Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 May, 2021

| Increased regulatory oversight led to a sharp decline in SPAC listings in April after record numbers in the six months prior. Source: Getty Images |

The SPAC wave is receding, leaving behind a high-water mark of uncertainty, amended filings and canceled IPO plans.

That does not necessarily mean special purpose acquisition companies, which allow an operating company to become listed on the public market through a reverse merger, will fade back into obscurity as quickly as they burst into the investing spotlight over the past six months. But in general, both SPAC sponsors and SPAC investors are rethinking their plans in the face of an overheated market, uncertain equity valuations and, most importantly, the specter of new federal regulations.

|

This is an update to a recent three-part series focused on tech SPACs. The full series can be found here: Tech and SPACs: A dance of Wall Street darlings Tech and SPACs: Too much of two good things Tech and SPACs: Feeding the frenzy |

In April, the U.S. Securities and Exchange Commission issued new guidance on how SPACs should account for the warrants issued as part of their IPOs. But further action from the agency is possible.

"The impact of the SEC regulations and investor interest is going to result in the SPAC market changing fundamentally," said Rajiv Shukla, chairman and CEO of SPAC Alpha Healthcare Acquisition Corp.

Safe harbor

One of the most important changes, particularly for growth companies in the tech sector, would involve the regulator restricting the safe harbor protections for forward-looking statements granted SPACs in their merger filings. If that safe harbor is removed, companies could be held liable if they are unable to meet their financial guidance issued during the M&A process.

The SPAC model provides access to public markets, but with the less regulated forward-looking statements of a merger agreement. That provision has proven to be particularly attractive for companies in the pre-revenue or pre-profit stage that are unable to garner a strong valuation through the typical IPO process, which restricts forward-looking projections.

This is partly why the SPAC space has seen so many high-profile deals in the technology sector, including a run of software and data startups. One-third of large SPACs listed in 2020 and another third of those listed in the first three months of 2021 targeted the technology, media and telecom, or TMT, industry — an outsized share compared to other industries. Large, in this case, is defined as those that raised $500 million or more.)

Tech startups often do not generate revenue or profits for years, but rather depend on market projections and forward-looking guidance to raise funding. Given current disclosure rules, this can compromise the prospects for those companies under a traditional IPO or create volatility as retail investors speculate on limited guidance; the SPAC model provides a vehicle around that limitation.

"One of the biggest advantages of SPACs over traditional IPOs is the availability of target projections and information on valuation that are not common in a traditional IPO prospectus," said Michael Fitzgerald, a managing director at MorganFranklin Consulting LLC, a Vaco company. "Changes in securities laws or elimination of safe harbor protections could reduce the benefit of SPACs in the future."

Full disclosure

While SPACs have been around for decades, they were largely ignored until 2019 when several high-profile institutional investors and investment banks showed interest in the model. This participation by big banks like The Goldman Sachs Group Inc., private equity giants like Thoma Bravo LLC, and even celebrities like Shaquille O'Neal, has proven a double-edged sword.

On one hand, those high-profile participants derisked the perception of the model, 451 Research analyst Brenon Daly said, making it more enticing to retail investors who may have otherwise been wary of the complicated structure.

"Without this patina of respectability, these SPACs would not have assumed the power in the marketplace," Daly said.

The increased notoriety, though, is also leading to increased scrutiny, and the involvement of investment banks in SPAC sponsorship creates a potential conflict of interest. Some banking sponsors were putting a minimal investment into the sponsorship of the SPAC, but also signing on as IPO underwriters for the launch and as deal advisers when it came time to acquire an operating company. Often those fees were much greater than the bank's investment in its sponsorship, so financially speaking, the success of the SPAC itself could be secondary to the completion of the IPO or deal.

As a result, the SEC will also likely require enhanced disclosures from SPAC sponsors on other financial interests they have in the lifecycle of the deal, Shukla believes.

