S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Feb, 2022

By Mark Anthony Gubagaras and Darakhshan Nazir

AT&T Inc. is getting smaller and so is its long-time dividend.

As part of its plan to spin off its interest in WarnerMedia, AT&T's board approved a post-close annual dividend of $1.11 per share, down 46% from $2.08 per share prior to the split. All told, AT&T expects to spend about $8 billion a year on dividend payouts.

AT&T said the new dividend will give the company much-needed financial flexibility as it simultaneously works to deploy mid-band spectrum for its 5G wireless network, expand fiber deployments and pay down debt. Analysts believe the dividend cut is a step in the right direction but note the company has a rough path ahead of it.

"AT&T will still be saddled with a considerable amount of debt after the [Warner] spin-off with limited options for additional asset sales, while its steep dividend cut could send income investors to the exits," CFRA Equity Research analyst Keith Snyder wrote in a Feb. 5 note.

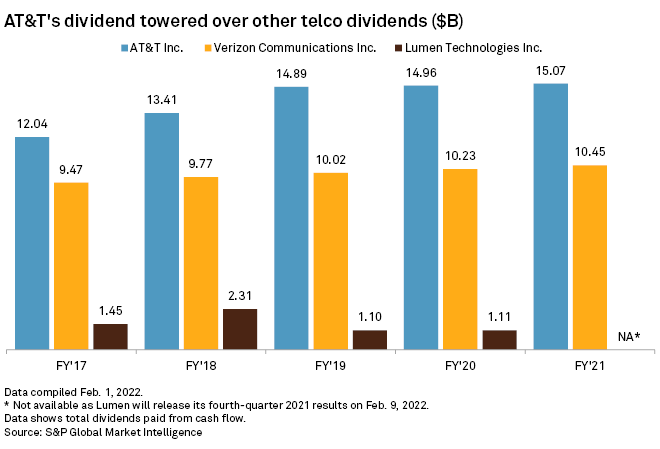

AT&T shareholders are used to generous dividends from the telco. The company in 2021 spent total cash of $15.07 billion, topping rival Verizon Communications Inc.'s $10.45 billion.

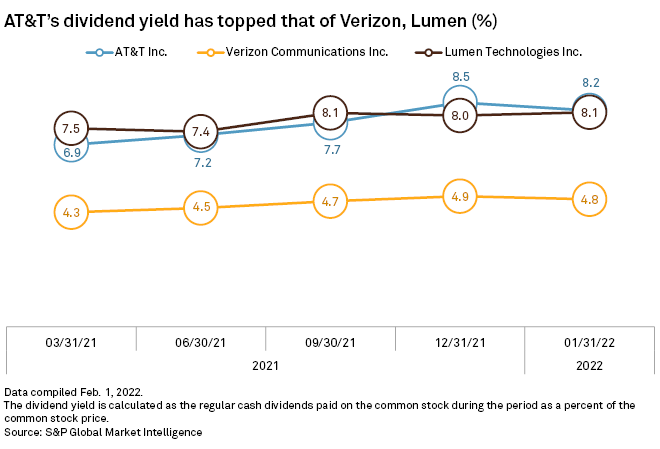

AT&T's dividend yield, in fact, has been consistently higher than Verizon's and even recently surpassed that of Lumen Technologies Inc. As of the end of January, AT&T's dividend yield percentage was 8.2%, against 8.1% for Lumen and 4.8% for Verizon.

AT&T said even after the WarnerMedia split and dividend cut, it will "continue to deliver an attractive dividend yield and be among the highest dividend yield payers in corporate America — estimated in the mid-90th percentile."

Still, as of market close Feb. 7, AT&T shares were down more than 9.6% from Jan. 25, the day before AT&T reported earnings and first indicated it expected to significantly reduce its dividend.

MoffettNathanson analyst Craig Moffett believes investors are not dropping the stock because of the reduced dividend.

"AT&T's problem isn't that their promised dividend is too low. It's that it's too high," Moffett said in a research note. "The market has already judged it to be unsustainable."

AT&T President and CEO John Stankey said in a recent earnings call that the company is on a "real and sustainable" path to growth following the WarnerMedia deal. "We're well-positioned ... to have a capital structure and balance sheet that puts us in an attractive position relative to our peers," he said.

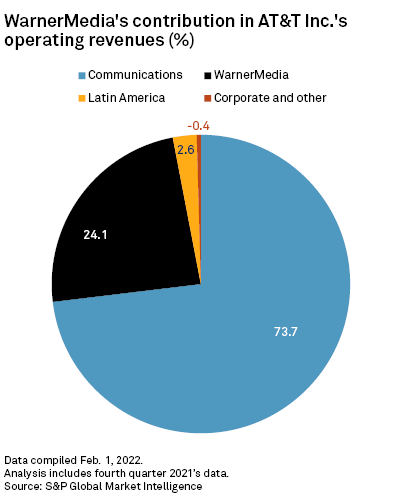

AT&T executives earlier said the smaller dividend would reflect the company's diminished size once the WarnerMedia spinoff is completed. The carrier expects the transaction to bring in cash proceeds of about $43 billion, or nearly half of the $85.4 billion in cash and stock AT&T paid in 2018 to acquire the former Time Warner Inc.

WarnerMedia contributed $9.87 billion or 24.1% of AT&T's operating revenues in the final quarter of 2021.

Segment