Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jan, 2022

Technology deal volumes and values hit astronomical records in 2021, and the break-neck activity is only set to continue in 2022.

The first three weeks of January saw nearly $100 billion in deals, maintaining the unprecedented pace that drove 2021 above $1 trillion in sector M&A. The month also saw Microsoft Corp. agree to pay more than any buyer in 2021 with its $77.96 billion acquisition of Activision Blizzard Inc.

Corporate development executives and investment banking advisers forecast the coming year to be equal to or even bigger than the 2021 market.

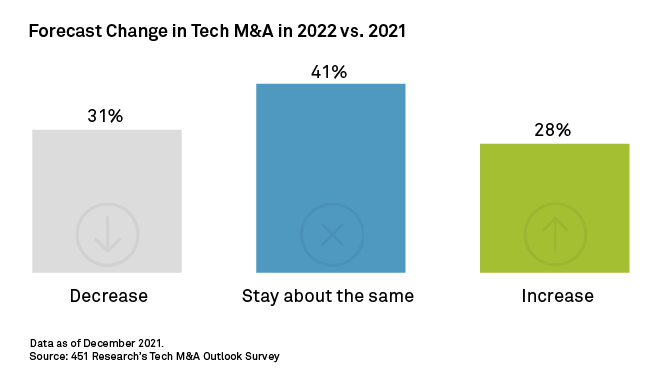

A full 69% of acquirers and advisers expect 2022 to sustain or add to 2021's feverish pace, according to recent 451 Research survey data. The market exited 2021 with $1.24 trillion in announced tech deals.

The survey found that 41% of respondents believe deal volumes will remain flat year over year and 28% believe activity will accelerate. A minority, 31%, said they believe activity will decelerate. The pessimism is atypical for deal-makers, who in past surveys have weighed more heavily toward M&A growth forecasts, 451 noted in a report on the survey, but it is also atypical for those deal-makers to be reflecting on a 13-figure run.

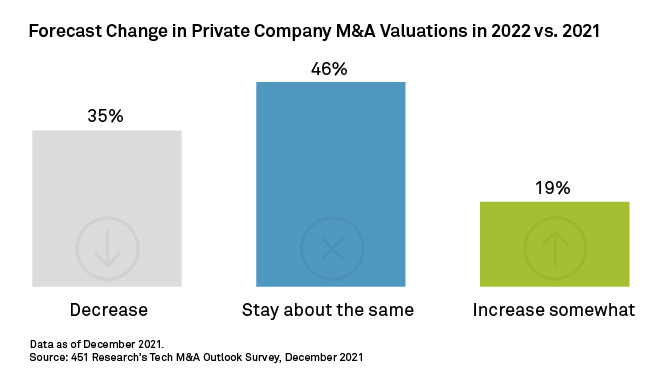

For targets, 451 survey respondents were confident in M&A valuations for the coming year involving private companies looking for a liquidity event. Only 35% of respondents said they believe private-company valuations will decrease in 2022 from historic highs, with the remainder saying they believe those valuations will hold or increase.

As to acquirers, publicly traded companies may feel pressure from falling equity markets, 451 argued. For large, public acquirers like Microsoft, part of what fueled their contribution to the 2021 M&A boom was a red-hot public equity market. Rising market capital provided a rationale for paying historically high prices for strategic combinations.

January 2022 has weighed on that capital. For the year through Jan. 24, the tech-heavy Nasdaq exchange was down 12.7%, and the large-cap S&P 500 index was off by 7.5%. For its part, Microsoft shares plummeted 13.2%. That negative three-week opening to 2022 came after 2021's gains of 21.4% for the Nasdaq, 27.7% for the S&P 500 and 50.5% for Microsoft.

Part of Microsoft's dip came after it announced its planned purchase of games developer Activision. That deal is over 3x the size of the largest 2021 transaction, the $20.86 billion take-private acquisition of legacy cybersecurity firm McAfee Corp. Microsoft also had the second-largest deal of 2021 with its $19.80 billion bid for Nuance Communications Inc.

While the Activision deal was much larger than the Nuance deal, it was valued at just 7.6x trailing 12-months revenue, according to 451. That is materially less than the 13.6x Microsoft multiple offered for Nuance three quarters prior. The Activision multiple was in line with the application software sector's average 6.6x trailing revenue multiple for the 1,483 sector transactions 2021 and the 7.6x average for the 116 deals posted in 2022 as of Jan. 25.

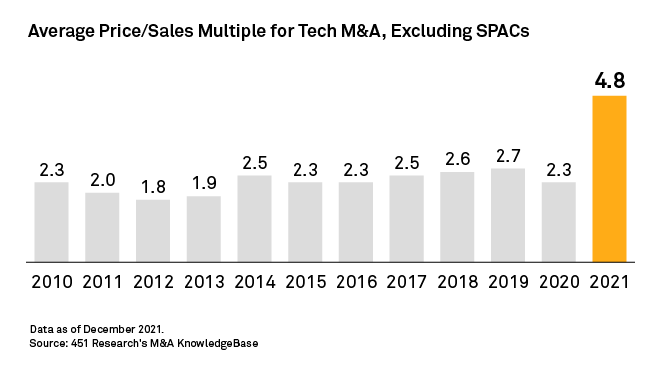

Notably, application software found some of the richest valuations in 2021. Looking at tech more broadly last year, the average multiple for deals excluding black-check acquisitions came in at 4.8x, up from 2.3x in 2020.