S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Aug, 2021

By Dyna Mariel Bade

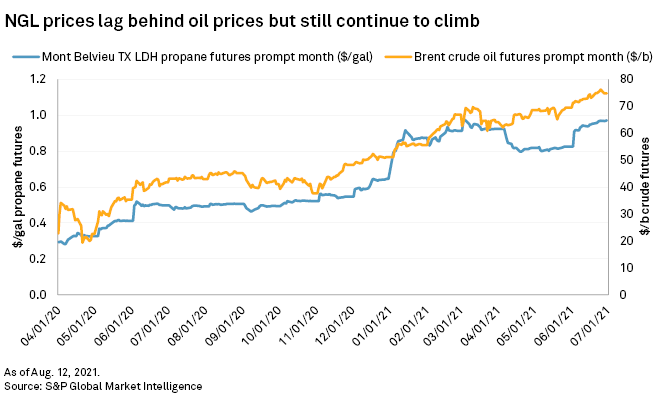

Top shale producers in the U.S. saw positive financial impacts from rising NGL prices, which are anticipated to continue throughout the rest of the year as liquefied petroleum gas demand remains high.

During the second quarter, 10 of the largest oil and gas producers covered by S&P Global Market Intelligence saw their NGL revenues grow dramatically from the same year-ago period as they posted year-over-year boosts in realized NGL prices of 104% to as high as 261%.

The companies' gains in the quarter came as both oil and NGL prices continued its upward trajectory. The average Mont Belvieu NGL spot price in the second quarter soared nearly 116% from the same period a year earlier, while the Brent crude oil futures prompt month contract climbed by 108%.

Growing LPG demand, exports to continue to drive prices up

Analysts with Tudor Pickering Holt & Co. in a July 8 note to clients said they expect propane pricing to remain strong throughout the second half of 2021 as demand for the product outpaced production.

Earlier in a June 14 report, Raymond James & Associates analysts noted that the U.S. market could be moving toward a propane supply shortage unless LPG exports ease up significantly. "A U.S. propane inventory shortage could lead to a corresponding Mont Belvieu propane price spike, creating economics-driven U.S. LPG export cargo cancellations in [the second half]," the analysts said.

David Cannelongo, Antero Resources Corp.'s vice president of liquids marketing and transportation, during the company's second-quarter earnings call said that Mont Belvieu prices need to continue increasing in the following months to curb exports amid a forecast decline in domestic propane inventories and more growth in LPG demand in China, Vietnam, North America and across Europe.

The Antero executive had attributed the steady increase in NGL prices during the second quarter and into the third quarter to "continued tightness in the LPG market," aside from improving oil and gas pricing.

Southwestern Energy Co. executives also cited low propane inventories and a potential tightening of supply in the winter as factors that are putting pressure on prices. "There's probably several factors that are driving propane, just the limited propane supply due to oil-related [capital expenditure] reductions and then just definitely increased plastics demand and exports to Asia," R. Jason Kurtz, Southwestern's vice president of marketing and transportation, said during an earnings call.

The company during the second quarter recorded the biggest year-over-year boost in NGL prices at 261%, with NGL revenues climbing 348% from the previous year.

"I think that the other thing that's driving propane higher is just the exports, probably roughly 1.2 million barrels per day on average, and this is just due to increasing global demand and the additional export facilities out of the Gulf Coast," Kurtz added.

Fellow Appalachian NGL producer Range Resources Corp. said it also anticipates "strong fundamentals to result in higher absolute prices for domestic propane and butane" during the second half of the year. Range in the second quarter posted an unhedged realized NGL price of $27.92/barrel, which represents a $2.24 premium to Mont Belvieu, the highest in the company's history.

Strong commodity prices underpin free cash flows

During the second quarter, oil and gas companies Antero, CNX Resources Corp., Devon Energy Corp., APA Corp. and Ovintiv Inc. said the ongoing strength in commodity prices had resulted in benefits in their free cash flows.

Antero, the country's second-largest NGL producer, said it anticipates the boost in natural gas and NGL future prices to "[result] in a substantial free cash flow outlook" for the company. Antero's executives also said they will continue to fast-track debt repayment and is now expecting a return on capital in early 2022, instead of its previous estimate of mid-2022.

APA struck a similar note and said the increasing prices generated "a very welcome amount of incremental free cash flow and will enable substantial progress on debt reduction." Ovintiv executives also noted that the "robust NGL market" has been helping put the company on track to generate more than $1.7 billion of free cash in 2021.

Meanwhile, Appalachian shale gas driller CNX on its earnings call said it has decided to boost its earnings and cash flow guidance amid the rising prices. The company during the quarter recorded the highest year-over-year growth in NGL revenues of 577% after it "[added] a little bit of activity at the beginning of this year to take advantage of some NGL prices."