Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2022

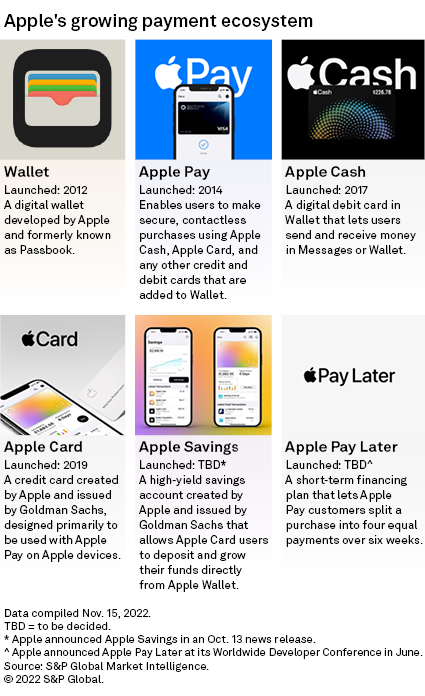

Apple Inc. is well-positioned to take a bite out of the financial services market with its growing payments ecosystem, despite some recent product delays.

The conspicuous absence of updates regarding two expected financial technology offerings with Apple's iOS 16 launch this fall implies more details need to be worked out. But analysts expect Apple will continue to broaden its fintech footprint, and they note a number of advantages that should help the company take some market share in the space. Those advantages include consumer affinity, trust in Apple's brand and an active device install base that the company projects could grow to 2 billion globally by the end of 2022.

"Apple is in a unique position to own the consumer-merchant interaction through the increasing ubiquity of digital payments channels, both in-store and online," said Kevin Kennedy, an analyst at Third Bridge.

Apple did not respond to requests for comment on the status of two anticipated new fintech products: the company's planned high-yield savings account or its buy now, pay later offering. The Apple Pay Later product was announced in June during the company's WWDC22 event for developers. The high-yield savings account offering for Apple Card users was announced in October.

Planting seeds

Over the past decade, Apple has launched an array of financial services, starting with its digital Wallet app and its digital payment system Apple Pay. Apple Card, the company's digital credit card that launched in 2019, counted 6.7 million users as of early 2022, according to a Cornerstone Advisors survey of credit card users.

Thanks to iPhone and Apple Watch, Apple has the advantage of a massive customer base. A stream of tailwinds is pushing Apple toward the fintech and payments market, including the increased adoption of digital wallets, greater prevalence of merchants accepting QR codes and instant payment features, and a heightened appetite from regulators to encourage competition against the duopoly of Visa Inc. and Mastercard Inc.

"Apple is building a revenue model around its banking products and services that over time will be a fairly meaningful contributor to its business," said Jordan McKee, principal research analyst at 451 Research.

|

Apple's iOS 16 launch opened up a host of new Apple Pay features for users, including detailed receipts and order tracking, and the ability to make a bundled purchase to multiple merchants in the same transaction.

Apple is betting that the Apple Card will help drive usage of the Apple Cash card, its debit product, because of its favorable revenue dynamics, including the interchange fees it charges to merchants.

Credit card issuers like Visa and Mastercard now split Apple Card interchange fees with Apple and Apple's banking partner, The Goldman Sachs Group Inc., said Hrvoje Pavisic, a fintech analyst and the author of the FinTech Wave newsletter.

"I think a lot of people will use [Apple's high-yield savings account] because it doesn't cost you anything to transfer the money there," Pavisic said.

Hurdles ahead

Despite Apple's significant advantages in rolling out fintech services, the company has faced its share of hurdles. A footnote in an announcement on Apple's website detailing the new features in iOS 16 said the company's planned high-yield savings account was "coming in a future update for qualifying applicants in the United States" and it may not be available in all states.

The announcement did not reference the buy-now, pay-later program, which is expected to allow customers to split a purchase into four equal payments over six weeks, with no interest or fees.

Once the savings account launches, analysts expect it to generate interest from consumers. They said Goldman will likely set its annual percentage yield around the 2.5% mark offered by the bank's Marcus high-yield savings account.

"I don't think Apple has to offer the best rate," Kennedy said. "Any competitiveness lost on the APR spread will be supplemented by the convenience of carrying these balances on a digital wallet."

Interest rates on savings accounts from traditional banks remain extremely low, even in today's higher-rate environment. "If you're getting 1% interest [from Apple], that's still much more than the 0.01% that you get from your ordinary bank," Pavisic said.

451's McKee sees the savings account offering as having strategic value for Apple.

"Apple is trying to get users to keep their money within Apple's ecosystem," McKee said.

One common capability that the Apple Card lacks is a direct deposit option. Apple is likely to pursue this functionality in the future, 451's McKee said, noting that Block Inc.'s Square payment processor also did not have the feature upon launch, but eventually added it.

Future ambitions

To continue growing its fintech business, Apple needs buy-in from merchants willing to accept Apple Pay, which will enable consumers to tap into the tech giant's growing suite of digital wallet offerings, analysts said.

A 451 Research survey conducted in March and April found that 42.5% of business leader respondents said offering shoppers alternative payment methods like Apple Pay or Alphabet Inc.'s Google Pay was of high importance to their organizations. The survey included responses from about 250 decision-makers at small, midsize and large North American commerce technology companies.

Because most Apple devices have become mobile point-of-sale terminals, Apple creating its own payment processor infrastructure for merchants to compete with alternatives like Square, Stripe Inc. and Dutch payment processor Adyen NV is a logical next step, McKee said.

Apple's ability to conquer emerging markets in the fintech space — such as the cryptocurrency market, or cross-border payments between countries — hinges on macroeconomic and regulatory factors, analysts said.

To make a viable entry into crypto, for instance, Apple would need to make significant investments in its compliance team given the challenges inherent in handling the cryptocurrencies' volatility, said Fintech Waves' Pavisic.

Meanwhile, regulatory complexity, foreign exchange requirements and competition present substantial headwinds for any company looking to start offering remittance payments abroad, said Third Bridge's Kennedy.

Just under a third of the 451 survey respondents (31.3%) said they were most interested in using cryptocurrency in their business to simplify cross-border transactions.

"Apple tends to seek out areas where there is friction, and where there is opportunity to create a better experience," McKee said. That could include creating its own stablecoin, which uses Blockchain technology but is backed by a fiat currency such as the U.S. dollar or gold, McKee said.

"There are still some very clear user experience challenges with crypto and converting crypto back to fiat currency," McKee said. "But down the road, I think that's a very realistic use case, and one Apple and others might pursue at some point."