S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Apr, 2023

By Tom Jacobs and Kris Elaine Figuracion

Nearly all of the top writers of US excess and surplus insurance recorded higher premiums year over year even as many also lost ground in market share.

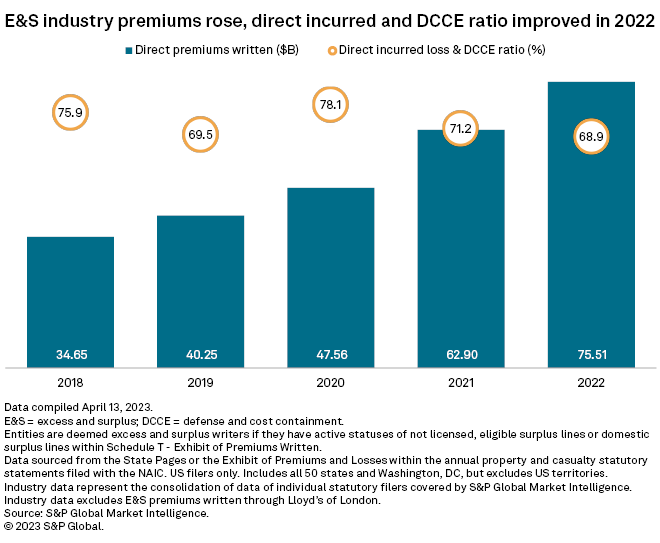

Excess and surplus (E&S) premiums increased for the fourth straight year in 2022, rising 20% to $75.51 billion from $62.90 billion in 2021. Premiums have more than doubled from the 2018 total of $34.65 billion.

The direct incurred and defense and cost containment ratio fell for the second consecutive year to 68.9% from 71.2% in 2021. Surplus line carriers tend to cover complex or high-risk businesses that are unable to find insurance within the traditional or admitted market. The regulatory model tends not to be as strict as the framework for admitted carriers, which gives E&S businesses greater flexibility when setting premium rates and terms for its policies.

Most top carriers lose market share

An S&P Global Market Intelligence analysis shows that 17 of the top 25 E&S carriers experienced year-over-year declines in their shares of the market. American International Group Inc. and Liberty Mutual Holding Co. Inc. had the most significant losses, followed by Markel Corp., Nationwide Mutual Insurance Co. and QBE Insurance Group Ltd.

The analysis was based on data sourced from statements filed with the National Association of Insurance Commissioners by US companies.

|

– |

Trisura Group Ltd.'s market share increased by 37 basis points, the biggest gain in this analysis. Arch Capital Group Ltd., Fairfax Financial Holdings and Kinsale Insurance Co. each had 24-basis-point increases, while Munich Re was up 19 basis points.

No change at the top

Berkshire Hathaway Inc. was again the top company, securing 9.2% of the market in 2022, down from about 9.4% in 2021. Both yearly values include the company's October 2022 acquisition of Alleghany Corp.

AIG remained in the second spot despite its market share slipping to 6.0% from 6.6% in 2021. However, the multiline insurer's direct written premiums rose 8.6% to $4.54 billion from $4.18 billion a year earlier.

Fairfax Financial was the lone company among the top 10 that picked up market share in 2022, rising to 5.0% from 4.8%. The company also experienced a 26.2% surge in premiums.

Canada-based Trisura had the largest premium increase by percentage in this analysis at 56.9%. Its premiums rose to $1.18 billion from $751.3 million in 2021, which CEO David Clare said in the company's 2022 annual report was due to new partnerships and the maturing of existing programs. Clare added that E&S lines may continue to benefit as business shifts away from the admitted marketplace.

Kinsale Insurance had the second-largest premium increase at 44.2%. Arch Capital was third after logging a 38.7% rise in premiums, followed by Munich Re with a 35.5% gain and AXIS Capital Holdings Ltd. with a 26.9% increase.