Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2022

Industrywide direct annuity considerations reached a record high in 2021, according to an S&P Global Market Intelligence analysis of annual regulatory statements.

The U.S. life sector's total annuity considerations rose to $397.53 billion in 2021, a year-over-year increase of 7.5%. The growth was driven by a surge in ordinary or individual annuity considerations during the year as the business line reached its highest yearly considerations total on record. The industry's individual considerations of $237.38 billion in 2021 were roughly $20 billion higher than the previous record set in 2019.

While individual annuity considerations experienced substantial year-over-year growth, group annuity considerations fell for the first time since 2014. Group considerations decreased by 1.8% in 2021 to $160.15 billion.

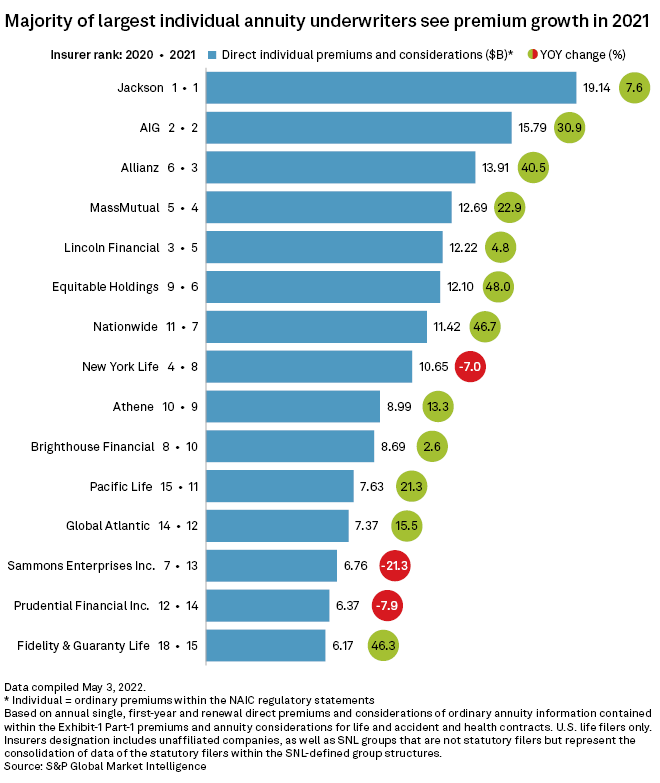

Jackson National remains atop individual annuity rankings

Jackson Financial Inc. continues to be the market leader in individual annuity considerations, a position the insurer has held almost exclusively since 2013. The Michigan-based insurer was briefly dethroned in 2018, when American International Group Inc. reported roughly $72 million more in yearly considerations within the business line.

Jackson's individual considerations climbed 7.6% to $19.14 billion in 2021. AIG held steady at No. 2 with its individual annuity considerations growing to $15.79 billion in 2021 compared with $12.06 billion in 2020.

In total, nine of the 15 largest individual annuity writers reported double-digit year-over-year growth in considerations, with Equitable Holdings Inc.'s 48% increase being the biggest.

Of the largest writers, Sammons Enterprises Inc., the parent company of North American Co. for Life & Health Insurance and Midland National Life Insurance Co., saw the largest year-over-year decline of 21.3% as its individual annuity considerations fell to $6.76 billion in 2021.

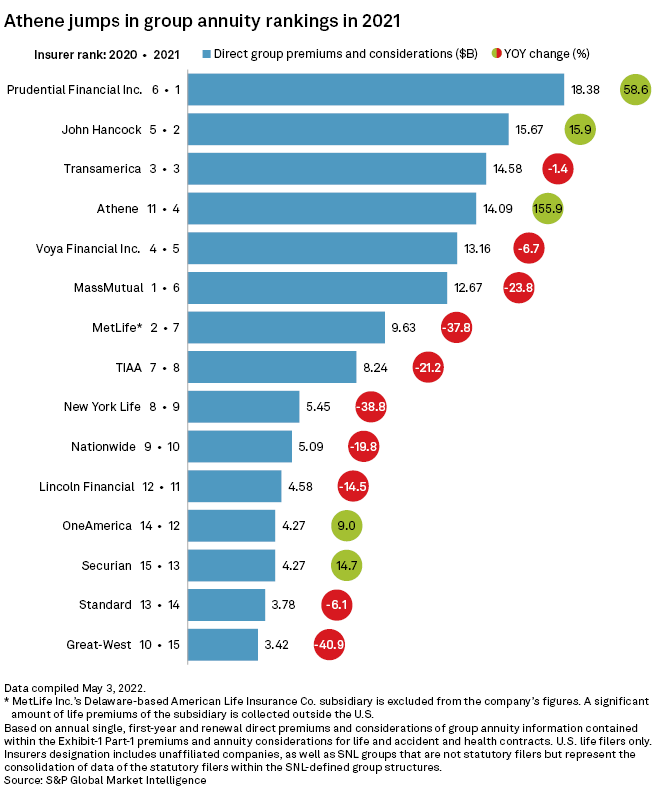

Group annuity considerations fall for most big writers

A majority of the largest group annuity writers reported year-over-year declines in considerations, with only five companies showing growth. Yearly performance for some insurers within the group annuity market can be uneven due to one-off transactions within the pension risk transfer market.

The two largest writers of group annuities in 2020, Massachusetts Mutual Life Insurance Co. and MetLife Inc., each dropped five places in the 2021 rankings to No. 6 and No. 7, respectively. MassMutual's group annuity considerations fell to $12.67 billion in 2021, a decrease of 23.8% from the prior year. MetLife's group annuity considerations dropped 37.8% to $9.63 billion.

Prudential Financial Inc. moved up five spots to the top position, with $18.38 billion in group annuity considerations in 2021, an increase of 58.6% from the prior-year total. The New Jersey-based insurer received the largest reported pension risk transfer deal in 2021 when it assumed roughly $5.2 billion in pension liabilities from HP Inc.

The biggest mover in the rankings was Athene Holding Ltd., which jumped seven spots to No. 4. Its group annuity considerations surged to $14.09 billion in 2021 compared with $5.50 billion in 2020.