S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Nov, 2021

By Eric Oak

The U.S. and EU have announced a deal to replace Section 232 tariffs on steel and aluminum with a tariff-rate quota system, signifying a thaw in trade relations between the two regions. This is a special report on the tariffs and possible outcomes from the resolution.

The source of the matter

The U.S. and EU have agreed to partially lift Section 232 tariffs on steel and aluminum. The breakthrough came right at the deadline set by the EU, thus preventing an increase in retaliatory tariffs on U.S. goods that was set to go into effect in December.

Tariffs on EU steel and aluminum exports were announced March 1, 2018, using the Section 232 process designed for national security, with official documents following shortly thereafter. Section 232 is a part of U.S. trade law that allows the president to take action on matters regarding national security, falling outside the sanctioned remedies that the World Trade Organization outlines. There is a national security carve-out under WTO rules, inherited from the General Agreement on Tariffs and Trade, but it was rarely used. The first test for the carve-out came in April 2019, when the WTO dispute settlement body ruled that Russian actions against Ukraine and other countries rose to the level of national security. Significantly, however, the panel ruled that national security exemptions fall under the jurisdiction of the WTO and can be reviewed. This cleared the way for the steel and aluminum challenges with the WTO to continue and potentially set a precedent for expanded use of the national security exemption in the future.

The 25% tariff on steel and 10% tariff on aluminum enacted in 2018 initially had several carve-outs for steel — including the EU, Canada and Mexico — that were quickly closed in follow-up announcements. The only countries that saw permanent exemptions were Australia and South Korea, with Argentina's products exempt until December and Brazil losing an exemption before regaining it that same month. The tariffs on goods from Canada and Mexico were eventually removed with the signing of the United States-Mexico-Canada Agreement in 2019.

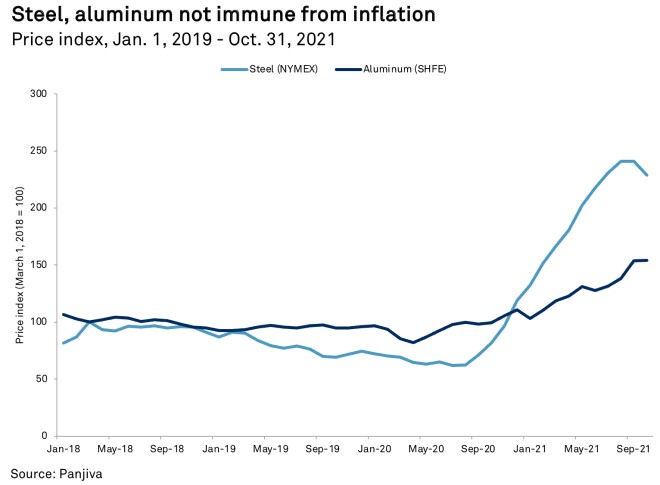

Many countries, including those in the EU, put in place retaliatory tariffs on U.S. goods, and the scheduled escalation of those measures in the EU likely influenced the timing of the new deal. The delay on the part of U.S. President Joe Biden's administration likely indicates the complexity of the agreement, as noted in Panjiva's research of Jan. 8, with buy-in from the U.S. steel industry likely needed in part to proceed. The deal had other measures as well, including statements on climate, labor and cooperation. Biden said in a statement, "It ensures a strong and competitive U.S. steel industry for decades to come and creates good-paying union jobs at home." Another key component for American businesses is the lifting of the retaliatory tariffs set by the EU. Moving forward, other countries may be able to ride the momentum of the U.S.-EU arrangement, including Japan and the U.K. The inflationary environment following the peak of COVID-19 in 2020 may also have been a factor, with prices of steel and aluminum increasing 264.2% and 43.2% year over year, respectively, in the third quarter. This likely increased the burden of tariffs while providing better profitability to producers, making it easier to reach an agreement.

