Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Nov, 2024

| The majority of trade with Asia flows through the Port of Long Beach and the Port of Los Angeles, pictured above. Source: Mario Tama/Staff/Getty Images News via Getty Images. |

President-elect Donald Trump repeatedly called for an a further blanket tariff of at least 10% on all imports and a flat tariff of 60% on those from China during his campaign. These would be on top of existing tariffs; in May, President Joe Biden directed his US trade representative to maintain duties incepted by the Trump administration under Section 301 of the Trade Act of 1974, which gives the president fast-track authority to negotiate trade agreements that Congress can approve or disapprove but cannot amend or filibuster. Trump's new proposals would raise the average US tariff on imports from countries excluding China to 11.1% from around 1%, and on imports from China to 80.6% from 10.6%, the Consumer Technology Association estimates.

The tariffs will make the US more competitive with China and lead to more US factories, Trump said. But industry insiders and supply chain experts question whether US consumers can absorb the price shocks that are expected to result from continuing protectionist economic policies.

"All of these policies will have a chilling effect on trade that we might want to consider for reasons of national security and building resilient supply chains," said Aleksandar Tomic, associate dean for strategy, innovation, and technology at Boston College. "But the question is, are consumers willing to pay? Things will cost more, and there will be job losses in some industries, and they are most likely not going to be offset in other industries that will benefit from tariffs."

Additional costs

Each US household will pay up to $7,600 in additional costs annually, paying higher prices for things like toys, apparel, household appliances, furniture and footwear, the National Retail Federation estimates.

Laptop and tablet prices are expected to rise by 46%, according to a report commissioned by CTA and undertaken by Trade Partnership Worldwide LLC, an international trade and economic research firm. It also estimated that the price of video game consoles would rise by 40% and smartphone prices would jump 26%.

US consumer purchasing power for consumer technology products would drop by $90 billion annually, the report estimated. Consumers are projected to purchase 54% fewer laptops and tablets, 44% fewer smartphones and 57% fewer video game consoles.

"The proposed tariffs will not create more employment or manufacturing in the US," CTA CEO Gary Shapiro and CTA Vice President of International Trade Ed Brzytwa wrote in the report's foreword. "In fact, the opposite may happen where our productivity decreases and jobs may be lost over time when workers and businesses have less affordable access to technology."

Businesses that export goods from the US can recover some of the tariffs they would pay through a duty drawback, but that would not prevent retaliation from China or other US trading partners, said Margaret Kidd, associate professor and director of the of Supply Chain and Logistics Technology program at the University of Houston.

"It's not just tariffs, but when we have supply chain disruption, it creates an inflationary environment," Kidd said. "Tariffs are basically a tax on consumers."

Supply chain squeeze

While the 60% flat tariff on imports from China is expected to fuel the ongoing trend of companies diversifying their supply chain, the CTA report found that enterprises will shift production to countries other than the US.

Many companies began diversifying their supply chains during the pandemic, and continued reshoring production to India or Vietnam, said Usha Haley, director of the Center for International Business Advancement and professor at Wichita State University. Stockpiling in advance could help mitigate rising costs precipitated by tariffs, but that carries embedded risks, Haley added.

"That, of course, assumes that technology won't change and customer tastes won't change," Haley said.

Many firms will find themselves swallowing higher prices, passing them on to customers and lobbying for government relief, Haley added.

Christopher Padilla, International Business Machines Corp. former vice president of global regulatory affairs and former undersecretary for international trade in the Commerce Department, said Trump's proposed tariffs would "instantly raise prices for nearly everything."

"The former president claims foreigners pay the tariffs," Padilla said. "As a former trade official and technology company executive, I can tell you this is simply false. When tariffs were imposed on China during the Trump administration and later continued under President Biden, importers like my former company wrote the check, not China."

Container ship traffic and volume will be directly affected by tariffs, especially on the West Coast, where the majority of trade with Asia flows through the Port of Long Beach and the Port of Los Angeles, according to shipment data from S&P Global Market Intelligence Panjiva.

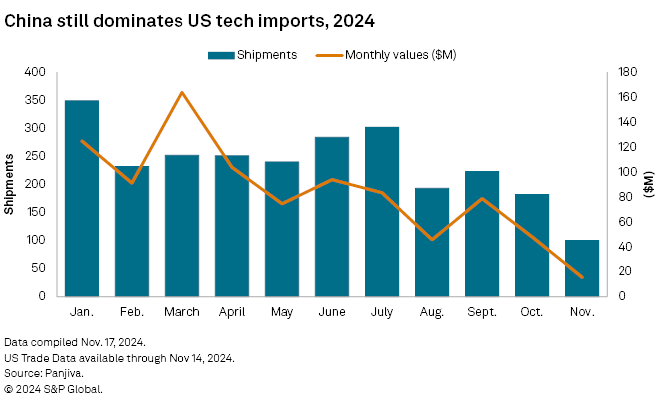

The 2,608 shipments logged since Jan. 1 through Nov. 18 — labeled as technology hardware, storage, and peripherals by Panjiva — account for $923 million in value, 86% of which originated from China.

Small businesses will be especially vulnerable to costs increases that result from higher tariffs, as most of them will lack capital or the line of credit to carry larger inventories or cover expedited transportation costs for their goods, Kidd said.

A brief history of Trumponomics

Beyond tariffs, Trump is expected to reboot his 2020 phase one agreement with China, according to Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center and a former adviser to the International Monetary Fund.

The deal included commitments by China to purchase an additional $200 billion worth of US products over 2017 levels in four sectors — manufactured goods, services, agricultural products, and energy — over a two-year period. Among other terms, the deal also included a new promise from China not to manipulate its currency and to protect foreign intellectual property.

The deal was widely considered a failure by economists. China purchased none of the additional $200 billion in exports it had agreed upon, according to a tracker maintained by the Peterson Institute for International Economics, a nonprofit, nonpartisan research organization.

While the overall deal did not boost US exports to China more broadly, the semiconductor industry did perform well. US exports of chips exceeded their target of $9.9 billion by 129% and semiconductor manufacturing equipment outperformed the deal's goals by 145%, recording $4.3 billion, according to PIIE. Demand for US chips was boosted by the COVID-19 pandemic and the shift to remote work, as well as stockpiling by Chinese firms as US export controls threatened to cut off tech companies like Huawei and SMIC.

A sympathetic ear

Major suppliers of Apple Inc. and NVIDIA Corp., including Foxconn Industrial Internet Co. Ltd., Pegatron Corp., and Quanta Computer Inc. said they are ready to expand their US footprint in response to the implementation of Trump's anticipated trade policy, NIKKEI Asia reported.

Brandon Daniels, CEO of Exiger LLC, an AI-driven supply-chain risk management solutions software platform, said the Trump administration's more hawkish approach to China will have important implications for diplomacy and human rights, including stricter enforcement of the 2021 Uyghur Forced Labor Prevention Act, a Biden-era law that empowers Customs and Border Protection to ensure that US imports have not been manufactured through forced labor in China.

"