Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jul, 2021

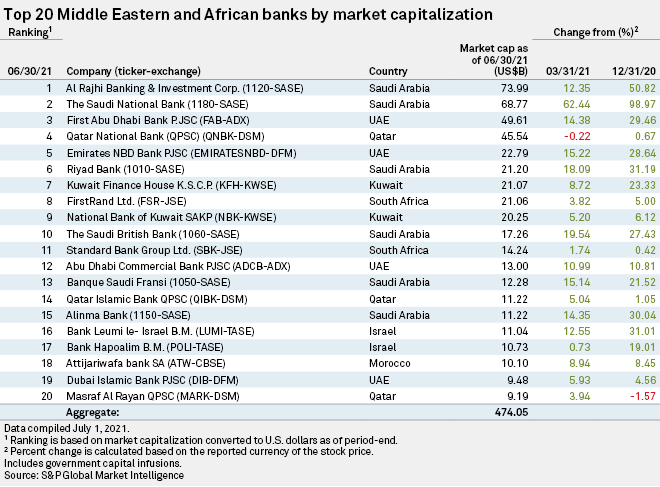

Saudi Arabia's Al Rajhi Banking & Investment Corp. topped the list of the 20 largest banks by market capitalization in the Middle East and Africa as of June 30, with a market cap of $73.99 billion, S&P Global Market Intelligence data shows.

S&P Global Ratings recently revised the outlook on Al Rajhi Bank to positive from stable, reflecting its expectation that the bank will be able to outperform its peers in the Gulf Cooperation Council region and maintain its stronger-than-average earnings generation capacity. Fitch Ratings also revised to stable from negative

The Saudi National Bank, the resulting entity from the tie-up between National Commercial Bank, or NCB, and Samba Financial Group, came second on the list, with a market cap of $68.77 billion. NCB and Samba agreed to merge in October 2020 and completed the process in April 2021.

First Abu Dhabi Bank P.JSC, Qatar National Bank (QPSC) and Emirates NBD Bank PJSC rounded out the top five with market caps of $49.61 billion, $45.54 billion and $22.79 billion at the end of June, respectively.

Four other Saudi Arabian lenders — Riyad Bank, The Saudi British Bank, Banque Saudi Fransi and Alinma Bank — made it into the top 20, while Moroccan lender Attijariwafa bank SA was also in the ranking, placing eighteenth.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.