Steel tariffs slice imports

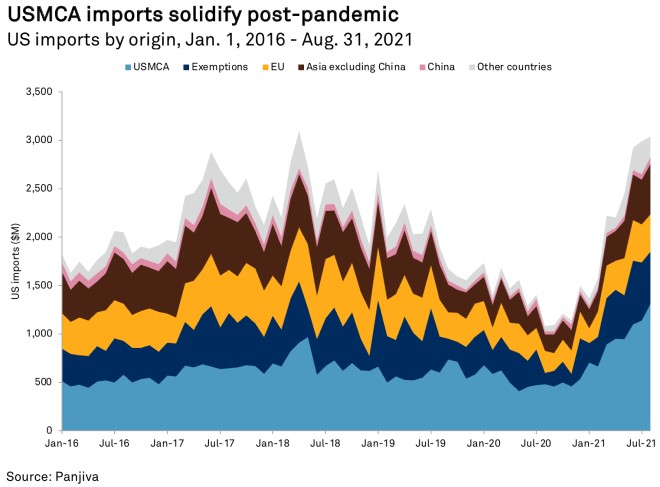

The deal removes Section 232 duties on the first 3.3 million tonnes of steel imported from the EU, with quotas allocated by country based on imports between 2015 and 2017. Any imports above those levels will face the 25% duty. This is likely a compromise between the EU and U.S. steel interests, keeping steel imports at a relatively stable level with historical comparisons. When the tariffs were enacted, they were successful at reducing imports — the main effect of such duties. The share of steel imports covered by the rules from the EU fell from 20.7% of the total in 2018 to 14.0% of the total in the first eight months of 2021. This represents a drop of 13.9% in the second quarter of 2021 compared with the second quarter of 2019, the largest decline in imports for that period except for China.

The largest importers of steel to the U.S. by value are Canada and Mexico, accounting for 41.0% of total imports in the first eight months of 2021 from a 29.1% share in 2018. The release of the two countries from tariffs in the USMCA likely set the stage for further growth, especially following the onset of the pandemic in 2020. Imports versus 2019 increased 88.4% in the second quarter and by 98.6% in July and August combined.

Exempted countries also saw increased volumes, with Brazil, Australia and South Korea increasing the share of imports associated with them to 20.3% in the first eight months of 2021 from 17.6% in 2018. Predictably, countries not exempted from the tariffs saw their share fall. Imports from China, for instance, lost 1.1 percentage points from 2018 to 2021. The rest of the world — divided into Asia excluding China, and all other countries — saw its share of the total drop 4.7 percentage points and 1.8 percentage points, respectively.

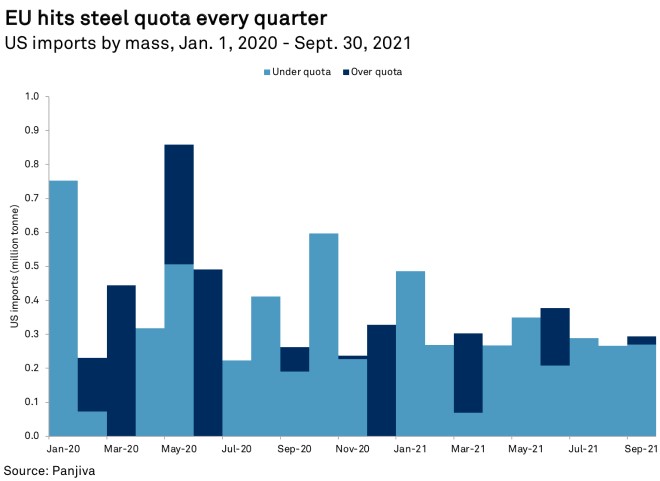

Panjiva's analysis of shipping records shows that all subject imports from the EU, reduced to the HS4 level, would have exceeded the quota in every quarter since the first quarter of 2016, if not before. Administered quarterly, the 3.3 Mt breaks down to 0.825 Mt per quarter, with the ability to roll over up to 4% of the quota for the quarter into the next. The second quarter of 2021 would have seen total imports by weight exceed the quota by 0.17 Mt, while the third quarter would have come close at 0.02 Mt over. It is important to note, however, that the quota will be further subdivided by country within the EU, based on historical levels, and that may change which imports are actually free from the duty. This could also have the effect of shifting steel trade within the EU, especially if a country's quota remains unfilled for multiple quarters.

