Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 May, 2021

By Matt Smith

Yield-seeking institutional investors are considering buying into South Africa's fledgling market for social impact bonds, although high costs and a lack of standardization could prove a deterrent.

Social impact bonds, or SIBs, enable investors to provide funding for other institutions — usually nongovernmental organizations — to deliver social welfare services. If the nongovernmental organizations meet pre-defined targets, so-called outcome funders, which are typically government institutions, then repay investors. As an alternative asset, social bonds should provide diversification benefits as well as environmental, social and governance benefits, said Thato Mashigo, portfolio manager at Sanlam Private Wealth in Johannesburg.

"Institutional clients are pushing more and more for fund managers to implement ESG within their investment process," said Mashigo.

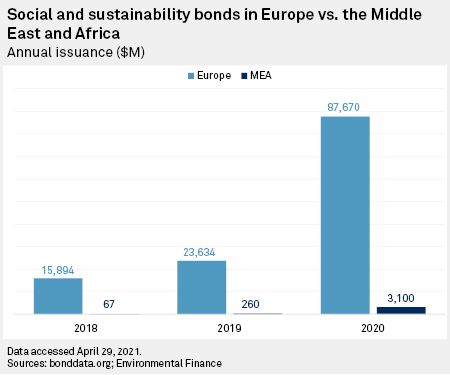

Social and sustainability bonds taken to the market in the Middle East and Africa lag Europe, though issuances in MEA are increasing and Africa is considered a fertile ground for ESG-aligned debt instruments, given its socioeconomic needs.

Low interest rates and a desire to align with ESG standards have made SIBs more attractive to investors. Ten-year European government bonds trade at zero or negative yields, while South Africa bonds of the same duration are trading at a nominal yield of around 10%, to provide a real return of around 6%.

"That's very attractive from a carry trade perspective. Global institutions, especially those that have fixed liabilities such as defined benefit pension funds, need to generate real returns," said Mashigo. "If South Africa can package securities such as social impact bonds that can give 8% or more real yield in rand that would be something global investors would look at."

South Africa's first two SIBs launched in 2018: the 124.5 million rand Bonds4Jobs, or B4J, and the 7.5 million rand Impact Bond Innovation Fund, or IBIF. The three-year IBIF bond paid a coupon of 14%, while the two-tranche, short-term B4J bond paid 11% to commercial investors and up to 7.5% to so-called first loss investors. The latter were foundations whose presence reduced the chances that senior, profit-first investors would suffer losses.

|

Kliptown is one of South Africa's most deprived areas. |

'Bespoke instruments'

Failure to achieve the targets set out in SIBs, though, could lead investors to lose their capital, according to an April report by South African research and consulting firm Intellidex.

SIBs are expensive in both their establishment and management, according to the report. For example, the IBIF bond required two years of negotiations before it could launch, while the lack of similar bonds to benchmark against made due diligence difficult to conduct.

"Part of what's going to get new people involved and get more and more types of commercial investors involved is creating more of a marketplace for this, where you have a more standardized approach."

Price of impact

As the social bond market matures and investors, lawyers, governments and intermediaries become more experienced, most nonprofits expect costs to fall as procedures become standardized.

"Our participation enabled the more commercial funders to come in and make this project fundable from a pure commercial point of view," T.J. Tapela, managing executive and director of companies at Cape Town's Brimstone Investment Corp, a Black economic empowerment firm that invested in B4J, said during the Intellidex webinar.

According to a study by the Brookings Institute, a U.S. think tank, 47 social impact bonds worldwide had completed their service delivery contracts as of the end of 2019. Of these, 24 repaid the principal and provided investors "positive" returns, while one repaid just the principal. Two were not repaid and five had partial repayment, with the outcome of the remaining 15 not yet public.

For ESG-focused investors, social impact is something to be balanced against yield.

"Social return is seen as an objective of investors that can be traded off against financial returns, implying that such investments should have lower-than-market financial returns with the discount representing the 'price' investors are paying for the social impact," Intellidex said in its report. "There also just aren't enough opportunities available to invest."

As of May 14, US$1 was equivalent to 14.12 South African rand.