Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jan, 2021

2020 was another year of dismal returns for value investors, but a good end to the year — and the prospect of investors increasingly switching from growth stocks to cyclical sectors — could mean the much-maligned trading strategy is turning a corner.

Already hamstrung by financial stocks that have struggled since the great financial crisis and missing out on the high-flying big tech stocks, in 2020, Value trading strategies were further hobbled during the pandemic by their exposure to energy stocks and being underweight healthcare.

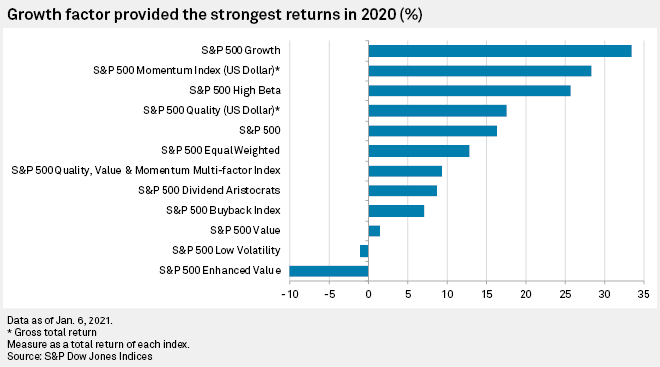

The S&P 500 Value index gave investors total returns of just 1.4% in 2020, a far cry of the 16.5% returns of the entire S&P 500 complex and in a different world to the 33.5% returns offered by the top-performing Growth index. It was the worst year value stocks have ever had relative to the benchmark and it came hot on the heels of their worst ever decade between 2010 and 2019.

But fortunes changed towards the end of the year. In November, value delivered a total return of 12.9% against 9.7% for growth, while in December a return of 3.5% was only slightly short of the 4.1% return of growth stocks.

"It is very easy to see a scenario where value makes up some lost ground against growth and attracts more inflows from investors," Chris Bennett, director, index investment strategy at S&P Dow Jones Indices wrote in an email.

"In the U.S., on balance, if the domestic economy revs back into high gear and inflation continues to tick up, smaller, more domestically focused firms and cyclical sectors, including financials, should be in prime position. As far as I'm aware, most value strategies are effectively portfolios of those exposures at the moment, so this could be a pretty solid foundation heading into 2020," Bennett said.

Top heavy growth

Driven by the tech giants Apple Inc., Microsoft Corp., Amazon.com Inc., Facebook Inc. and Alphabet Inc., growth has been on a tear for a decade giving an annualized total return of 16.5% in that period, improving to 20.5% in the past three years. In 2020, the market concentration of the biggest stocks reached new levels with the five largest companies in the S&P 500 accounting for 40% of the growth index at the end of the year, the highest ever annual reading, according to S&P Dow Jones Indices.

By contrast, value investing has suffered for over a decade, returning an annualized 10.7%, making it the second-worst performing of the 11 trading strategies monitored monthly by S&P Global Market Intelligence, and only kept off the bottom spot by the Enhanced Value index.

Extensive monetary policy in 2020, lowering interest rates and directly purchasing bonds, boosted the value of companies with business models that work independently from the economy, most notably technology. But with multiple vaccines being rolled out, investors are hopeful for a sharp economic recovery in 2020 and have moved back into cyclical stocks.

Oil and gas companies stand to benefit from stronger demand and higher prices as the economy recovers. Even as countries re-enter lockdown, the price of oil is rising with WTI approaching $50 a barrel, territory that has not been seen since the start of the pandemic.

An upturn in the economy is also good for financials, particularly banks, as steepening yield curves and improved economic activity bolsters their profitability.

"We have seen the sharp difference this year between the growth tech stocks and value styles in terms of performance," investment managers Charles Hepworth and James McDaid of GAM wrote in a market commentary. "Next year these value styles will no doubt come back to the fore, as we have witnessed recently. Stock and sector selections will be even more critical."

However, AXA IM strategists Jonathan White and Varun Ghotgalkar expect the rally in value stocks to be "short lived as the initial vaccine euphoria fades," though the gradual re-opening of the global economy and stimulus policies should be supportive for value stocks with the capacity to grow, they said. "Low interest rates and the rise of the virtual economy nonetheless remain important headwinds for value."

For Bennett, investors may have moved too quickly, discounting the persistence of the pandemic, which is once again resulting in broad lockdowns, notably in Europe.

"That economic bull likely scenario requires an efficient roll-out of the vaccine and a quick return to normal," Bennett said. "I fear there may be some pricing that shift in sooner than is realistic. If there is a sudden reversal or downturn, those [cyclical sectors] are likely to get hit the hardest."