S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Sep, 2021

By Vanya Damyanova and Cheska Lozano

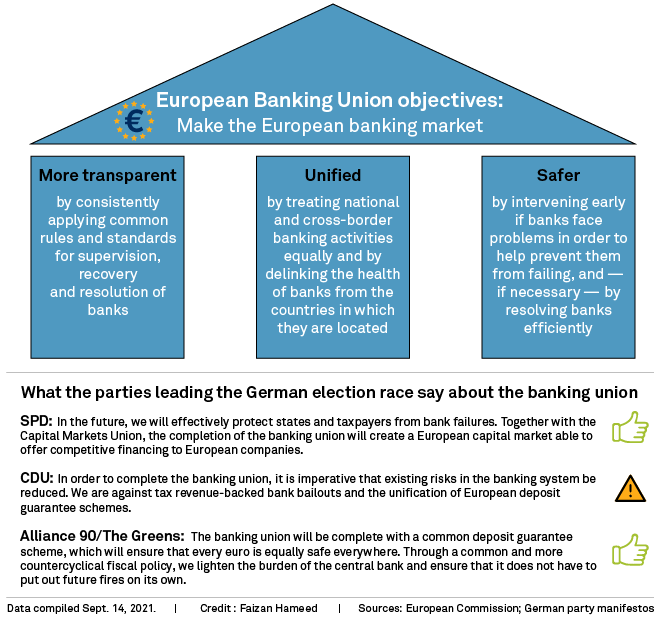

The project to harmonize European banking rules and unify the sector to make it more competitive globally could be rejuvenated should the Social Democrats win the upcoming German election.

Olaf Scholz, the party's candidate and Germany's finance minister, is the front-runner to win the Sept. 26 vote to succeed Angela Merkel, whose 16 years as chancellor are coming to an end. Germany is the largest economy in Europe and wields significant political clout, but it has long opposed the European banking union.

Germany has been setting conditions and "making most of the problems at the table" during the negotiations for the banking union so far, despite saying it wants to complete the project, Paweł Tokarski, a senior associate at the EU/Europe Research Division of the German Institute for International and Security Affairs SWP, said in an interview. The latest round of talks in June failed again, Tokarski said.

At the heart of Germany's opposition to the banking union is the European deposit insurance scheme, or EDIS. The Europe-wide shared deposit scheme is designed to kick in should there be a failure of national guarantee funds, which are in place to protect deposits. EDIS is contentious in German politics over concerns that Germany could effectively subsidize bank failures in other eurozone countries. Scholz broke away from Germany's skeptical position toward EDIS in late 2019 with a proposal for a compromise on deposit guarantees and a plan to complete the banking union.

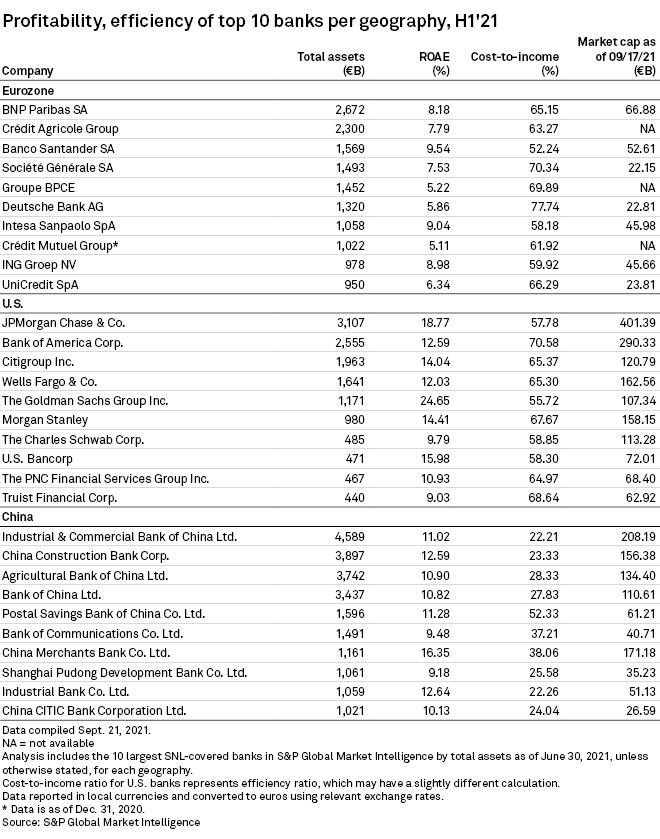

Bank of France Governor Francois Villeroy de Galhau and ECB supervisory board Chair Andrea Enria have also spoken about the urgent need to complete the banking union. The lack of an integrated eurozone market is detrimental to European banks, which have to face global rivals with much deeper and efficient home markets, such as U.S. banks, Enria said in a Sept. 9 speech.

