Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2021

Tesla Inc. enjoyed a breakout 2020 in China on the back of record sales and the rollout of locally produced electric vehicles, but the company faces a stiffer challenge in the country in 2021 from rivals including Volkswagen AG.

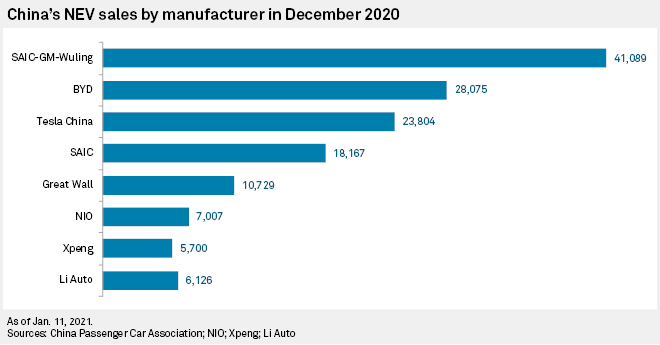

The California-based electric-car maker delivered 499,550 vehicles worldwide in 2020, slightly behind its target of 500,000 units. It does not break out sales by market but data from the China Passenger Car Association shows that it accounted for about 11.6% of the new energy vehicle, or NEV, market, with sales reaching 135,404 in 2020. The association expects Tesla's China sales to reach 280,000 in 2021, while Tesla has said it expects to achieve 50% average annual growth in deliveries "over a multiyear horizon."

China will be a key growth market for the automotive industry in the coming years. Sales of new energy vehicles, a category that includes battery, plug-in hybrid and fuel-cell models, are expected to rise from 1.4 million units in 2020 to 1.8 million vehicles 2021, according to the China Association of Automobile Manufacturers.

"We are currently the leader in the Chinese EV market. So I think we must be doing something right," Tesla CEO Elon Musk said during a Jan. 27 earnings call.

However, Tesla will have to navigate a range of challenges in 2021 if it is to maintain this position, chief of which will be the ambitious plans of Volkswagen.

On Jan. 18, Tesla slashed the cost of its Model Y crossovers in China by 30% to a starting price of 339,900 yuan for its long range model, making it about 10% cheaper than locally manufactured gasoline SUV models from Daimler AG and VW-owned Audi.

In the following days, Volkswagen priced its ID.4 Crozz electric SUV at 199,900 yuan after subsidies and CEO Herbert Diess on Twitter stated his intention to take market share from Tesla. The ID.4 SUV, which was built by its local joint venture with FAW Jiefang Group Co. Ltd., will have a driving range of up to 550km and allows over-the-air software updates, a popular feature in Tesla vehicles.

Volkswagen's lower price points and entrenched dealership network across the hinterland cities make it better placed to win the NEV game in the long run, said Jochen Siebert, managing director of JSC Automotive. The German carmaker is planning to launch eight ID. electric models in China by 2023. Siebert predicts that VW will overtake Tesla as the top electric car brand in the country, as it did in Europe in 2020.

"In China, it might take a little longer. Instead of three months, it might take nine to 10 months. Until then, Tesla will feel the heavy impact because VW is going to use all its marketing power. That is going to be tough," said Siebert.

Gaining share in the smaller cities where Volkswagen has a long-established presence will be important for Tesla. About 60% to 70% of Tesla vehicles sold in China are done so in first-tier cities such as Shanghai and Beijing that employ license plate quotas to tackle vehicle congestion, noted Yan Zhang, powertrain market analyst from LMC Automotive. A license plate bought at auction in Shanghai, for instance, can cost more than the vehicle.

Sales of NEVs in Shanghai spiked in November 2020 after the local government restricted cars with out-of-city plates from its highway during peak hours. Tesla sold the most NEVs in Shanghai during November at 6,846 units, over 200% more than the previous month, according to auto insurance data cited by Huatai Securities.

"Once its demand reaches a saturation in these cities with license plate quotas, how [Tesla] can grow in other cities is an issue. The subsidies are also being cut back this year," said Zhang.

"The point of having a $25,000 vehicle would be to get more Teslas on the road. There would be more data and opportunities to sell services," said Tu Le, managing director at Sino Auto Insights.

Tesla also faces a growing threat from domestic EV makers such as NIO Ltd., XPeng Inc. and Li Auto Inc., all of which are U.S.-listed and enjoyed massive share price increases in 2020. However, while these startups have been able to secure sizable investment by pitching bold expansion plans, their growth is likely to lag the overall EV market due to production constraints, Le said.

"I would have preferred to see the Chinese EV companies focus more on the domestic market and strengthen their market share rather than quickly go abroad. But because of their market valuation and share prices, I think there's going to be pressure from investors to see expansion abroad. That's likely to divide management's attention," said Le.

Until then, Tesla is still likely to hold on to its position, but competition is certainly heating up. BYD Co. Ltd., the largest Chinese EV maker backed by Warren Buffett, raised $3.9 billion in an upsized share sale on Jan. 20 to bolster its balance sheet and fund research and development.

"Within a few years, Tesla will not be the only one in town. There will be many, it will be so competitive," said Siebert.

As of Jan. 29, US$1 was equivalent to 6.43 Chinese yuan.