Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 May, 2022

|

Stock prices for U.S. coal companies have increased dramatically as tight supplies persist in the face of greater demand for the fuel. |

As many investors were turning away from coal, others saw an opportunity — and are now being rewarded.

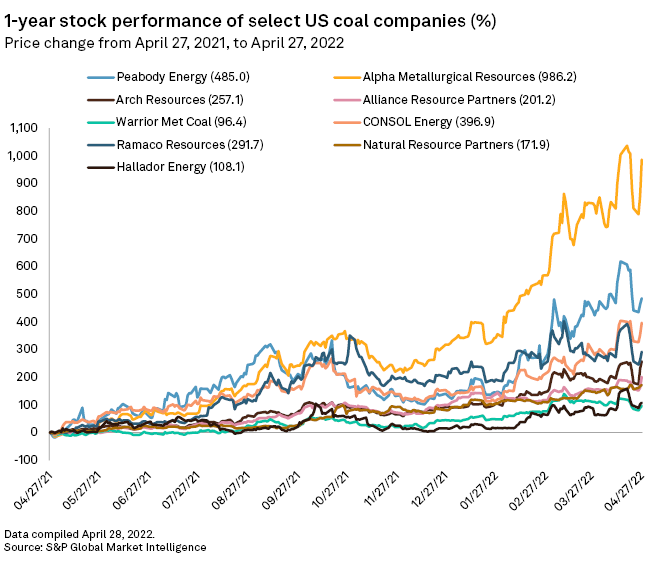

Tight coal supplies and increased demand have driven up prices, allowing U.S. coal producers to reap profits after many faced bankruptcy and large debt loads in recent years. And with U.S. coal consumption on a path of long-term decline, coal companies are not investing in new production, but are instead returning much of their windfall gains to shareholders. With coal company share prices increasing as much as 986.2% in one year, some investors may now also collect the rewards of betting on the sector.

"They've absolutely exploded," said Joung Park, an individual investor who said he bought coal sector stocks two years ago. "My philosophy is to buy hated sectors at inflection points. ... Within the energy sector, the most hated sub-sector is coal because everyone thinks it's going to die, it's going to go away, that it's an archaic relic from the 20th century."

The share price of Alpha Metallurgical Resources Inc. jumped 986.2% year over year as of April 27, while the nation's largest coal producer, Peabody Energy Corp., recorded a 485.0% increase. Of the nine U.S. coal miners analyzed by S&P Global Commodity Insights, all of them increased in share price over the past year with some equities multiplying several times in value.

The U.S. drastically cut back its coal use in the past decade as cheap natural gas and renewable power displaced it in the power sector and investors pushed companies to reduce greenhouse gas emissions. With a dim outlook on the horizon, coal stocks were often deflated. Many of the largest producers in the sector turned to bankruptcy restructurings and were subject to delisting from public stock exchanges. For example, Alpha Metallurgical is a leaner, restructured version of a predecessor company that filed for a bankruptcy reorganization in 2015.

However, demand for U.S. coal bounced back in 2021 after production levels hit a multidecade low in 2020. While elevated prices drove coal production up to an estimated 578 million tons in 2021 from 535 Mt in 2020, according to the U.S. Energy Information Administration, the response has been relatively muted in comparison. That could mean elevated prices are here to stay in the near term, and investors have taken notice. While Alpha's stock has traded as low as $12.09 per share over the past year, its share price reached as high as $161.30 per share in recent weeks.