Importers that may benefit from reduced duties on steel include thyssenkrupp AG and Voestalpine AG, both of which have kept importing from the EU despite the increased costs. Thyssenkrupp's imports of steel by weight to the U.S. increased 26.9% in the third quarter versus 2019, having been 1.2% down in the second quarter. Voestalpine's situation was the opposite, with third-quarter imports versus 2019 down 13.6% when they had been up 3.9% in the second quarter. Both companies have been able to keep imports up year over year despite tariffs, and they may be well positioned for a decrease in costs. Thyssenkrupp may have been anticipating some action to alleviate duties as well, with Panjiva's research of Aug. 9 noting an uptick in imports.

Salzgitter AG and Tubos Reunidos SA are examples of companies that may ramp up imports to the U.S. once the new quota is established, as both have reduced imports since the tariffs were introduced. Imports associated with Salzgitter in the third quarter fell 70.8% compared with 2019, while imports linked to Tubos Reunidos dropped 92.5% in the same period. The prospect of reduced costs to import their products into the U.S. may spark an increase in activity.

Aluminum duties lighten

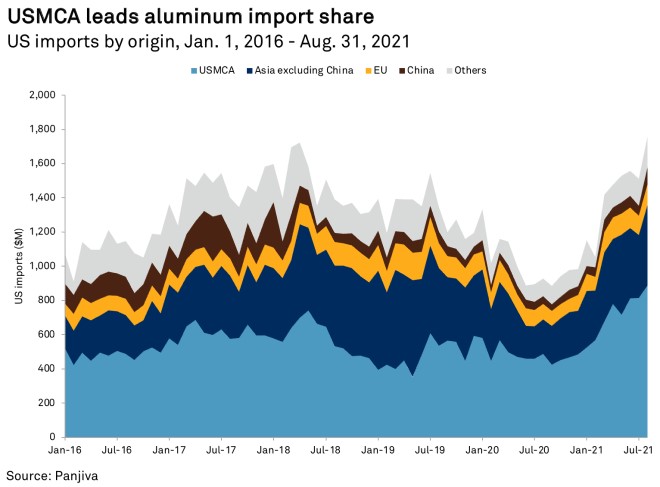

The Section 232 tariffs on aluminum share much of the same story in how they originated and came to be. Set at a 10% duty, the burden on importers was less, and, subsequently, the effects on trade activity were harder to see. In fact, U.S. imports of aluminum from the EU increased to 10.9% of total imports in 2019, the year after the duties were implemented, from 8.7% of the total in 2018. The pandemic tempered that performance, and in the first eight months of 2021, aluminum imports from the EU accounted for only 7.9% of the total value. Imports in July and August 2021 combined show that these levels were 26.5% lower than for the same two months in 2019, the aforementioned high point, but indicate that the EU may have been looking to reverse that trend in agreeing to a deal.

USMCA partners Canada and Mexico again took the top spot in U.S. imports of aluminum, increasing their share from 39.8% in 2018 to 50.5% in the first eight months of 2021. This amounted to a 49% year-over-year increase in July and August, with the bloc benefiting from the lifting of aluminum tariffs under the USMCA in 2019. The growth of imports from the two countries came at the expense of all other regions, with the share of imports from China dropping 1.9 percentage points from 2018 to the first eight months of 2021 and the share of imports from Asia excluding China and from all other countries dropping 3.6 percentage points and 4.3 percentage points, respectively. The new deal puts imports from the EU on an even playing field with those from Canada and Mexico, ignoring logistical differences, and that may benefit EU sources.

