S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jan, 2022

By Camille Erickson

|

Canadian developer Nouveau Monde Graphite's Matawinie project near Montreal is pictured above. The planned graphite mine is expected to produce 42,000 tonnes of battery anode material starting in 2025. |

Global reliance on China for graphite, a key ingredient in batteries, has emerged as a major obstacle to electric-vehicle makers' production schedules amid trade disputes and soaring demand.

U.S.-based battery and car companies have urged President Joe Biden to ease trade restrictions or risk impeding the administration's push to electrify transportation sectors, according to industry experts. Producers trying to break into the market for graphite, the largest component of lithium-ion batteries by volume, have begun building out new production facilities in the U.S. and Canada, but they are years away from production.

"The global anode supply chain is 100% reliant on China at some point within that chain," Shaun Verner, CEO and managing director of Australian graphite miner Syrah Resources Ltd., said in an interview. The company operates the Balama natural graphite mine in Mozambique and plans to build the first graphite processing facility in the U.S. "That heavy reliance on a single source ought to be quite concerning for [original equipment manufacturers]."

Graphite is an abundant mineral around the world and relatively cheap compared with other battery materials, but finding the right quality and type of graphite needed for batteries can be tricky. The global demand for EVs is expected to drive a massive increase in demand for graphite. The world could be short 80,000 tonnes of the mineral in 2022 as demand from the EV sector rapidly scales up, according to Benchmark Mineral Intelligence. Sales of passenger plug-in EVs are projected to hit 9.6 million units in 2022, according to an S&P Global Market Intelligence forecast published in December 2021.

Price and supply troubles ahead

The average value of natural flake graphite shot up 25% between May 2021 and December 2021, according to Suzanne Shaw, principal analyst and lead graphite expert at Wood Mackenzie. Benchmark Mineral Intelligence assessed the price of flake graphite at about $650 per tonne, up year over year from $540/t, according to its latest price report published Dec. 31, 2021. The price reporting agency has forecast the cost for this feedstock breaking $700/t in 2022. Meanwhile, the price for 15-micron spherical graphite was $2,800/t, decreasing slightly year over year from $2,825/t, according to the agency. Spherical graphite is battery grade and ranges in particle size from 10 microns to 25 microns.

The price rally will likely continue through early 2022 as the sheer scale of anticipated demand buoys prices. China's power rationing due to decreased coal supplies could also persist into the second quarter of 2022. The country primarily uses coal to provide energy, but it has been facing supply disruptions from an Indonesian export ban and a prolonged trade dispute with Australia.

"The graphite market is tightening, especially for grades that are suitable for use in batteries as demand rises robustly," Shaw told Market Intelligence in an email. "In the short term, there is room for Chinese producers to further increase production to meet capacity and alleviate some of the gap, but we believe that a tightening market will increase prices in the coming years and encourage several new producers to come online outside China by the middle of the decade."

