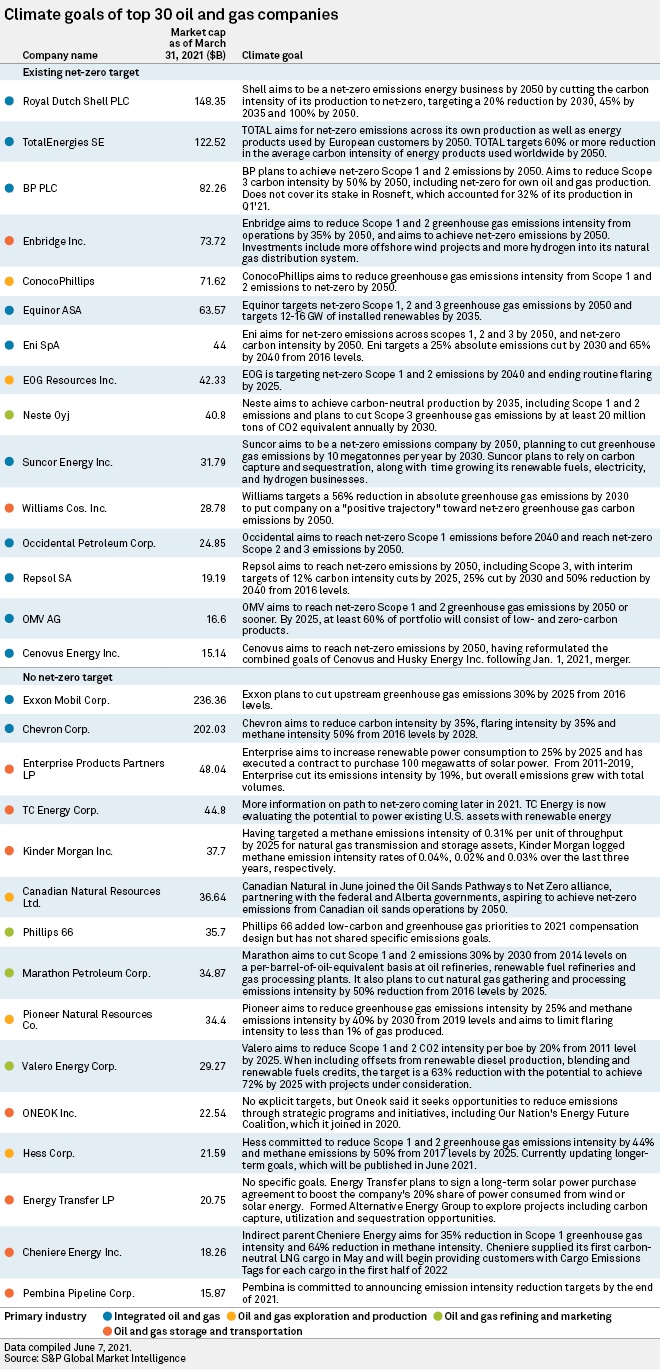

Designed with input from the financial and regulatory communities, the largest oil and gas trade group in the U.S. rolled out a standardized template for member companies to report greenhouse gas emissions starting this year.

|

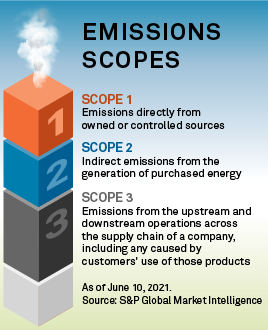

The one-page Excel spreadsheet lets companies report their Scope 1 and Scope 2 greenhouse gas emissions in a standardized format, the American Petroleum Institute, or API, said June 24, giving investors a better way to compare one company to another.

The template does not include Scope 3 emissions, or emissions by customers using oil and natural gas products, although the trade group left open the possibility of adding Scope 3 numbers in later updates to the template. Scope 1 and 2 emissions are from a company's operations and supply chains.

The introduction of the API's template for its member companies comes as the U.S. SEC may stiffen its disclosure requirements, while outside the U.S., developed countries are mandating climate change disclosures under a rubric developed by the Task Force on Climate-related Financial Disclosures.

"With this template, we are meeting a need that hasn't yet been fully realized by these other frameworks and that is standardized reporting for a concise set of [greenhouse gas] indicators to provide for like-for-like reporting by individual companies," API Manager of Climate and ESG Policy Aaron Padilla said.

Raymond James & Associates oil, gas and renewables analyst Pavel Molchanov said the standardized template will prove helpful and the lack of Scope 3 numbers is not fatal to measuring environmental, social and governance progress for shareholders.

"Will the guidelines be useful? Yes, because they provide a common template and methodology that allows for straightforward comparison from one company to another," Molchanov said. "The guidelines are a foundation — individual companies can, and indeed should, provide broader disclosure, including Scope 3, when the investment community is asking for it."

Padilla said that while Scope 3 emissions make up the bulk of oil and gas emissions, limiting the demand for oil and gas and the use of its products is outside of a company's control. "The mere act of reporting on Scope 3 emissions doesn't lower consumer demand and drive down [greenhouse gas] emissions," Padilla said.

"What will reduce the emissions associated with our use of hydrocarbons is the carbon pricing, public policy instruments ... the significant features of our climate action framework," Padilla said.

By leaving out Scope 3 emissions, oil and gas companies are ignoring their biggest risk in any transition to a low-carbon future, according to Robert Schuwerk, the North American director for the Carbon Tracker Initiative, a London-based think tank that analyzes the financial risks of an energy transition.

"Scope 3 emissions are approximately 90% of an upstream oil and gas companies' emissions, and every major investor-led group working on climate change expects such companies to report them, so leaving that out is a glaring omission," Schuwerk said. "You would think that upstream oil and gas companies would be focused almost exclusively on Scope 3 emissions — not just because they are 90% of emissions, but because the use of their products causes the [greenhouse gas] emissions.”

"There's no way around that. Given the world is trying to zero out [greenhouse gas] emissions, that's not a sidecar ESG issue; that's clear, unequivocal market risk," Schuwerk said.