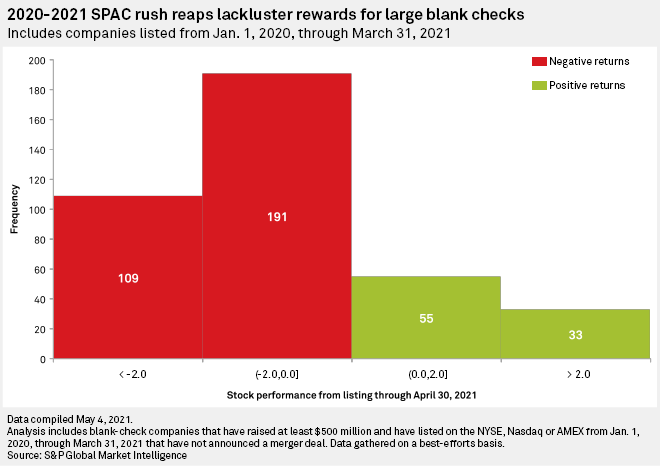

A majority of the larger SPACs listed since 2020 that were still trading as of April 30, 2021, have seen negative returns. Nearly 200 blank check companies saw their stocks drop between 0% and 2% compared to their IPO prices. More than 100 of these SPACs saw more than 2% declines in value since their respective listing dates.

Less than one-quarter of SPACs have risen in value since their listings.

Unwarranted

Lastly, the SEC may require SPACs to begin accounting for warrants it issues upon IPO as a liability, since they reflect a dilution event in the future. A warrant represents a partial share of the company once the SPAC merges with an operating entity, and it can be redeemed at a future date.

Currently, many SPACs account for those warrants as equity on their balance sheet, but the SEC in April said warrants may need to be accounted for as liabilities. This has caused a major logjam in the SPAC market as companies in various stages of the SPAC process amend their financial statements and plan for a future shift in the equity-to-liability ratio.

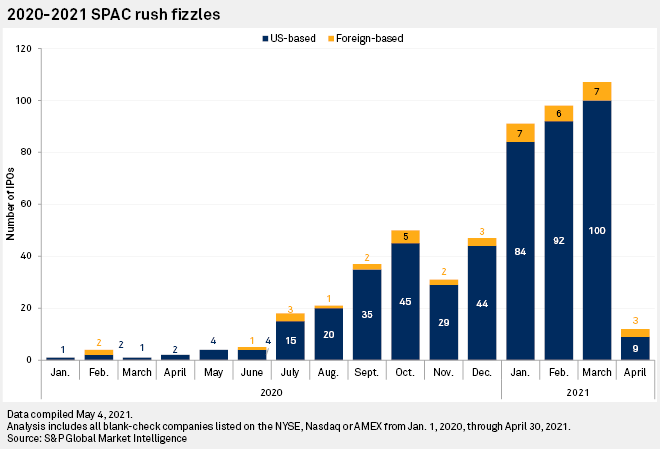

This drop-off in activity is especially apparent when looking at the number of SPAC listings in the last month.

According to S&P Global Market Intelligence data, the first quarter was a record period for SPAC activity. But U.S. SPAC listings cratered in April, dropping to just nine from 100 in March

Only one of those nine, TCV Acquisition Corp., stated outright that it would target the TMT space, according to S&P Global Market Intelligence.

Not enough unicorns

For some, the April drop-off had less to do with the risk of regulatory action and was more due to an inevitable correction.

"Not every startup should be on Wall Street, and not every money manager or tech entrepreneur should be a SPAC sponsor," said Daly of 451 Research. "We've worked through the supply. The available market participants have made their moves."

Jay Ritter, finance professor at The University of Florida, agreed: "There aren't 400 unicorns ready to go public."

Further, investor terms were becoming less attractive, Ritter said. Shares were being bid up more rapidly post-IPO, even before merger were announced, and the warrants included with a SPAC unit were decreasing in value. Whereas a year ago, a typical warrant represented half a share, in February, that was down to one-quarter, Ritter said.

But others remain more bullish about the model, saying they did not share those structural concerns.

"We may not see a return to the pace we’ve experienced the last few months but SPACs will continue to be part of the market strategy going forward. If anything, the success of SPAC transactions during 2020 has led to the sentiment that this is a credible vehicle to enter the public markets," said Fitzgerald.

For Shukla, the fact that number of deals closing was increasing with the number of SPAC listings hitting the market shows demand was increasing along with supply.

He also believes increased regulatory scrutiny could benefit both the SPAC model and investors.

"All organic systems evolve in response to external stimuli," Shukla said. "Are SPACs dead? No. But there will be a new breed that comes into place, and that breed is going to be better for investors and better for the market."