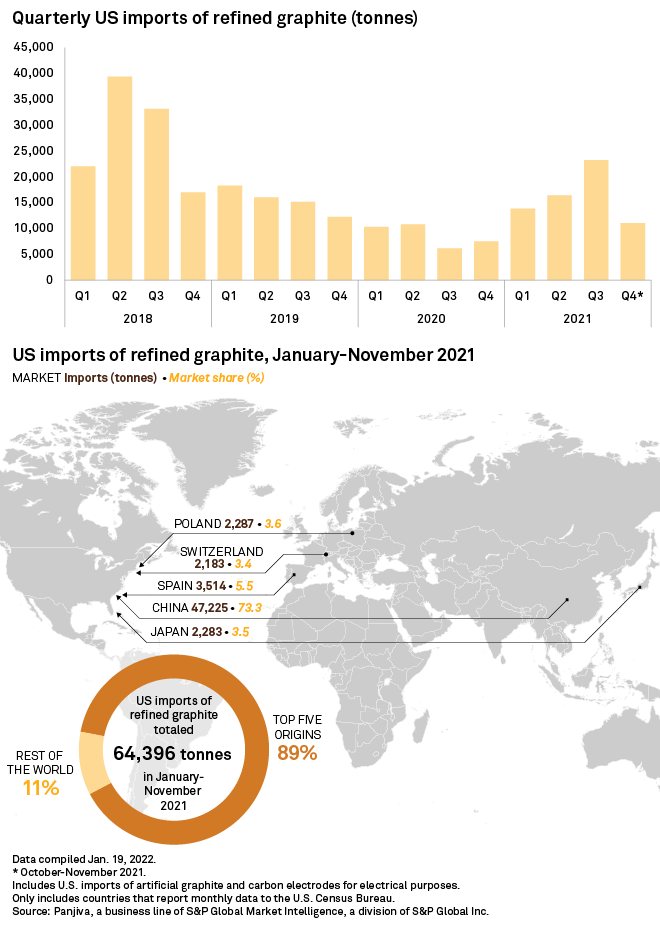

China touches almost all of the world's graphite along its path to the consumer. The U.S. imported 64,396 tonnes of refined graphite between January and November in 2021, of which 73.3% came from China, according to data from Panjiva, a supply chain-focused business line of Market Intelligence. Even when graphite is mined or manufactured outside of China, such as from Mozambique, it is typically routed to China for processing and refinement. And most graphite refined in places such as Japan comes from China.

Trade squeeze

A tariff battle within the Biden administration has only exposed the battery industry's dependence on China for graphite. In 2018, U.S. trade officials slapped tariffs on several products associated with the EV supply chain coming from China, including artificial graphite. The Trump administration eventually allowed companies to apply for certain exclusions, but those exemption opportunities expired in 2021. In public comments, companies bemoaned the impossibility of getting graphite from anywhere but China.

"Tesla has concluded that no company in the United States is currently capable of producing artificial graphite to the required specifications and capacity needed for Tesla's production," California-based EV and battery giant Tesla Inc. said in comments filed with the Office of the U.S. Trade Representative and posted on Dec. 1, 2021. Tesla could not be reached for comment.

SK Battery America Inc., a subsidiary of South Korea battery-maker SK Innovation Co. Ltd., also supported the extension of the tariff exclusion on graphite, stating it was "unfeasible" to obtain graphite from the U.S. for use in the manufacturing associated with its $11.4 billion investment in lithium-ion factories in Kentucky and Tennessee in partnership with U.S. automaker Ford Motor Co. as well as its $2.54 billion investment to build battery plants in Georgia.

"Presently, it is not feasible for SK Battery America and BlueOvalSK to obtain graphite from other sources outside of China due to the uniqueness of the product, the incredible risk of entering the graphite industry, and the lack of suppliers that can meet our present needs," the company wrote in a comment to the U.S. Trade Representative.

The U.S. Trade Administration press office did not respond to multiple requests for comment on the status of the tariffs. Partners at law firm Arent Fox expect the government agency to announce whether the product exclusions will be reinstated in early 2022, according to a Jan. 13 report.

Onshoring graphite production

Syrah Resources revived its Balama graphite mine in Mozambique in early 2021 and plans to ship a portion of the graphite it extracts to its new Vidalia anode processing facility in Louisiana. The company plans to announce a final investment decision for the construction of Vidalia in January. The majority of the Balama graphite output will still flow to China for processing, but Verner said the company aims to gradually shift more volume to the Western hemisphere for processing.

"We chose the U.S. because we saw that the manufacturing footprint of electric vehicles and batteries was moving out of Asia," Verner said. "Manufacturers want their manufacturing base closer to their markets."

Canadian developer Nouveau Monde Graphite Inc. has plans to erect a battery anode manufacturing hub near Montreal in Quebec and has started construction on a natural graphite mine. The Matawinie

"We cannot rely on China to build it all for us, like in the past," said Eric Desaulniers, founder, president and CEO of Nouveau Monde Graphite. "We need to streamline permitting. We need to go back to exploration to find more deposits of all those minerals. And we need to build our own supply chain locally," Desaulniers added.

In early December 2021, Canadian company Northern Graphite Corp. agreed to purchase the Lac des Iles graphite mine in Quebec from Imerys SA, with plans to produce 15,000 tonnes of graphite concentrate over a three-year period. And Australian Securities Exchange-listed Novonix Ltd. is working to open up a synthetic graphite plant in Tennessee.

Tesla is seeking to diversify its own supply of the gray flaky mineral. On Dec. 23, 2021, weeks after Tesla's comments on the trade dispute, Syrah Resources announced it had signed an off-take agreement to supply 8,000 tonnes of graphite for four years from the facility starting no later than May 2024.

Yet the question remains if companies with new graphite assets in the pipeline will be able to meet the speed of EV demand.

"Supply will struggle to catch up with graphite demand," said George Miller, a Benchmark Mineral Intelligence analyst.

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.