Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2022

By Sanne Wass

Banks and fintech firms remain optimistic that blockchain technology can help transform the paper-heavy industry of trade finance, despite a recent wave of news of canceled projects and moves to other technologies.

When Barclays PLC issued the world's first blockchain-based letter of credit in 2016, it talked of a forthcoming "blockchain revolution in trade finance." A transaction that would normally take up to 20 days was cut to less than four hours.

In the years that followed, trade finance players lined up behind countless proofs of concept, pilots and industry consortia to bring the promises of blockchain to life. Bank collaborations such as we.trade, Marco Polo Network, Contour, Komgo, Batavia and CordaKYC sought to build industrywide platforms, while fintech companies embraced the technology for anything from the letter of credit and the bill of lading to fraud detection, cross-border payments, asset distribution and know-your-customer utilities.

In 2018, the World Trade Organization labeled blockchain as potentially the "biggest disruptor to the shipping industry and international trade since the invention of the container."

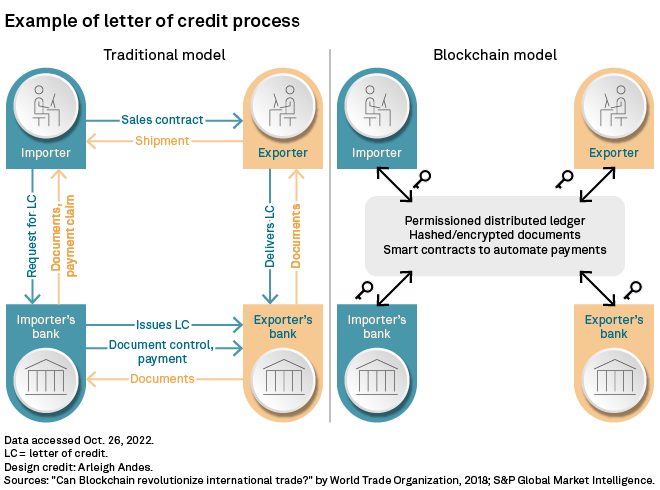

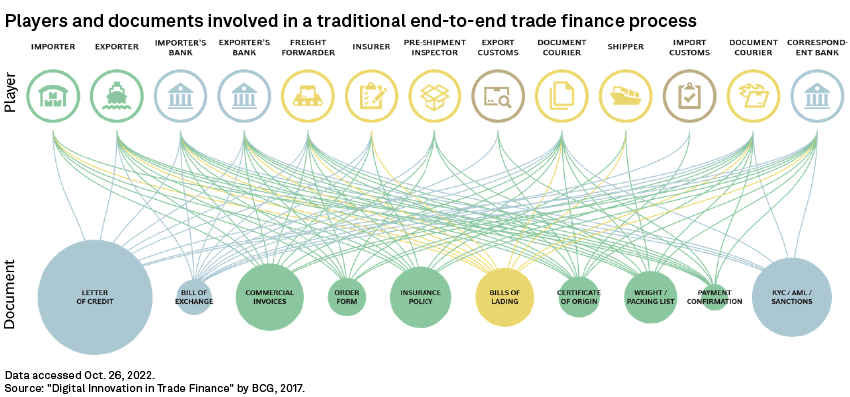

Trade finance is a paper-heavy business involving document exchanges between a large number of entities, such as exporters and importers, banks, insurers, transportation and logistics companies, and government authorities. The intrinsic characteristics of blockchain — the ability to connect multiple parties in a decentralized network while providing a permanent, tamper-proof and distributed digital record of transactions — made it the perfect technology to make the $5.2 trillion global trade finance ecosystem more efficient, transparent and secure.

|

Fast-forward to 2022, and blockchain is yet to fulfill its promise in trade finance. We.trade, a platform owned by 11 European banks, said in May that it would discontinue its activities, and Marco Polo Network shelved its blockchain-based payment commitment this year. Originally blockchain-focused companies such as Komgo and MonetaGo have favored other technologies. Many more initiatives never moved past the proof of concept or pilot stage.

What happened?

For bank-led projects, business model challenges and low corporate uptake have been among the biggest hurdles.

"The technology was not the problem. It was essentially the commercial model," said David Sutter, chief product officer at Marco Polo Network, which has developed an open-account trade finance platform with a large network of banks including Bank of America Corp., BNP Paribas SA, The Bank of New York Mellon Corp. and SMBC. The company is still using a blockchain-based infrastructure but has shelved its payment commitment product in order to focus investments elsewhere.

"The product was developed with banks, to meet bank requirements and to solve bank problems. And that did not translate into corporate demand," Sutter said.

|

Marco Polo Network was unable to onboard enough corporate clients to make it a sustainable business model, Sutter said. The company is now focusing its investments on its supply chain automation solution, which is sold directly to corporates and is targeting the pain points of buyers and suppliers. This has led to more traction among corporate users, Sutter added.

