S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Jul, 2021

By Rebecca Isjwara

Social bonds will likely remain a significant chunk of the growing market for sustainable debt, even if issuance comes off a peak as the world gains a better grip on the COVID-19 pandemic, analysts say.

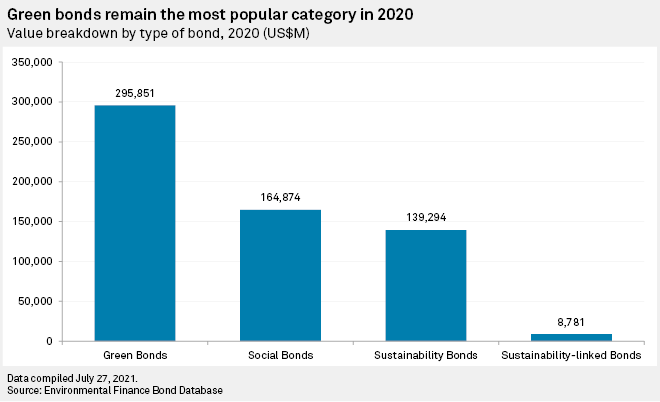

From a relatively smaller share in the environmental, social and governance space, bonds sold to fund social causes, such as building hospitals and schools, jumped nine-fold to $164.87 billion in 2020 from the previous year, according to data from Environmental Finance, a global sustainable finance news and analysis provider.

The COVID-19 pandemic was the primary driver for social bonds in 2020 as investments in healthcare surged, said Meredith Jones, head of ESG at financial services firm

The size of the overall ESG debt market nearly doubled to $608.8 billion in 2020, from $326 billion in 2019, according to Environmental Finance. Green bonds, typically used to fund climate change mitigation projects, at $295.85 billion made up nearly half of the total ESG debt in 2020. Issuance of sustainability bonds, a hybrid of green and social debt, tripled to $139.29 billion in the same year. Sustainability-linked bonds, which have specific performance targets, totaled $8.78 billion, the data showed.

Slow, but steady

"It would be difficult to sustain the enormous growth social bonds saw in 2020 over the long term, although issuance in the first quarter of 2021 was extremely brisk at more than 50% of 2020's total in just three months," Jones said. "Demand remains high and we expect positive growth generally."

Global investors are increasingly applying nonfinancial factors such as ESG to identify risks and growth opportunities. ESG funds outperformed the S&P 500 index throughout the first year of the pandemic, from March 2020 to March 2021, according to S&P Global Market Intelligence data. A study published by UBS Group AG on July 5 said the next generation of Asia's wealthiest families are leaning on sustainability to stamp their mark on their businesses and also to grow returns in the post-COVID-19 world.

Governments have been the biggest issuers of social bonds, seeking to help their economies climb out of the pandemic-induced downturn, said Ayman Ahmed, senior fixed-income analyst at Thornburg Investment Management.

"The pandemic certainly helped grow the social bond market, most notably in sovereigns and banks. With social spending on transfers, debt forgiveness, debt extension, and subsidies seen as a must for the population to navigate the crisis, issuers took advantage of market trends," Ahmed said. The coupon on such bonds is, on average, lower by about 15 basis points and they help issuers save on debt service costs "when they most need it," the analyst added.

Social washing risk

The rising popularity of ESG debt also carries the risks of greenwashing or social washing, where the funds raised are used more to burnish the image of the issuer than for investments in projects that help combat climate change or make a difference to people's lives, said Mary Leung, head of advocacy, Asia-Pacific at the CFA Institute.

She highlighted the need to harmonize standards and taxonomy to provide investors with better disclosure and understanding. Social bonds often have a relatively smaller issue size, which means that the low liquidity can be an additional challenge for investors, Leung said.

The abstract nature of quantifying social bond investments has made clients wary of "getting burnt" in the process, said Gayatri Talwar, vice president of risk at investment firm Lighthouse Canton. "Investors are using a very selective approach to picking these investments in ESG, particularly in social bonds, given the risk of social washing," Talwar said.

Even with the possible risk of misuse, lenders such as Deutsche Bank AG see the opportunity in the unstandardized social space.

There is more demand to finance social causes than there is supply, said Kamran Khan, the bank's head of ESG for the Asia-Pacific. "The reason behind the lack of ESG's [social] deals in the market is related to supply, not demand. Investors continue to have appetite for good quality [social] deals — there are just not many such deals to be found," he said.

The bank wants to be the market leader for social deals, Khan said in an interview. Globally, Deutsche Bank is aiming to facilitate €200 billion of sustainable finance and investments by 2023-end.

The Asia-Pacific region has historically been an active market for green bond sales, led by China. With governments and international development banks increasing focus on social and sustainability bonds in the region, the region's overall market for ESG debt will likely rise, said David Liu, Asia-Pacific regional managing director at Kroll, a corporate investigations and risk consulting firm.

"The trend is only going to go up, especially with the COVID-19 impact on [small and medium-sized enterprises] and job losses causing more inequality, which will draw focus on social bonds," Liu said.