Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Feb, 2021

By Morgan Frey

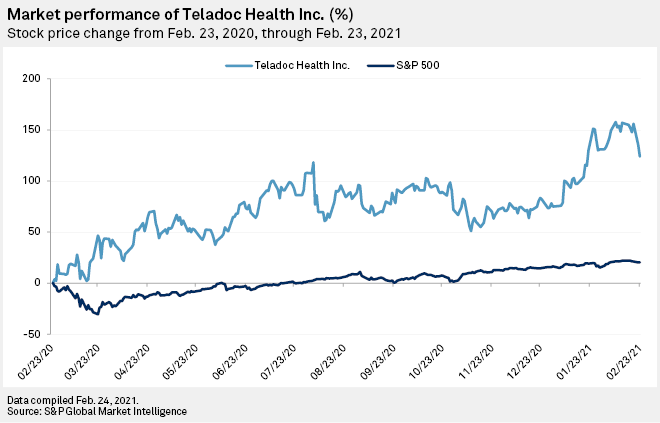

Following a record-breaking 156% increase in worldwide visits to its platforms, Teladoc Health Inc. CEO Jason Gorevic said he remains confident that the company has plenty of opportunities to continue to grow membership.

During a Feb. 24 earnings call, Gorevic described 2020 as a "transformational year" for Teladoc, noting that the telehealth company onboarded 15 million new paying members. Fourth-quarter revenue was $383 million, an 145% increase year over year, and Gorevic said the company also saw organic growth of 79% when excluding the InTouch Health and Livongo acquisitions.

Even as coronavirus vaccines continue to be shipped out, raising hopes of a return to normalcy, Gorevic echoed the sentiments of experts who predict that the well of telehealth opportunities will not suddenly dry up.

"If you look at our growth pipeline, the membership growth opportunity is actually 50% larger than it was at this time last year," Gorevic said. "I think that gives me significant confidence over the longer term. We still have 65 million members' worth of white space within existing clients."

Gorevic did note, however, that growing membership would likely be a multi-year process as the company has had to "re-fill the pipeline" after its COVID-19 boom, and these programs are still in earlier selling stages.

The CEO said he remains "bullish" on continued visit volume growth and pointed to the fact that total visits increased 140% year over year in the fourth quarter despite a 17% drop in infectious disease visits caused by a historically low cold and flu season. This showed that patients are already using Teladoc's services for a growing variety of conditions, such as mental health and dermatology, Gorevic said.

For the full year 2021, Teladoc expects total visits to rise to between 12 million and 13 million, compared to 10.6 million in 2020. The Purchase, N.Y.-based company also anticipates total U.S. paid membership in 2021 to be 52 million to 54 million, compared to 51.8 million by the end of fiscal 2020.

In addition, Gorevic provided updates on the company's pilots of its Primary360 virtual primary care offering, which began in the second quarter of 2020.

"Primary360 goes beyond just enabling virtual visits. Rather, it's a reimagining of the entire primary care experience, and it positions us to become the trusted healthcare destination for the consumer regardless of what they need for both their mental and physical health," Gorevic said during the call.

Results from the first pilot showed over 30% consumer engagement, and Primary360 physicians were able to perform first-time diagnoses for diabetes and pre-diabetes, as well as for hypertension and pre-hypertension patients. Gorevic said the pilots provide the company with the opportunity to direct these patients to the Livongo suite of monitoring tools early in their health journeys.

"We have a pipeline of well over 100 opportunities, ranging from Fortune 1000 employers to large payers looking to partner on Virtual First health plans," he said. "In fact, just last week, we signed another new partnership with a very large employer expected to launch later this year."

Financial results

Revenue for the fourth quarter of 2020 was $383.3 million, and the company's adjusted gross profit was $260.4 million. Adjusted EBITDA for the fourth quarter was $50.4 million, a 231% increase from 15.2 million in the year-ago period.

The company's unadjusted net loss for the quarter was $3.07 per share, or $394 million, compared to the year-ago net loss of 26 cents, or $19 million.

For the full year 2020, adjusted EBITDA was $126.8 million, compared to $31.8 million in 2019.

Unadjusted net loss for the full year was $5.36, compared to a loss of $1.38 the previous year.

The fourth-quarter and full-year results include $331.7 million of accelerated stock-based awards expenses related to the merger with Livongo and $57.6 million and $88.2 million, respectively, of acquisition and integration-related costs.

For its 2021 outlook, the company anticipates full-year revenue to be $1.95 billion to $2 billion, with adjusted EBITDA of between $255 million and $275 million.

The S&P Capital IQ normalized EPS consensus estimate for 2021 is a loss of $1.30.