S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Sep, 2021

By Morgan Frey

|

|

Telehealth is becoming a permanent fixture in the healthcare landscape even as usage falls from 2020's pandemic-induced peaks.

Virtual behavioral health services have exploded in response to a demand for mental health care and a shortage of providers. Another trend contributing to the staying power of telehealth is its adoption by U.S. provider networks such as HCA Healthcare Inc. and Universal Health Services Inc.

"It sounds like the hospital side of the world is making some pretty big investments into telemedicine, which also tells me that it might be here to stay because hospitals don't take their investment dollars anything but very seriously," SVB Leerink senior research analyst Stephanie Davis said in an interview.

The biggest challenge for telehealth in the pre-pandemic era was that consumers and healthcare providers were unfamiliar with the concept, said Davis, who covers companies including Teladoc Health Inc. and GoodRx Holdings Inc.

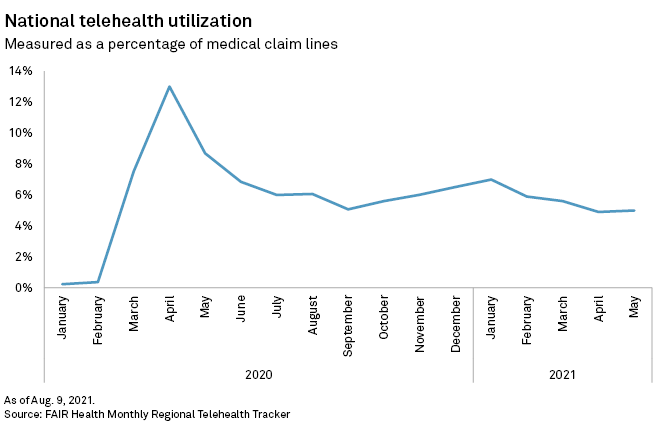

Over the past 18 months, telehealth usage has risen and fallen alongside COVID-19 cases. It exploded in the early months of the pandemic, accounting for 13% of all medical claim lines at the height of the first wave of cases. By January 2021, usage had dropped to 7% of claims, according to data by nonprofit healthcare cost research group FAIR Health. Since then it has fluctuated slightly, remaining above 4.5%.

Consulting firm McKinsey & Co. has also noted a drop in telehealth utilization from April 2020 peaks, although medical claims suggest it remains anywhere from 30 to 40 times above pre-pandemic levels, according to Oleg Bestsennyy, a partner at the firm.

Another contributor to the stabilization of telehealth has been its adoption by hospitals and healthcare providers. While telehealth was initially forced on the sector as a way to reduce person-to-person contact during the pandemic, providers have quickly adapted to this method of healthcare delivery and have found they want to keep doing it, Bestsennyy said.

Telehealth has proven to be a convenient way for providers to check in on patients, particularly those with chronic conditions, said fellow McKinsey partner Jenny Rost. Recent findings from the American Medical Association and the COVID-19 Healthcare Coalition found that 68% of physicians surveyed said they were motivated to increase their use of telehealth, while 71% said their organization was motivated to do the same.

Among healthcare organizations eager to continue using telehealth are hospital networks like UHS. The company, which operates 334 behavioral health facilities and 26 acute care hospitals, has been working to expand its telehealth capabilities in its behavioral health services unit, UHS vice president of telehealth product management Jeremy Maynor told S&P Global Market Intelligence.

Last year, the business focused on building out its telehealth capabilities in order to serve patients who could not come to the hospital or behavioral health facility, Maynor said.

"While in 2020 I think UHS did a fantastic job of overcoming this urgent mountain of getting care to be delivered virtually, the next phase is really taking technology [and] putting it into a platform where it's supportive of the care experience, it simplifies the clinicians' life ... and then of course the last leg of that stool is making sure that the patient experience is really exceptional," Maynor said.

Among large employers, virtual tools and mental health services are two of the top priorities when planning their healthcare strategies for 2022 and beyond, according to a survey by the employer membership body Business Group on Health.