Investors hunt for value

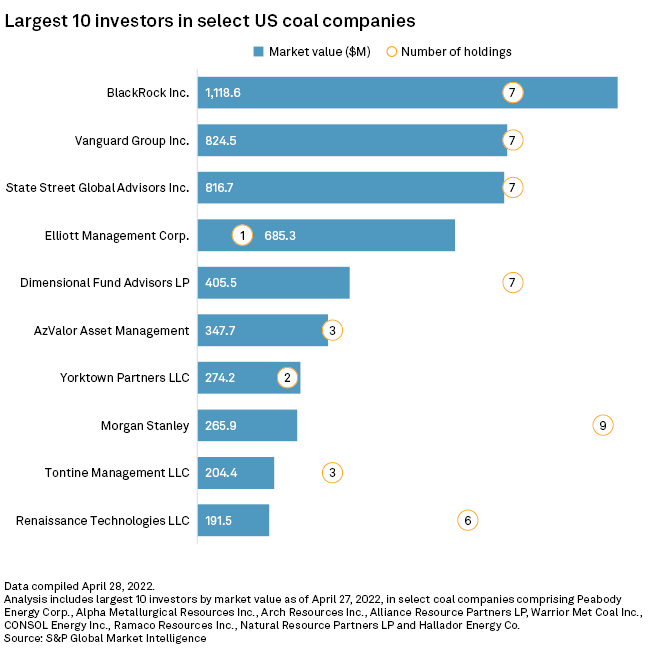

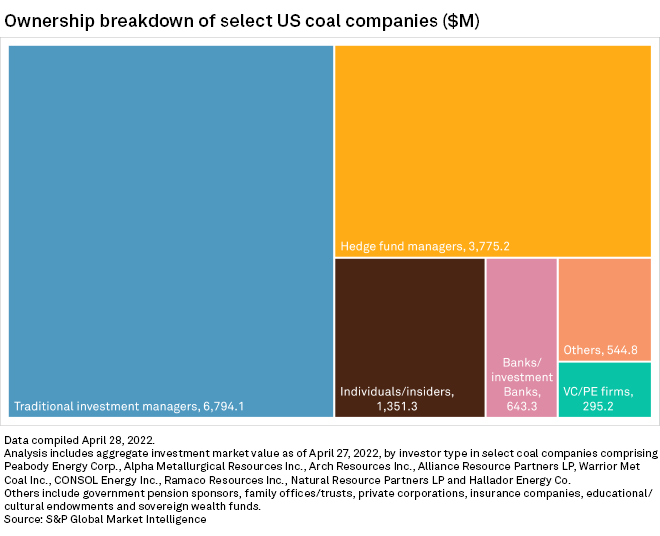

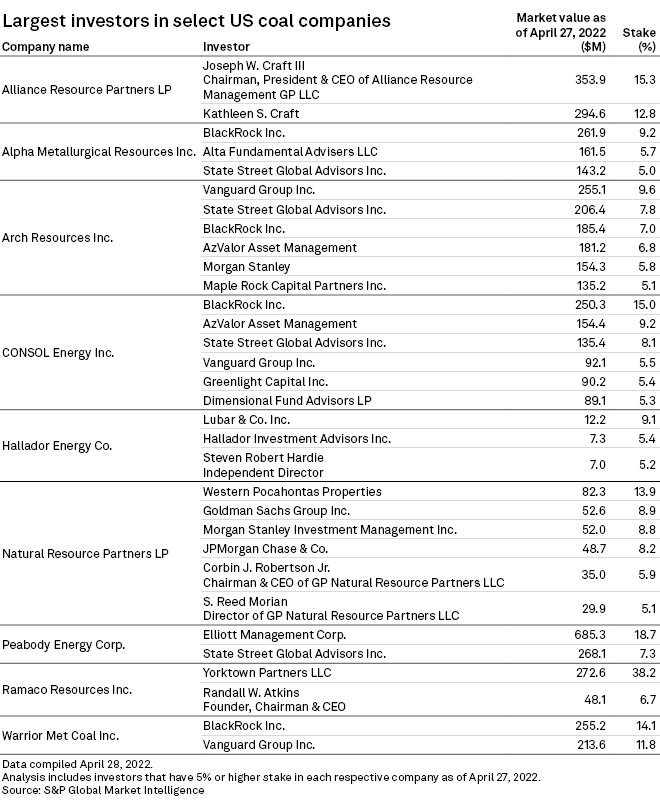

Individual investors, including insiders, make up about 10.1% of the public ownership of U.S. coal companies, according to Commodity Insights data. They are dwarfed by traditional investment managers and hedge funds that comprise the bulk of public investment in U.S. coal companies, including BlackRock Inc., Vanguard Group Inc., State Street Global Advisors and Elliott Management Corp. However, some retail investors are now jumping into coal stocks rather than avoiding them.

Michael Wiggins De Oliveira, the author of the Deep Value Returns newsletter published on Seeking Alpha, said he invested in Arch Resources Inc. in March as part of a broader shift from a focus on tech stocks to commodity companies. For years, coal was "left for dead" by many in the investment space, Wiggins De Oliveira said. Substantial free cash flow and limited capital expenditures attracted him to the sector.

"I think that the risk-reward is more favorable there than having to try and understand where tech companies may or may not go," Wiggins De Oliveira said.

