Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Mar, 2021

For blank-check companies hungry for an acquisition, the tech sector has thus far proven a happy hunting ground. But there are signs hunting season could be coming to an end.

|

This is the second installment of a three-part series focused on tech SPACs. The full series can be found here: Tech and SPACs: A dance of Wall Street darlings Tech and SPACs: Too much of two good things Tech and SPACs: Feeding the frenzy |

Blank-check firms, formally known as special purpose acquisition companies, raise capital through an IPO for the purpose of acquiring an existing operating company. They have no commercial operations of their own upon launch, but they may have a targeted industry, like technology.

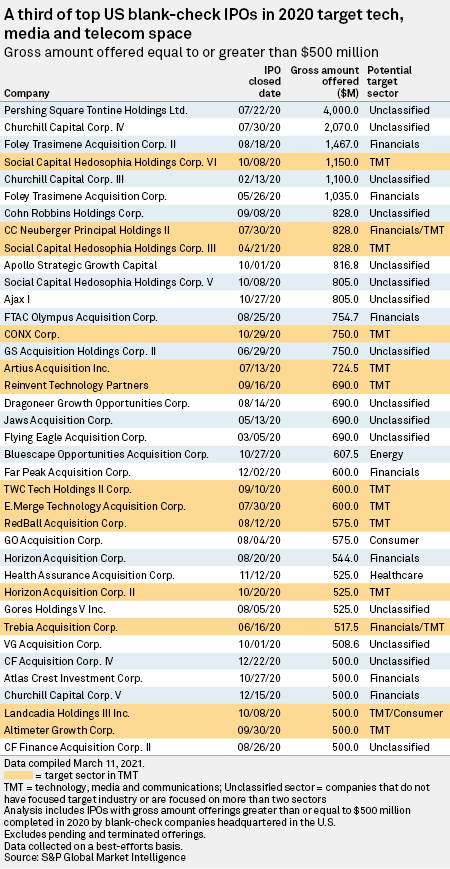

Certain qualities of the SPAC model and the tech sector make the two well suited for each other, and according to an analysis of S&P Global Market Intelligence data, a third of SPACs listed in 2020 and another third of those listed in 2021 targeted the technology, media and telecom, or TMT, industry. This figure represents an outsized share compared to other industries.

While there is a reason for the preponderance of TMT SPACs, there are also natural limits to the amount of deals that can get done. And amid a historic SPAC boom that is playing out amid a historic IPO and M&A boom, the market may now be running up against those limits.

Looking for capital

One major reason the market has seen so many tech SPACs is that there tends to be a lot more private companies in the tech industry in various stages of growth, analysts agree. So there are more tech-targeted SPACs partly because there are just more private tech companies looking for capital compared to many other industries.

|

|

In this sense, the tech industry may need the SPAC model to fund innovation as much as investors are looking to tech for the kind of speculative growth to which SPACs lend themselves.

At least, that is the story being told by some tech-focused SPAC sponsors.

"The future success of the capital markets for technology companies is dependent on new company formation ... and an increased willingness of private technology companies to become publicly traded and therefore become available to a broader universe of investors who can benefit from their disruption and growth. Our mission is to create an alternative path to a traditional IPO for disruptive and agile technology companies," SPAC sponsor Social Capital Hedosophia Holdings Corp. says in its mission statement.

Social Capital is a SPAC-focused venture operated by celebrity Silicon Valley investor and SPAC evangelist Chamath Palihapitiya. The firm made a big splash in the SPAC world — and contributed considerably to the model's credibility — through its successful merger with commercial space flight venture Virgin Galactic Holdings Inc. Shares of Virgin Galactic closed at $34.55 on March 12, more than 3x the 2019 SPAC IPO price.

Virgin Galactic is just one of six SPACs listed on Social Capital's website, each in different stages of the SPAC process. But while Virgin Galactic has done well, Social Capital is not batting 100. Its transaction for Clover Health Investments Corp., a tech-focused health insurance company, has been battered by short sellers. As of March 16, Clover Health's stock was down over 45% from Jan. 7, when it completed its merger with Social Capital.

The growth of value

One problem is that both tech companies attempting to raise capital on speculative valuations and retail investors using personal finances to buy into those companies are highly sensitive to market conditions. Jay Ritter, finance professor at The University of Florida, and Scott Denne, an analyst with 451 Research, agreed that low interest rates and a strong outlook for technology vendors compared to other product categories have been crucial contributors to the growth in tech SPACs in 2020 and 2021.

Those dynamics, which encourage borrowing, have driven record valuations for growth stocks, as growth companies look for affordable capital that does not depend on historic earnings.

But cracks are beginning to appear in that thesis, which could lead to a decline in SPAC listings and deals, as it has already contributed to a decline in public market tech valuations. Combine an increasing sensitivity for risk among investors, increasing cost of debt for companies looking for capital and historically high tech valuations, and you get a once-in-a-decade shift out of tech-heavy growth stocks and into more reliable value stocks that trade at lower, but more reliable, price-to-earnings ratios.

To illustrate, the S&P 500 Value index returned 8.6% in 2021 as of March 8, beating the 2.0% gain for the broader S&P 500 index. By contrast, the tech-heavy S&P 500 Growth index declined 3.8% over the same period.

"The types of companies [SPACs] buy are a risky slice of the overall equity market, so if investors start to back off, I think we'd see less SPAC activity," Denne at 451 Research said. 451 Research is an offering of S&P Global Market Intelligence.

Closing the deal

In turn, while TMT represents one of the most active industries for blank-check IPOs, that does not mean deals are being closed. Just as TMT is overrepresented among SPAC sector targets, those targeting TMT mergers are the least likely SPACs to have closed a transaction, said Rajiv Shukla, chairman and CEO of the SPAC Alpha Healthcare Acquisition Corp. and partner with SPAC data firm SPAC Research.

Moreover, tech SPACs that have closed a deal are underperforming, with tech SPACs that have completed deals trading on average at about $11, compared to industrials above $20, financial firms in the mid-teens and automotive, which is also fueled by speculation in connected and driverless car innovations, at about $25 on average, according to Shukla's database.

"It's quite surprising. If you look at the number of tech deals that have closed … the performance of these deals hasn't been very good," Shukla said.

Many retail investors have the opposite impressions, largely due to a proliferation of high-profile SPAC combinations and a proliferation of large investment bank and celebrity advisers of tech-focused SPACs.

And while Shukla believes the SPAC model has proven its worth and will remain an important option for certain companies, the muted investor enthusiasm for tech SPACs may just be the beginning of a much more subdued marketplace for the model, increasingly governed by company fundamentals and market research rather than the exuberance of retail investors buying a trend.

"This bubble talk only should worry people that are relying on the bubbles for success," the executive said.