S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Nov, 2021

By Sanne Wass and Rehan Ahmad

Svenska Handelsbanken AB (publ)'s decision to put its Danish and Finnish operations up for sale is a welcome move for an M&A-hungry banking sector in Denmark, while in Finland finding a buyer is likely to be more difficult.

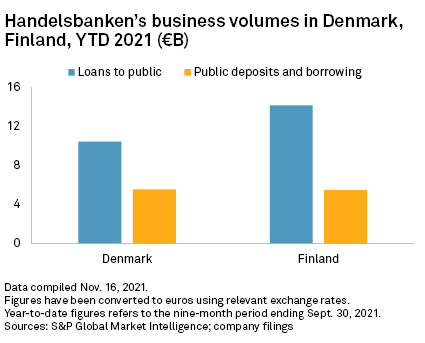

Sweden's largest lender by assets said last month that it would divest these businesses, which serve both retail and corporate customers, because there was little opportunity to scale up its offerings without significant investment. Handelsbanken's average lending volumes totaled €10.38 billion in Denmark and €14.11 billion in Finland in the first nine months of 2021.

A range of institutions may be interested in the two divisions, with analysts naming Nykredit A/S and Spar Nord Bank A/S as top candidates in Denmark and Danske Bank A/S as a potential bidder in Finland.

The Danish business will likely be easier to sell, and fetch a higher price, according to analysts.

Andreas Håkansson, a Sweden-based equity analyst at Danske Bank, expects "a handful" of lenders to consider bidding for the Danish unit and that the price will be above book value. For the Finnish business it will likely be less than book, he said.

The Danish banking sector has experienced a deal-making appetite in the past couple of years as lenders address pressure on profitability, rising capital requirements and tighter regulation.

Many small-to-mid-sized banks in Denmark have historically shown an interest in growing, and the Handelsbanken business "would transform quite a few of them in terms of size," Håkansson said. In Finland there are fewer banks that have a structural need for a deal and so there will be fewer potential buyers, the analyst said.

The capital allocated to Handelsbanken's Danish and Finnish operations totaled €736 million and $746 million, respectively, at the end of the third quarter, and these are good proxies for their book values, said Finland-based Antti Saari, head of research at OP Financial Group. Saari also expects the Danish unit to fetch more than the Finnish one because of more potential bidders and better profitability.

Saari estimates that the Danish business could go for between €850 million and €920 million, and the Finnish one for between €600 million and €700 million.

A 'desirable transaction' in Denmark

Handelsbanken's sale is a "desirable transaction" in the Danish banking market, and a buyer is likely to be found relatively quickly, according to Mikkel Emil Jensen, a Denmark-based equity analyst for Sydbank.

"It is not every day that some 80 billion Danish kroner in lending volumes are put up for sale," he said.

Nykredit and Spar Nord are the most likely bidders, according to Jensen. They use the same IT platform as Handelsbanken in Denmark, BEC, meaning a merger would be easier and cheaper, he said.

Banks that use different IT providers, such as Jyske Bank A/S, would face large costs to move customers to their own platform, Jensen said, although he would not rule them out as possible candidates. BEC's exit fee alone would amount to 1.1 billion Danish kroner for Handelsbanken in Denmark, according to calculations by business newspaper Børsen.

Danish equity analysts have also suggested Sydbank A/S, A/S Arbejdernes Landsbank and Ringkjøbing Landbobank A/S as potential bidders for Handelsbanken Denmark, according to local media.

Finland more difficult

In Finland, meanwhile, the process of finding a buyer may drag out. Saari does not expect a deal to be agreed upon before next year as "time is on the buyer's side."

He deems Danske Bank A/S the "most obvious buyer" of Handelsbanken's Finnish business. The Denmark-headquartered bank already has a presence in Finland and is the only potential candidate that can afford the whole operation, Saari said. Other large Nordic players such as Swedbank AB (publ) and Nordea Bank Abp have indicated they are not interested.

Jensen described the sale of Handelsbanken's Finnish unit as a "golden opportunity" for Danske to drive scale and improve profitability through an acquisition, especially given the Danish lender is struggling to grow business volumes in the wake of various scandals.

The fact that Danske still faces a potential money-laundering fine may hamper its appetite for spending capital on a major deal, Saari said. Denmark's largest bank by assets may consider divesting from some of its less profitable businesses to finance the purchase, such as that in Ireland, according to Jensen. Saari suggested that Danske could engage in an exchange that will see it give its Norwegian business to Handelsbanken in return for the Finnish unit on offer.

If Danske does not buy Handelsbanken Finland, the business is unlikely to be sold in one piece, Saari said. Splitting it into multiple transactions will allow smaller and midsized banks in Finland to participate, he said, pointing to Aktia Pankki Oyj, Oma Säästöpankki Oyj and S-Group as potential candidates to take over Handelsbanken's retail activities in Finland, while Norway's DNB Bank ASA or Sweden's Skandinaviska Enskilda Banken AB (publ), both of which have Finnish branches, could be interested in the corporate part of the business.

Interest from the market

None of the banks contacted by S&P Global Market Intelligence explicitly ruled out making a bid.

A spokesperson for Spar Nord said the Danish activities "look intriguing" but had no further comments. Danske said its focus "remains to be a strong, Nordic universal bank" and that it would not comment on M&A speculation.

OmaSP said it is watching "with great interest" but said it is "completely unclear" whether any of the business of interest to it would even come up for sale. S-Group said it does not have any plans to bid on parts of Handelsbanken's Finnish business, "at least not yet."

Aktia CEO Mikko Ayub said the bank is "observing the Finnish banking market closely," and in the event that opportunities arise, it would take a look. However, he emphasized its strategy is not dependent on inorganic activity.

SEB, meanwhile, referred to comments made by CEO Johan Torgeby to Dagens Industri last month, in which he said the bank's business plan is not driven by acquisitions. But he did not categorically deny that SEB would be interested if it received new information or competitive dynamics were to change.

Nykredit had no comment, and DNB did not respond to a request for comment.

As of Nov. 22, US$1 was equivalent to 6.60 Danish kroner.