Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Sep, 2022

U.S. states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use as well as use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are "disposed" by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the filing was approved by the regulator.

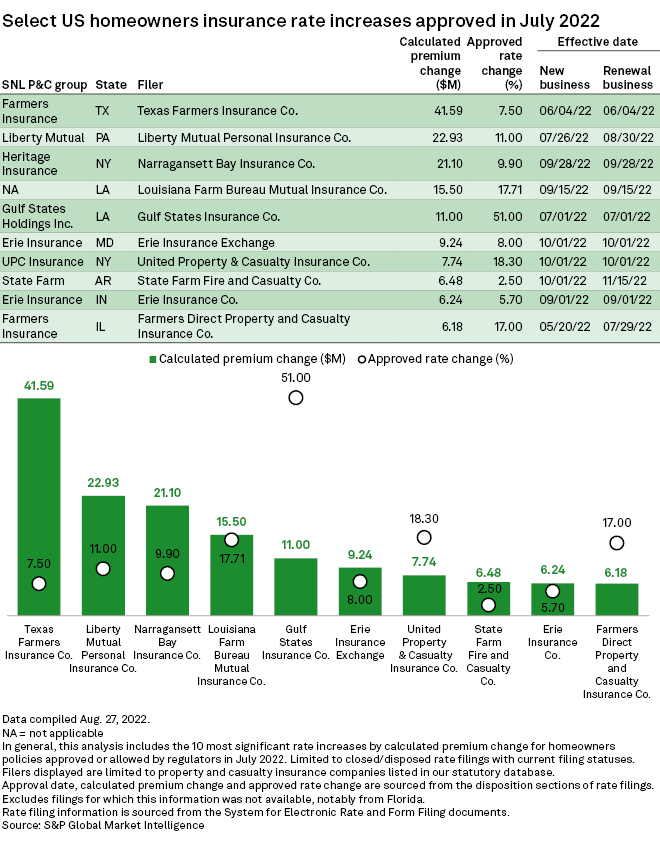

State regulators in Texas signed off on eight rates hike requests during the month of July, which expected to generate an additional $56.5 million in premiums written across the industry, according to an S&P Global Market Intelligence analysis. That was the largest aggregate premium increase for any U.S. state from rate hikes approved in July as carriers continue to raise homeowners rates across the country.

Among all insurers in this analysis, Farmers Insurance Group of Cos. is expected to see the largest cumulative positive premium impact from 34 rate hikes approved in July across 19 states. Those approved increases are expected to bolster the group's written premiums by more than $90 million. About 47% of the projected increase stands to come from two rate hikes approved in Texas.

Texas Farmers Insurance Co. obtained what looks to be the most-impactful single rate increase disposed during the month. The 7.5% rate hike in Texas stands to boost Farmers' premiums by $41.6 million. It will impact about 272,000 policyholders.

Liberty Mutual Holding Co. Inc., which received approval for seven homeowners rate increases across two states, is projected to see the second-largest aggregate positive premium impact from changes in July at $29.8 million. More than three-quarters of that calculated increase looks to have come from an 11% rate hike in Pennsylvania. The rate change took effect on July 26 for new business and on Aug. 30 for renewals.

* Download a template to analyze rate changes for selected entities, state or type of insurance over a selected period.

* Read an article about second quarter results for few lines of business in the US P&C Industry.

Indiana rate reduction stands out

At the other end of the spectrum, one Farmers subsidiary received regulatory approval for the most-significant rate decrease during the period. The 8.3% rate cut in Indiana was submitted to adjust the base rate on a previous file-and-use filing that was disposed during the month. That filing sought to boost rates by 27.3%, but the regulator said the expected return on equity was too high.