We.trade appears to have suffered similar business model challenges. Like Marco Polo Network, we.trade sought to help companies and banks facilitate and finance open-account trade, focusing on small and medium-sized enterprises in Europe. The blockchain-based platform had attracted investments from IBM and European banks including CaixaBank SA, Deutsche Bank AG, Erste Group Bank AG, HSBC Holdings PLC, KBC Group NV, Nordea Bank Abp, Rabobank, Banco Santander SA, Société Générale SA, UBS Group AG and UniCredit SpA, but corporate uptake lagged.

"Month-on-month growth rate in transactions confirmed the value of the platform but was not quick enough to ensure the network effect needed to ensure the sustainability of the company," said we.trade in a statement May 30. Existing shareholders could not reach an agreement on the financing of new investment needed, it said.

Most of banks' blockchain projects fail either because they do not solve the problem they were intended to solve or because the problem does not exist, said Chris Sunderman, an independent consultant and until earlier this year the trade finance innovation lead at ING. "Or the market doesn't want it," he said.

However, external events such as the coronavirus pandemic and the war in Ukraine have also played a role, as banks needed to prioritize more urgent operational and compliance issues, Sunderman said.

Moves to other technologies

In other parts of the trade finance market, blockchain consortia and solution providers have recognized that what they were trying to achieve did not require blockchain technology at all.

MonetaGo, for one, offers a data repository for banks to detect duplicate financing by checking information from invoices and trade finance documents against other network participants. The fintech company has already built a solution in India using blockchain but decided the technology was not appropriate for a global platform, as it would slow down the speed at which transactions could be undertaken and drive up the cost, according to Michael Hogan, managing director for the U.K. at MonetaGo.

"Our main focus is on protecting the privacy of customers' data, and we achieve that with security best practices and confidential computing technology," Hogan said.

Komgo, a platform that digitalizes commodity trade finance workflows, is also no longer offering a blockchain-based letter of credit, citing costs and scalability challenges among the reasons. The platform is owned by banks including ABN Amro Bank NV, BNP Paribas SA Citigroup Inc., Credit Suisse Group AG, ING, MUFG, Natixis SA, SMBC and Société Générale as well as major commodity traders.

The company is focused on reducing complexity, managing volatility, boosting margins and increasing transactional security for trade finance players, said Guy de Pourtales, CTO of Komgo. "Many of these issues don't require a complicated and expensive technical architecture to solve," he said.

Moving from paper documents, emails, Excel sheets and PDF documents to smart contracts running on a decentralized blockchain is "like going from horse-and-carriage to flying cars," de Pourtales said. "It sounds great on paper, but in practice, it's a lot more complicated." Komgo still has blockchain at its disposal, but its deployment will depend on specific business needs and the desired outcomes, he said.

Lessons learned

Blockchain may not have revolutionized trade finance in the way it was portrayed it would, but the technology is indeed still relevant to the industry, and the past six years of testing and trialing have not been a waste, according to industry players speaking to S&P Global Market Intelligence at the sideline of the International Trade and Forfaiting Association's annual conference in Porto Sept. 8.

"We missed the target sometimes, but we learned a lot about the technology," said Patrik Zekkar, CEO of Enigio, a financial technology company using blockchain to digitalize trade finance documents, and previously a we.trade board member. Banks have become more used to and accepting of blockchain and other new technologies, Zekkar said.

The industry has also come far in overcoming legal hurdles to implement digital trade instruments, said Daniel Cotti, an independent trade finance fintech consultant and previously managing director at Marco Polo Network.

The U.K. earlier this month introduced an Electronic Trade Documents Bill into Parliament, part of a G-7 commitment to reform trade documents. It will modernize 1982 and 1992 legislation to put digital trade documents on the same legal footing as their paper-based equivalents.

The International Chamber of Commerce last year published the uniform rules for digital trade transactions, which serve to standardize digital trade transactions and promote the usage of electronic documents.

Blockchain still offers key benefits such as data privacy and security as well as the immutability of data, Cotti said. "The technology will prevail, it will gain traction over the next decade, for sure, in the financial services industry, but also in other industries," he said.

But there is a greater appreciation across the trade ecosystem that, while blockchain may be good for certain use cases, it is not the most essential part of digitalizing trade finance.

"To succeed, the solution needs to provide value or solve a problem for the customer. Then if it's based on blockchain, that's just a part of the technical due diligence," Zekkar said.

"When you start cutting through the hype, blockchain has some very good uses. But it's not going to fix everything. It depends on the problem that you are trying to solve," Hogan said.

The trade finance industry is far from giving up on blockchain, with companies such as Tradeteq, Enigio and Contour, to mention just a few, still moving ahead with the technology for their specific applications.

HSBC, one of the world's largest trade finance banks, also continues to see an opportunity for blockchain technology to accelerate trade digitalization, said Shehan Silva, global head of digital solutions within the bank's trade finance business, by email.

"We see the biggest potential in use cases where networks utilize distributed ledger technology to connect and collaborate," such as transactions based on letters of credit or title documents, and, in the future, with the tokenization of trade assets, Silva said. HSBC, like the rest of the shareholders of we.trade, did not want to give more details on why the blockchain initiative did not succeed.