S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2021

By Erin Tanchico and Rehan Ahmad

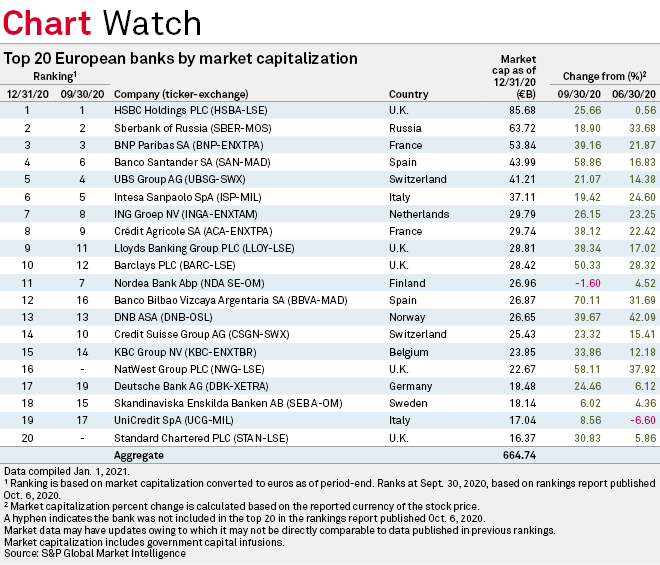

British lenders Standard Chartered PLC and NatWest Group PLC broke into the ranks of the 20 largest European banks by market capitalization in the fourth quarter of 2020, as their share prices recovered some value that had been lost amid the COVID-19 pandemic, according to data compiled by S&P Global Market Intelligence.

StanChart overtook Svenska Handelsbanken AB (publ) to take 20th place after seeing a 30.83% quarter-over-quarter increase in market cap to €16.37 billion, while NatWest placed 16th with a market cap of €22.67 billion after a 58.11% increase over the period.

Fellow U.K.-based lender HSBC Holdings PLC retained the top spot with a market cap of €85.68 billion following a 25.66% rise over the period. Sberbank of Russia and France's BNP Paribas SA also retained their rankings at second and third place, respectively, with markets caps of €63.72 billion and €53.84 billion, rounding out the top three.

British banks have generally improved their capital strength over the past several years, with the help of regulatory intervention. The Bank of England, which recently maintained its bank rate at a record low of 0.1%, is carrying out a review of banks' readiness to cope with potential negative central bank interest rates, but economists say U.K. lenders are robust enough to cope with such rates.

Meanwhile after nearly five decades as an EU member state, the U.K. left the bloc's customs union and single market following the end of the Brexit transition period on Dec. 31, 2020, after the two sides reached a trade deal. The agreement, however, does not remove licensing barriers that arose as a result of Brexit, a concern for the finance sector, and negotiations over the U.K.'s future relationship with the bloc will continue.

The biggest movers among the banks in the list were Finland-based Nordea Bank Abp and Spain's Banco Bilbao Vizcaya Argentaria SA. Nordea moved down four notches to 11th place with a market cap of €26.96 billion, down 1.60% quarter over quarter, making it the only bank in the list that saw a decline in the market value of its outstanding shares. By contrast, BBVA climbed four notches to 12th place after its market cap grew to €26.87 billion as of 2020-end, up 70.11% on a quarterly basis. BBVA announced in November 2020 that it is selling its U.S. business to PNC Financial Services Group in a deal expected to close in mid-2021 and boost the lender's capital levels.

Spanish lender Banco Santander SA, whose market cap amounted to €43.99 billion, moved up two notches to fourth place. Germany's Deutsche Bank AG and British banking groups Barclays PLC and Lloyds Banking Group PLC also climbed two notches to 17th, 10th and 9th place, respectively.

Norway's DNB ASA remained in 13th place, while Sweden's Skandinaviska Enskilda Banken AB fell three places to 18th, despite a 39.67% and 6.02% increase in market cap over the period, respectively.