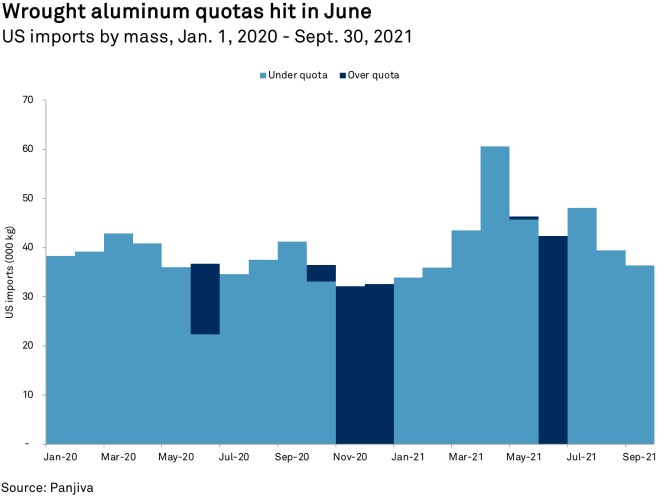

The quota for aluminum imports will be administered differently than that for steel: semiannually, and limiting the first half of the year to 60% of the annual amount. The limits are also divided into two categories, unwrought and wrought aluminum. The unwrought quota is 18,000 tonnes a year, a number that is completely out of sync with the 135,600 tonnes imported from the EU in 2020. In the first three quarters of 2021, imports were averaging 14,200 tonnes per month.

The wrought quota is 366,000 tonnes a year, which may be more favorable to EU businesses, with imports in 2021 not reaching the 60% mark until June. Applying the quota to 2020 imports shows similar results, with the 60% mark reached in June and the total quota filled in October. The differentiation in the two quotas may be a nod to protecting the domestic refining industry, while imports of wrought goods may be more specialized. As with the steel quotas, the aluminum limit will be further subdivided to each country in the EU based on historical levels.

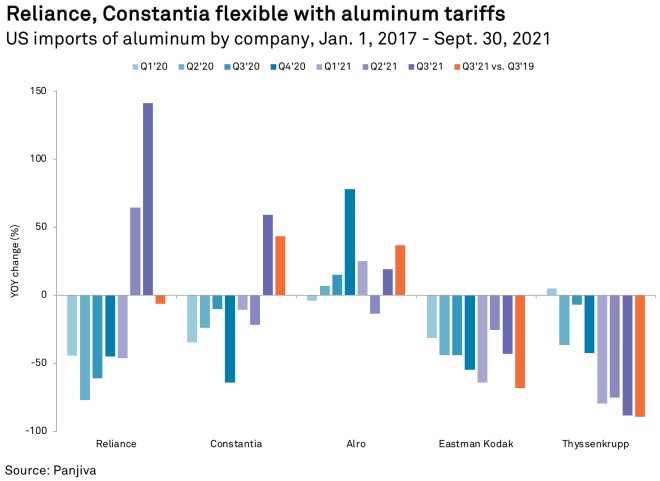

Thyssenkrupp reappears in the list of aluminum importers, albeit showing a different trend. Imports linked to the company were down 88.5% year over year in the third quarter and by 89.3% compared with the third quarter of 2019. The metals firm is joined by Eastman Kodak Co., which saw third-quarter imports decline 43.0% year over year and by 68.2% from 2019.

Imports associated with Reliance Steel & Aluminum Co., Constantia Flexibles AG and Alro Steel Corp., meanwhile, increased in recent quarters. Reliance saw a 141.2% surge year over year in the third quarter, although that may have been partly due to the pandemic, as mass compared with 2019 fell 6.4%. Constantia and Alro were more consistent with import growth, increasing 59.2% and 19.0% year over year, respectively, in the third quarter, and by 43.4% and 36.9%, respectively, from 2019. These firms may be able to capitalize on reduced tariffs on their already active imports.

Eric Oak is a researcher at Panjiva, a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.