Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jul, 2022

By Sydney Price

While communication networks have traditionally been associated with infrastructure like towers and fiber, more and more network operations are moving off the ground and into the cloud, creating new opportunities for both cooperation and competition.

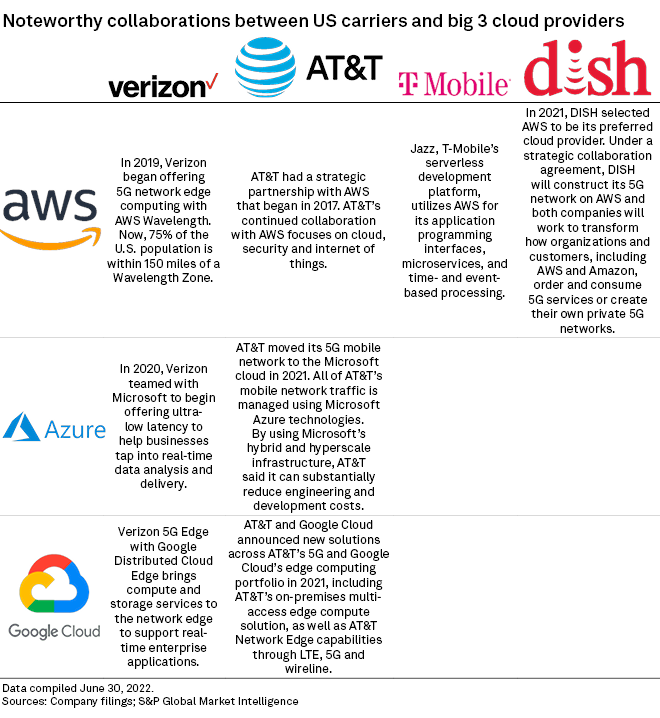

Over the past three years, the big three U.S. wireless carriers as well as newer market entrant DISH Network Corp. have struck a dizzying array of agreements with the major U.S. cloud service providers. While analysts and experts see benefits to all of these agreements — including greater network efficiency, resiliency and reduced latency — they noted that some cloud service providers are farther along than others when it comes to breaking into the telco market.

"AWS has several things going for it, but its mindshare with developers as the global leader in [infrastructure as a service], unmatched global infrastructure footprint and willingness to partner on edge computing buildouts stand out as compelling drivers of telecom interest," wrote Brian Partridge, an analyst at 451 Research, of Amazon Web Services Inc., or AWS.

AWS advantage

Indeed, Amazon.com Inc.'s cloud service has some of the longest-running wireless relationships because it entered the market before its two biggest competitors, Microsoft Corp.'s Azure and Alphabet Inc.'s Google Cloud, said Alex Besen, founder and CEO of the mobile data consulting firm The Besen Group LLC. AWS also offers pay-as-you-go pricing for more services than its competitors.

"AWS is bundling the hardware, the software, and the maintenance and installation. I think that makes it an attractive offer for enterprises and for the private wireless networks," Besen said.

A partnership with AWS also offers companies the chance to de-risk 5G investments by aligning with one of the IT industry's most powerful agents of digital transformation, said Partridge.

Deal with DISH

As a part of its 5G buildout plans, DISH chose AWS as its preferred cloud provider in 2021. The satellite operator, which broke into the consumer wireless market with its acquisition of Sprint Corp.'s prepaid business in 2020, aims to deploy the first stand-alone, cloud-native, autonomous 5G network.

Through its AWS partnership, DISH is reducing capital expenditures and more rapidly deploying new mobile services such as network slicing, said Sameer Vuyyuru, AWS' head of Worldwide Business Development for Communication Service Providers. By using AWS, DISH can build network slices in seconds with little to no human intervention.

"The ability to fully automate business support systems in the cloud enables DISH to adapt quickly to varying network usage conditions and scale network capacity on demand to meet customers' 5G workload needs," Vuyyuru said. "As a result, DISH is able to monetize its mobile network faster and at a reduced cost compared to legacy [communications service providers] networks."

Though AWS is its sole cloud partner, DISH has expressed its willingness to enter into agreements with other cloud providers.

"DISH currently uses AWS as a cloud provider for our network build, however, our partnership with AWS is not exclusive," a DISH spokesperson wrote in an email. "We continue to evaluate and enter into discussions with other cloud providers to meet our customers' needs."

AWS has helped other established communications service providers, such as Verizon Communications Inc. and AT&T Inc., augment their 5G networks and enable use cases such as video distribution, inference at the edge, connected vehicles, augmented reality and virtual reality. T-Mobile US Inc. uses AWS to operate its serverless development platform, Jazz.

Vuyyuru said one of the biggest challenges for cloud implementation at telcos is balancing the client's current needs with future expectations.

"Some organizations can feel a sense of paralysis if they can't figure out how to move every last workload," Vuyyuru said. "One of our focus areas is working with communications service providers on portfolio analyses — helping them to assess what to move and when, as well as ongoing training on the cloud."

AT&T and Microsoft

Though AWS has deep, lucrative relationships with America's top wireless providers, each of its competitors offers a unique set of capabilities to its wireless partners. Verizon and AT&T, for example, have extensive relationships with Microsoft Azure and Google Cloud.

In particular, AT&T entered into a partnership with Microsoft Azure in 2019 reportedly valued at over $2 billion. Two years later, they cemented that partnership with Microsoft acquiring AT&T's carrier-grade Network Cloud platform technology in a deal that moved the telecom operator's 5G mobile network to Microsoft's Azure for Operators cloud platform. Now, AT&T's 5G mobility core is fully cloud-based, integrating network functions from multiple vendors that are hosted on the Network Cloud platform technology.

"Of the hyperscale operators, Microsoft has been boldest in its willingness to acquire core telecom network software and IP," wrote 451's Partridge in a research report.

Google and the rest

Google Cloud Google developed the Google Distributed Cloud, which allows communications service providers to deploy Google infrastructure at the edge of their networks to deliver 5G and LTE services to business customers with the separation of workloads into microservices through a container management platform.

"With [Google Distributed Cloud], Google now has a direct answer to AWS Outposts and Azure Edge Stack, which will enhance their attractiveness for [communications service providers] seeking to bundle managed edge stack capabilities with private networks and services," Partridge wrote.

International Business Machines Corp. has also supported cloud-based expansion at wireless companies. In 2021, Verizon chose IBM and Red Hat to help build and deploy an open hybrid cloud platform as the foundation of its 5G core to harness applications that can support advanced 5G use cases. T-Mobile used tools from IBM Cloud Pak to integrate two networks after its merger with Sprint in 2020.

451 Research is part of S&P Global Market Intelligence.