Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 May, 2021

By Anna Akins

Big tech's meteoric rise in 2021 could soon come crashing down to Earth amid the specter of new internet regulations and changes to the digital advertising landscape, analysts say.

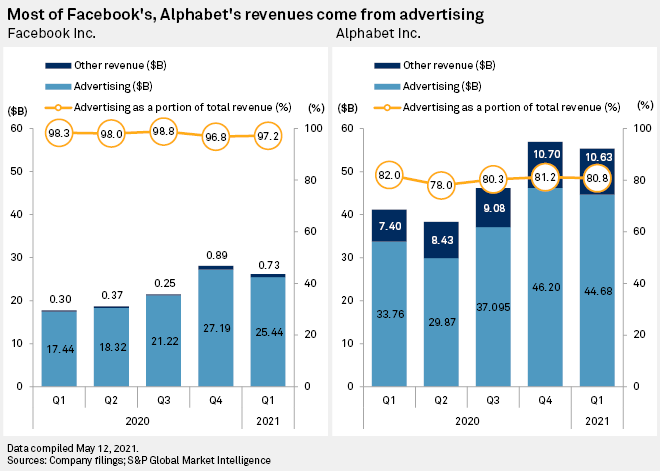

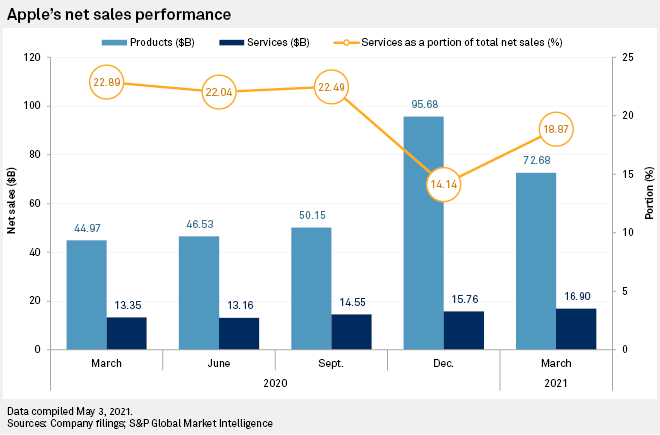

Major tech and social media companies Facebook Inc., Apple Inc. and Alphabet Inc.-owned Google LLC handily beat analysts' forecasts in the first quarter and continued to grow their key business segments. Facebook and Google posted double-digit year-over-year growth in their advertising businesses, while Apple delivered earnings that were powered not just by the iconic iPhone, but also by some of its less-flashy segments — Mac computers and services.

The companies' seemingly boundless growth, however, has not gone unnoticed by U.S. lawmakers and regulators, who continue raising questions about their business practices and seek to rein in their market influence. At the same time, there are growing concerns within the industry about the impact of Apple's latest operating system privacy update, which requires apps to seek users' permission to collect and share data. Analysts warn the threat of looming regulation and Apple's iOS14 update are two headwinds that major tech players are unlikely to overcome anytime soon.

Facebook executives on an April earnings call said that while Apple's new privacy change is still in its early stages, the company expects the update to contribute to increased ad targeting headwinds in the current quarter. Under the privacy change, Apple users will have to opt-in before apps and advertisers can use Apple device identifiers to help target ads and track how effective they are.

Eric Seufert, an independent analyst and marketing strategy consultant who runs mobile advertising trade blog Mobile Dev Memo, previously forecast that Facebook could take a 7% revenue hit as marketers spend less on ads and as more iOS users opt out of allowing Facebook to collect their data.

"The damage to Facebook's revenue caused by Apple's new privacy policy will be material," Seufert wrote, saying that he expects the global average Facebook opt-in rate to range from "30% in a best-case scenario to 10% in a worst-case scenario."

Facebook reported total revenue of $26.17 billion for the just-ended period, up 48% from $17.74 billion a year ago. Advertising revenue for the quarter grew 46% year over year to $25.44 billion.

On the regulatory front, Facebook faces two separate antitrust lawsuits from the U.S. Federal Trade Commission and 48 attorneys general from across the U.S. that allege, among other things, that the company has engaged in anticompetitive behavior. The lawsuits called for a slew of potential remedies — from divestitures to requiring Facebook to gain approval for future M&A.

Meanwhile, Google is facing with an antitrust suit from the U.S. Justice Department and 11 states alleging the company unlawfully maintained monopolies in general search and search advertising. Advertising revenues in Alphabet's main Google segment climbed to $44.68 billion in the just-ended quarter, up from $33.76 billion in the same period a year ago.

Apple also has come under fire from lawmakers and regulators for charging a 30% commission to app developers, which critics claim has resulted in fewer choices and higher prices for consumers. The company is battling Epic Games Inc. in a court battle aimed at determining whether Apple's policies have resulted in an Apple monopoly over the digital payments landscape, as Epic alleges.

The App Store is included within Apple's broader services business, which also comprises Apple Music, video services and cloud offerings. While Apple does not provide specific sales figures for the App Store, net sales in the company's services business came to $16.90 billion for the March quarter and comprised about 19% of Apple's total net sales in the period.

Rather than company breakups, Daniel Morgan, a senior portfolio manager at financial service firm Synovus, expects regulators to impose additional limits on big tech's main business operations, such as restricting Facebook and Google's ad tracking capabilities, similar to Apple's latest privacy changes.

"You may see some sort of curtailment where they come in and say you guys can't do that, you have to open [your businesses] up," Morgan said in an interview. "I think that'd be one of the easier ones to initially address as opposed to going after a major breakup."

In a January note, Kevin Rippey, who at the time was an analyst with Evercore ISI, said he considers Facebook's battle with Apple to be a greater risk for the company than government regulation, noting Zuckerberg's support of Congress taking a more active role in crafting new regulations is a positive. The CEO in January urged government officials to set clearer rules around privacy and content moderation, saying those topics are "very difficult for a private company to balance" on its own.

Despite regulatory risks and advertising challenges, some analysts remain bullish on big tech's future growth potential.

Wedbush Securities analyst Daniel Ives in a recent report said he expects major tech players to lead the digital transformation in areas such as cloud computing, next-generation 5G wireless technology and cybersecurity, which he considers to be a $2 trillion market opportunity over the next decade.

"Taking a step back, our bullish view of tech stocks over the years is predicated on our multi-year thesis that the digital transformation story across the consumer and enterprise ecosystem is still in the early innings of playing out," Ives said.

John Petrides, a portfolio manager at Tocqueville Asset Management, agreed, noting in emailed comments: "FAANG as a group all posted solid earnings results and the fundamentals of the group continue to look strong."

The so-called FAANG stocks, which include Facebook, Apple, Amazon.com Inc., Netflix Inc. and Google, are often tracked together due to their influence on U.S. markets.