S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Jun, 2021

By Ryan Jeffrey Sy

As the top six economies in Latin America continue to cope with the effects of the coronavirus pandemic, first-quarter real GDP figures for these countries, albeit lower compared to the previous quarter, managed to surprise analysts at S&P Global Ratings.

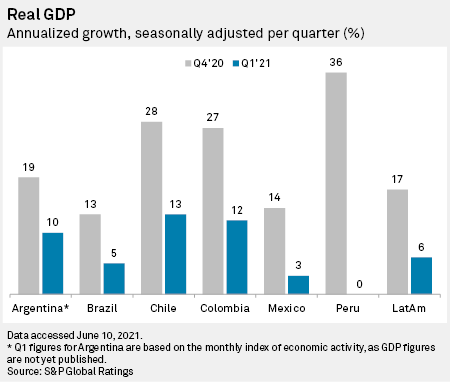

Economic growth for Latin America's top six economies has decelerated in the first quarter of 2021 compared to the linked quarter, according to data gathered by the rating agency.

As a group, growth for the top six economies dropped to 6% during the first quarter, down from 17% growth in the linked quarter. On an individual basis, Peru's growth has decelerated the most among the top six economies of the region, from 36% growth in the fourth quarter of 2020 to zero growth in the first quarter of 2021. Growth for Brazil, Latin America's largest economy, slowed the least, to 5% in the first quarter, compared to 13% in the previous quarter.

In comparison, the International Monetary Fund forecast world growth of about 6% in 2021 and Latin American regional growth of only 4.6%, against the backdrop of vaccination campaigns and spillover from U.S. stimulus programs.

Joydeep Mukherji, managing director and sector lead for sovereign ratings at S&P Global Ratings, acknowledged in a recent webcast that structural challenges persist in Latin America, but the region still exhibits strengths even amid the coronavirus outbreak.

In the same report on first-quarter GDP in Latin America, S&P Global Ratings pointed to an expansion in the service sector despite an increase in daily new COVID-19 cases at the time, combined with lockdowns in some countries. "The lesson learned here is that households and businesses in the region are rapidly adapting to living in a pandemic," the rating agency said.

Meanwhile, Alejandro Werner, IMF Western Hemisphere director, said that investment in the region has still not grown significantly, and will be unlikely to do so due to social and political issues. Werner noted that very few countries globally have seen their political parties unify to combat the pandemic.

Werner also pointed to Argentina's rocky debt status in recent history, as it defaulted in 2001, 2014, and again in 2020. However, it has been holding debt talks and reached a deal in August 2020 with some of its creditors to restructure about $65 billion in debt, which lends a more positive view that the country can slowly recover.

Both Werner and S&P Global Ratings pointed to a rally in commodities prices that started during the second quarter of 2020, and expect Latin American sovereigns will benefit from strong exports in the first quarter of 2021. Countries such as Chile and Peru have had good fiscal policies in place, which means they have less debt to worry about.

For its part, Mexico has adopted a less hands-on approach, allowing debt to grow a bit, and sending the message that sovereign debt should be manageable. Despite this, Werner noted the country's rather slow growth, combined with the debt, could translate into problems in the long run.

The use of economic aid programs has also helped some countries partly offset the impact, but analysts pointed out that sovereigns have already started rolling back on them.

S&P Global Ratings and S&P Global Market Intelligence are owned by S&P Global Inc.