That enthusiasm has shown up in some telehealth companies' earnings. Teladoc, which offers virtual chronic care management and behavioral health services in addition to doctors' visits, saw usage among its members increase to 21.5% in the second quarter of 2021, marking the fifth sequential quarterly increase.

"The persistent strength in utilization has been driven by growth in visits in noninfectious diseases and specialty care as consumers are turning to our services for a broader array of conditions," CEO Jason Gorevic said in a July earnings call.

Teladoc's competitor Amwell reported a quarter-over-quarter decline in visits from 1.6 million to 1.3 million, which the company attributed to a normal drop in urgent care visits entering the summer months. Amwell is seeing growth in specialty care visits such as behavioral health, CFO Keith Anderson said in an August earnings call.

A rise in mental health needs

Mental health conditions accounted for 30% of telehealth claim lines in January 2020, narrowly surpassing acute respiratory diseases and infections at 25.5%, according to FAIR Health. By May 2021, mental health conditions accounted for 60.4% of telehealth diagnoses, with developmental disorders and acute respiratory diseases and infections tied at second-highest with just 2.8% each.

"There's a general sense that ... speaking to a mental health professional lends itself to

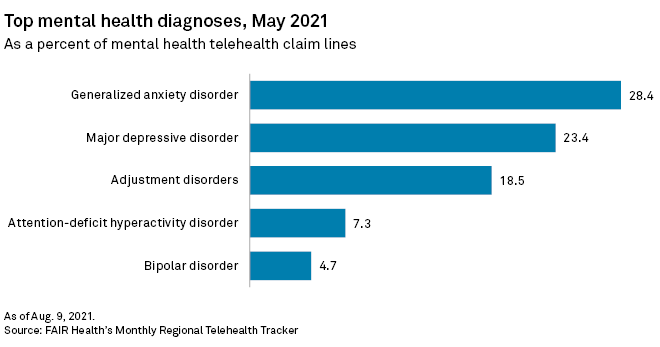

The most common mental health diagnoses from telehealth visits in May 2021 were generalized anxiety disorder, major depressive disorder and adjustment disorders, according to FAIR Health data. Among the top procedure codes attributed to telehealth by clinicians, 60-minute psychotherapy consultations were the most commonly recorded interactions from January 2021 through May.

McKinsey partners Bestsennyy and Rost noted that telehealth has to some extent offered a solution to the national shortage of behavioral health providers, as well as giving rural residents the opportunity to connect with specialists who may be unavailable in their areas.

Mobile downloads of many mental health-focused apps are also growing, according to data from Apptopia, which tracks mobile app usage. Meditation health app Headspace Inc. has increased daily active users by 5.9% over the past three months and Teladoc's direct-to-consumer mental health service BetterHelp grew daily active users by 5.6% in the same period.

Companies have responded to this mental health demand with new services and acquisitions. Teladoc recently launched myStrength Complete in response to an increase in mental health visits. Meanwhile, Amwell added to its own mental health offerings with the acquisition of SilverCloud Health, while Headspace and mental health app Ginger.io Inc. announced a merger Aug. 25.

'Tinkering' with telehealth

In a May 2020 report, McKinsey partners estimated that up to $250 billion of U.S. healthcare spend could potentially be transferred to virtual services. Since then, about two-thirds of this estimate has been reached, with some specialties even exceeding McKinsey's initial expectations, Rost noted.

"I'm not sure we'll ever see that full potential going virtual. ... What I do think we will continue to see is more innovations in how the care is delivered to optimize those in-person hybrid models, as well as with additional advances in digital health moving even beyond just pure telehealth," Rost added. "So you might not even need that live visit at all to address some health needs."

While the volume of visits may be settling down, the pace of innovation has not, with advances continuing to be made in the fields of remote patient monitoring at home and self-diagnostic tools, Bestsennyy said.

"This continuous tinkering will lead to additional breakthrough innovations both around convenience, but also around the actual clinical care itself that improves not only the patient experience but also the outcomes," Bestsennyy added.