Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 May, 2022

By Zuhaib Gull and Ali Shayan Sikander

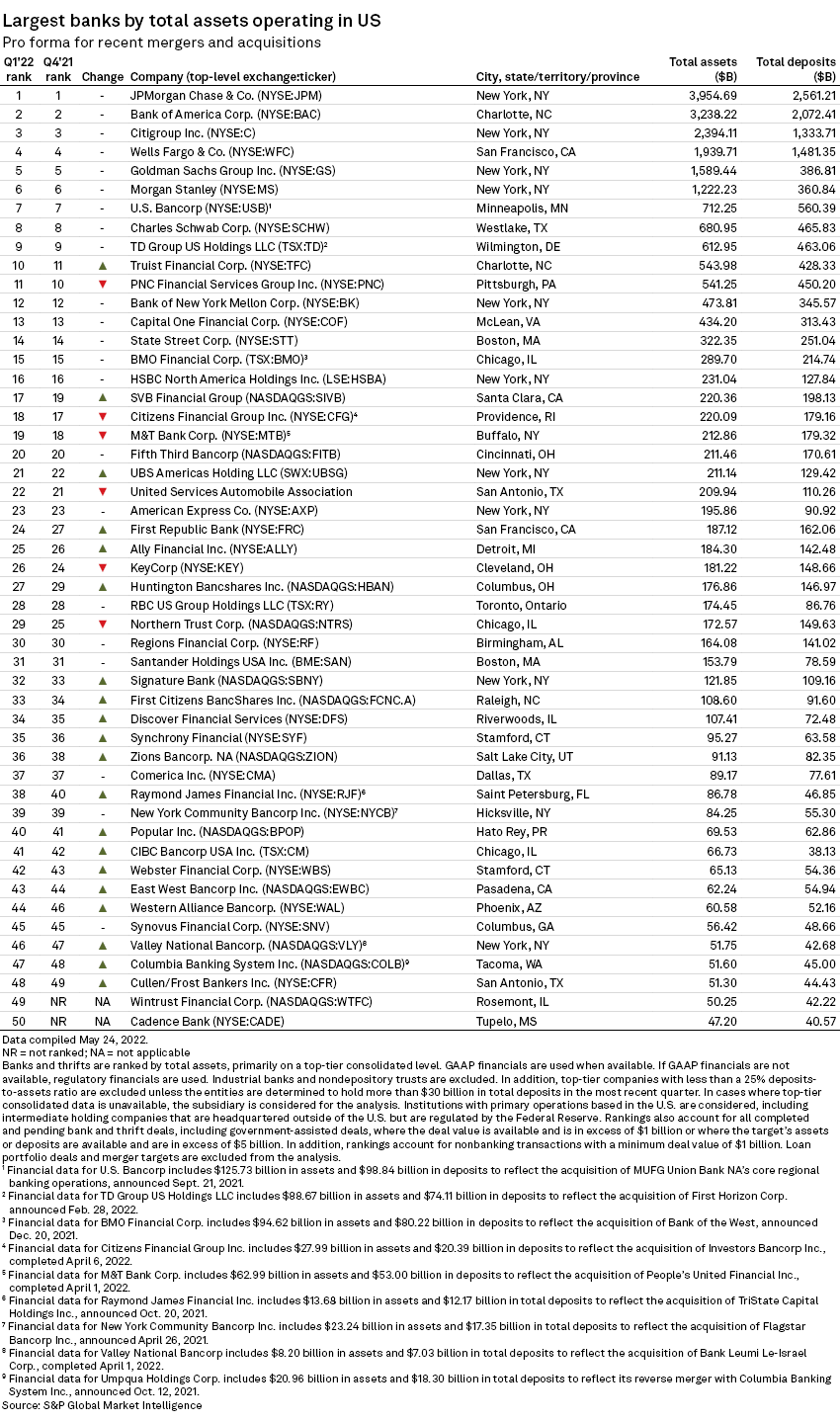

Twenty-eight of the 50 largest U.S. banks and thrifts reported asset growth in the first quarter of 2022, according to S&P Global Market Intelligence data.

To conduct this analysis, S&P Global Market Intelligence examined the largest U.S. banks and thrifts by assets with a deposits-to-assets ratio of at least 25% or at least $30 billion in deposits as of quarter-end.

To compile a pro forma ranking, S&P Global Market Intelligence calculates pro forma assets after accounting for pending M&A transactions that closed after quarter-end. To be included in pro forma adjustments, the deal value must be over $1 billion or involve assets or deposits in excess of $5 billion. Loan portfolio deals are not included because of a general lack of data on both deal consideration and the impact on total assets.

To view an Excel spreadsheet containing the top 50 U.S. banks and thrifts in the first quarter of 2022, click here.

Eight of top 10 banks record growth

The top 10 banks added a combined $559.88 billion in assets during the first quarter, while the next 40 only added a combined $2.28 billion.

JPMorgan Chase & Co., Citigroup Inc. and Goldman Sachs Group Inc. each added more than $100 billion in assets during the first quarter.

Goldman's assets rose 8.5% quarter over quarter, the largest growth rate among all top 50 banks, while assets at JPMorgan and Citigroup grew 5.6% and 4.5%, respectively.

Total assets at Wells Fargo & Co. and TD Group US Holdings LLC both fell in the first quarter, but by less than 0.5%.

One billion-dollar deal announced in 2022

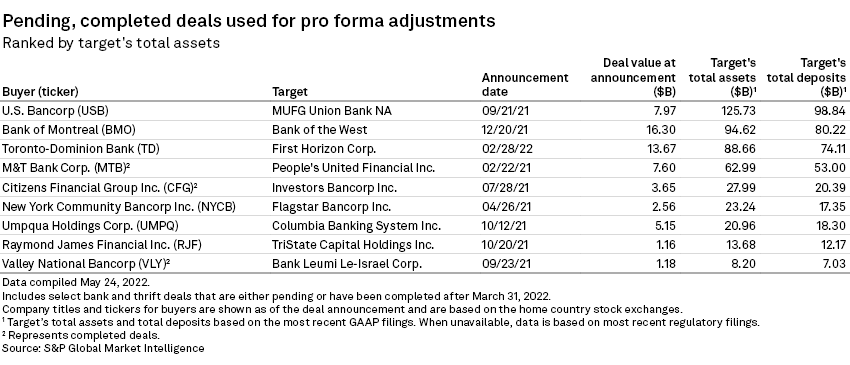

Toronto-Dominion Bank's acquisition of First Horizon Corp., announced Feb. 28, has been the only deal announced so far this year with a deal value above $1 billion amid a downturn in bank M&A activity.

However, three deals involving top 50 banks closed in April, including M&T Bank Corp.'s acquisition of People's United Financial Inc., which was announced more than a year ago, Citizens Financial Group Inc.'s deal with Investors Bancorp Inc., announced in July 2021, and Valley National Bancorp.'s acquisition of Bank Leumi Le-Israel Corp., announced September 2021.

Rising interest rates and market selloffs to dampen M&A further

Alongside regulatory hurdles, recent rate hikes and the dip in the stock market, deal activity is expected to remain muted in 2022.