While many investors are increasingly focused on environmental, social and governance issues in investing, Wiggins De Oliveira expects portfolio managers may return to previously shunned sectors. He suggests investors do not "try to be a hero" by combing through smaller names looking for an opportunity, but instead look to "relatively safe" bets on coal companies with larger market capitalizations.

"I would just advise to go for the best balance sheets," Wiggins De Oliveira said. "I don't believe it's worthwhile overthinking it."

Park, who previously worked as a metals and mining equity analyst with Morningstar, said he purchased holdings in Peabody, Alpha and Arch in 2020 when coal stock prices crashed and continued to expand that position in 2021. In May 2021, Park published an article pointing investors to Peabody as an "uninvestable stock" with significant upside potential — calling it a "speculative lottery ticket."

That ticket appears to have paid off. Park said his coal investments proved to be "multi-baggers," investments with potential returns several times over the initial investment. For example, if an investor bought 100 shares of Peabody for $83 when it hit a recent low of 83 cents per share on Nov. 10, 2020, that position would have been worth $2,142 as of market close on May 2 when Peabody's share price was $21.42. And a $210 investment in 100 shares of Alpha when they sold for $2.10 apiece in March 2020 — now up well over 5,000% — could have sold for $14,823 based on the share price as of the May 2 market closing.

While some of the factors leading to today's high-price environment in coal were difficult to predict, such as Russia's invasion of Ukraine, Park said the supply and demand dynamics were already favorable for investment. When the balance between supply and demand is as tight as it is in coal, any major world event can disrupt the market, whether that's the conflict in Ukraine today or the widespread flooding in Australia that disrupted metallurgical coal supply more than a decade ago.

While many are thinking the commodity cycle is in its seventh or eighth inning, Park said he thinks it is looking more like the third or fourth, with a couple of years of higher commodity prices still on the horizon. After going through a "brutal" bear cycle for more than a decade, Park said investors were overlooking coal.

"When it's like that, everyone just kind of gives up on the sector," Park said. "That's when the inflection point comes. That's when you can now find these amazing bargains."

Cash flows through coal companies

Analysts expect all seven large, publicly traded coal companies recently analyzed by Market Intelligence to report more revenue in the first quarter compared to the prior-year period. With balance sheets relatively clean several years after a wave of bankruptcy swept over the sector, and minimal capital expenditures allocated for new projects, coal companies are generating substantial free cash flow.

A lot of that cash is flowing back to investors. In February, St. Louis-based coal producer Arch Resources announced it would return 50% of the prior quarter's discretionary cash flow to a variable quarterly cash dividend in addition to its fixed dividend. The remaining 50% is intended for share buybacks, repurchasing dilutive securities, special dividends or capital preservation.

"We realize it's atypical for a company to commit to return effectively 100% of its discretionary cash flow to shareholders, but it's also atypical for a company with our cash-generating capabilities to have such modest cash requirements going forward," Arch President and CEO Paul Lang said April 26 during the company's first-quarter earnings call.

Arch's initial $8.11 per share dividend is likely to be "handsomely surpassed in the coming quarter," B. Riley FBR analysts said in an April 27 note. Only 25 cents of that dividend came from the fixed component of the company's dividend, with the bulk of the payout coming from its cash flow-based variable dividend.

Lang noted the company delivered a second consecutive quarter of record earnings and repaid $280 million in debt, restoring its balance sheet to a net debt-neutral position as it takes in record gross margins from its metallurgical coal sales.

But only for now

Coal companies do seem to be in a much stronger financial position today than only a few years ago, said Seth Feaster, an analyst at the Institute for Energy Economics and Financial Analysis. However, there has been little evidence that utilities in the U.S. will be reversing a trend of reduced coal consumption. Feaster said that, given coal companies are not broadly held by a lot of investors, the stock price of the companies could be moved by a relatively small number of investors looking at investing in places they may not have before.

"The market has suddenly found commodities to be pretty interesting," Feaster said. "A lot of the coal companies are being swept up in that."

While producers are currently enjoying the windfall from higher pricing and elevated demand, few are bulking up their producers. That is because thermal coal sold to domestic power plants accounts for most of the volume sold by miners in the country, and utilities continue to shut down coal-fired power plants while plans for coal-based replacements remain elusive. That dynamic means it is risky for companies to initiate any new projects that could take years and substantial capital to deploy.

"I don't think that anybody is really thinking this is a great investment for the long term," Feaster said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.