Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Jul, 2022

By Joseph Williams and Darakhshan Nazir

As tech, media and telecommunications equities reeled from a steady slide into bear market territory, initial public offering activity in the sector dropped off precipitously from 2021 peaks.

For the first two quarters of 2022, the S&P 500 index shed about 20%, marking the biggest first-half decline since 1970. The tech-heavy Nasdaq index plummeted about 30% over the same period, essentially erasing gains made during the aggressive bull market of 2021.

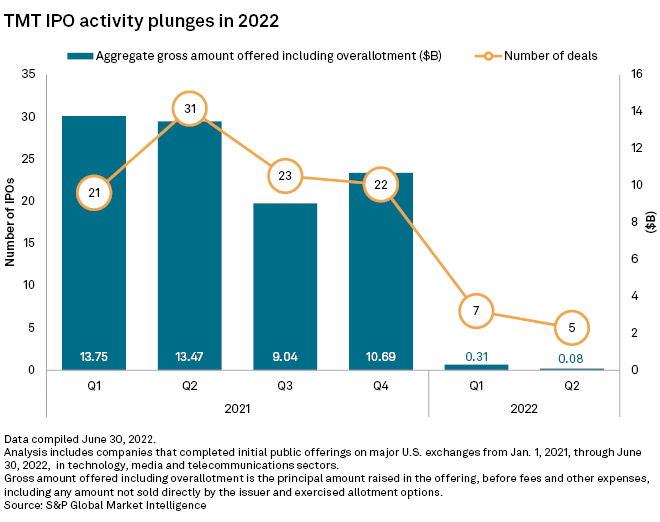

In turn, public markets have proven to be less appealing for companies looking for liquidity in 2022. Only 12 technology, media and telecom IPOs were completed in the first half of 2022, including five in the second quarter. In comparison, 52 IPOs were completed in the first half of 2021, including 31 in the second quarter.

Granted, 2021 represented a very difficult comparison with which to keep pace. Global IPOs across sectors began surging in the second half of 2020 as the pandemic slump burned off, hitting a peak in the first half of 2021. There were 849 total IPOs worldwide across industries in the first quarter of 2021, raising aggregate proceeds of $211.28 billion, more than the first two quarters of 2020 combined, according to research from S&P Global Market Intelligence.

The U.S. technology, media and telecom industry also hit a high-water mark in the first half of 2021. The 21 IPOs in the first quarter of 2021 raised $13.75 billion, while the 31 in the second quarter of 2021 raised $13.47 billion. Total gross offerings in the first two quarters of 2022 were about $300 million.

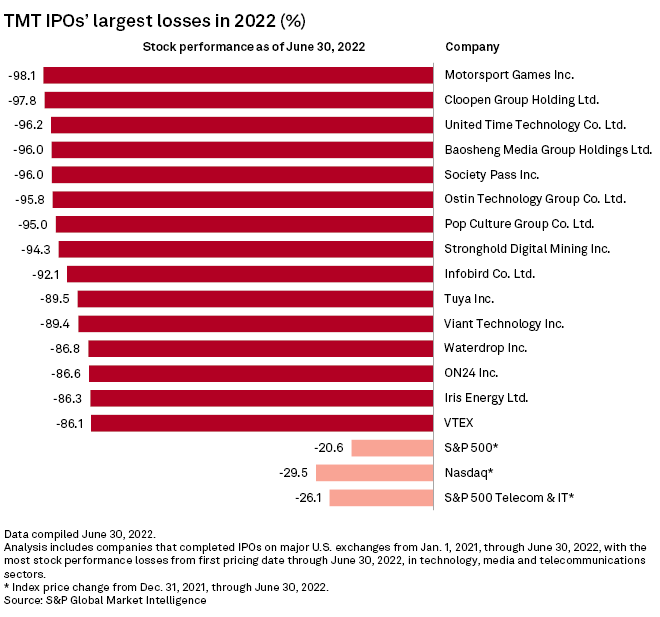

Notably, IPOs that listed during the boom of 2021 and into 2022 have struggled to provide returns from their IPO price. The worst performing 15 tickers have each seen declines of over 80%.

These have largely included Chinese companies listing on U.S. exchanges, including Cloopen Group Holding Ltd., Ostin Technology Group Co. Ltd. and Tuya Inc. The negative sentiment emerged as U.S. regulators increased scrutiny of Chinese companies trading publicly in the U.S., with threats of potential delisting if certain disclosure requirements are not met.

For technology, media and telecom stocks listed since the beginning of 2021, other superlative declines came from cryptocurrency companies Stronghold Digital Mining Inc. and Iris Energy Ltd. Several factors have eroded confidence in cryptocurrency investments through the first half. The price of leading currency Bitcoin has plummeted in recent months, dragging other crypto businesses down with it.

The damage was not just reserved for newly listed companies. Coinbase Global Inc., a leading "cryptoeconomy" infrastructure company that listed in 2014, has shed about 81% of its market capital year to date in 2022.

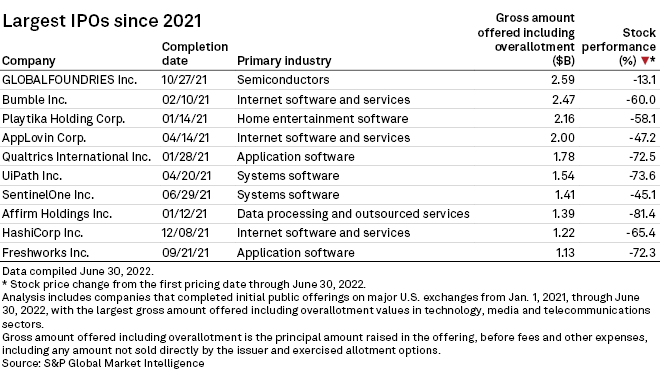

The boom year of 2021 saw some high-profile IPOs, and even those have not proven immune to declines in 2022. Popular dating-platform operator Bumble Inc. launched a $2.47 billion IPO. Mobile games developer Playtika Holding Corp. went public for $2.16 billion. Major mobile app monetization software company AppLovin Corp. closed a $2.0 billion offering.

Each of those tickers began shedding market cap shortly after their public debuts. As of June 30, Bumble was off by 60% since listing. Playtika had shed 58%. AppLovin was down over 47%.

But not all big 2021 IPOs underperformed the broad markets. GLOBALFOUNDRIES Inc. was the largest IPO since the beginning of 2021 at $2.59 billion. The company operates semiconductor foundry services globally, manufacturing and integrating the materials used in microchips. With global semiconductor supply shortages weighing against the microchip business, companies up and down the supply chain have become highly valued, both in their product position and as potential M&A targets.

GLOBALFOUNDRIES has spent most of its time on public markets trading at a premium to its IPO price. As of June 30, it was down 13.1% since its listing, well outpacing its IPO peers and broader markets.