|

Despite Scholz's support, there has been little progress in the EU banking union talks over the past two years, but that might change if Scholz's Social Democrats, or SPD, form a new government with more EU-friendly coalition partners, Carsten Brzeski, global head of macro for ING Research, said in an interview.

Opinion polls show the SPD ahead with 26% of the projected vote; followed by Merkel's Christian Democratic Union, or CDU, with 21%; and the Greens in third place with 16%. This puts the Greens in play as a potential coalition partner with the SPD.

The Greens have advocated for risk-sharing in the eurozone and the completion of the banking union, Tokarski said.

Another likely coalition partner is Germany's Free Democratic Party, or FDP, currently fourth in the polls with 11% of the projected vote. A grand coalition between the SPD and the CDU, as in the latest Merkel cabinet, is "extremely unlikely" and all indications point to a three-party coalition government, Tokarski said.

If the SPD wins the election, one probable outcome is a so-called traffic-light coalition with the Greens and the FDP. This will be the best setup to press on with the banking union issue if the FDP, which is more conservative on the matter, remains a junior partner, said Silvia Merler, head of research at the Algebris Policy and Research Forum, which writes reports and recommendations on European economic policy. If the next German finance minister is from the FDP, one can "forget about major progress on the banking union issue," Tokarski said.

Weak German banks

What could give some impetus to the banking union debate on a domestic level is the weak German banking system, which has struggled to remain competitive due to low interest rates, high cost-to-income ratios, lack of digitalization and pressure from challengers in the market, Brzeski said.

Scholz's 2019 push to complete the banking union was seen as a response to the reduced relevance of German banks in global markets, most notably the country's top two listed lenders, Deutsche Bank AG and Commerzbank AG, both of which are undergoing major restructuring. The German government still owns a stake of more than 15% in Commerzbank.

Earlier in September, Deutsche Bank CEO Christian Sewing called for further market integration in Europe and the completion of the EU banking and capital market union projects in particular. "We must finally make use of Europe's economies of scale," Sewing said, adding that Europe needs big, strong banks or it will be too dependent on U.S. financial institutions. Currently, JPMorgan Chase & Co. and Bank of America Corp. alone are worth as much on the market as the 18 largest European banks together, Sewing said.

Deutsche Bank's own market capitalization is currently nearly 18 times lower than JP Morgan's, S&P Global Market Intelligence data shows.

Although EU politicians understand the impact of market fragmentation on domestic banks, finding common ground on the remaining banking union reforms will not be easy. "It's a very difficult project to move ahead, particularly because the parts of it that are left are very complicated and very contentious," Bruegel's Christie said.

Apart from an agreement on common deposit guarantees, EU member states will have to agree on attaching a certain level of risk to sovereign debt on bank books, which currently is a risk-free asset. This is a "no go" for Italy given the country's legacy with bad debt after the crisis, Tokarski said.

Political sentiment in other key member states such as Italy and France will play a key role and there are elections coming in both countries, Merler said. France will hold a presidential election in 2022 and Italians will go to the polls for a general election in 2023.

Therefore, even with strong support from Germany, the banking union will likely take several more years to complete, the analysts said.

Germany and France would likely benefit most from the completion of the project given that the total banking assets concentrated in the two countries are higher than the total of the rest of the eurozone.

Top of the agenda

Policy experts question how high the banking union could rank on Scholz's own agenda should he become chancellor.

Climate policy has been a key topic during the election campaign with the Green Party gaining rapid popularity and turning the traditional two-party race for the German chancellery, between the Social and Christian Democrats, into a three-way contest.