S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Jul, 2021

By Nina Flitman

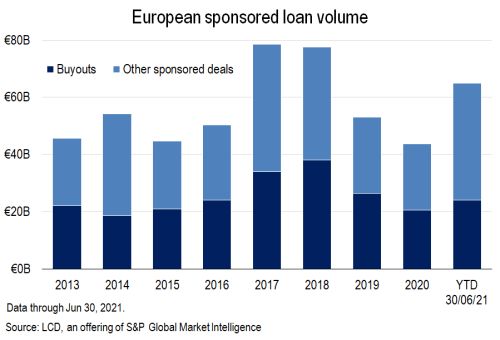

The leveraged buyout boom during the first six months of the year in Europe generated a pickup in corporate carve-outs, but an expected surge in take-private deals after the summer should bring a further bonanza of new issuers for both leveraged loan and high-yield bond investors.

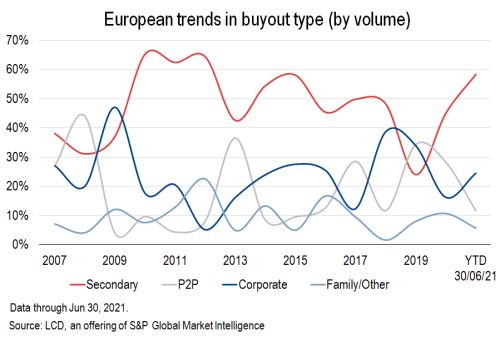

Across the first half of the year, the proportion of corporate carve-outs by volume seen across European financings rose to 24%, according to LCD, boosted by deals such as the jumbo triple-tranche debt package backing the £6.6 billion acquisition of U.K. supermarket chain ASDA Group Ltd. by the Issa brothers and TDR Capital from Walmart, and the €1.7 billion bond and loan financing supporting Hillhouse Capital's carve-out of Philips Domestic Appliances Holding BV.

These jumbo carve-outs are far from the only large-scale transactions seen in the first half of the year, however, and secondary buyouts still made up the bulk of buyout activity over the first half. In among the largest buyout financings in the European leveraged loan market in the year so far were the EQT-led acquisition of Cerba HealthCare SAS from Partners Group, which was financed with a €1.525 billion seven-year term loan, and ICG’s buyout of telecoms operator Groupe Circet SA from Advent International, which was backed by a €1.625 billion term loan. In all, these transactions contributed to one of the busiest years for European buyouts since 2007.

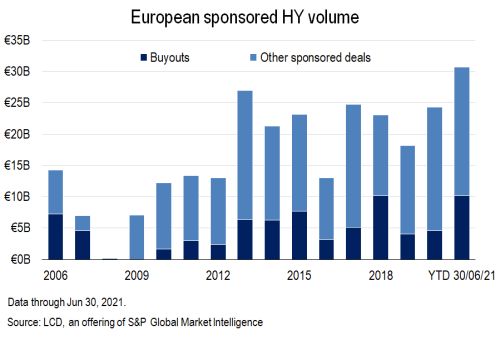

Buyout bonds

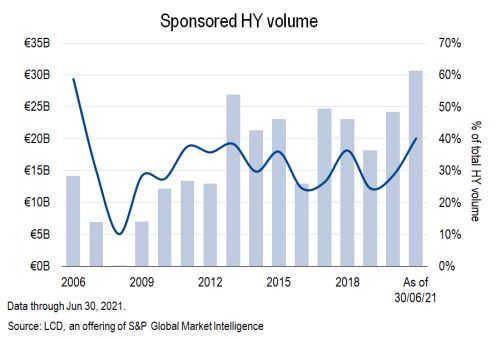

Alongside the surge in buyout loan activity has been a large step-up in buyout bond issuance, with roughly €10.2 billion of such bond supply recorded in the first half of the year — already more than any full-year tally since LCD began tracking this data in 2006.

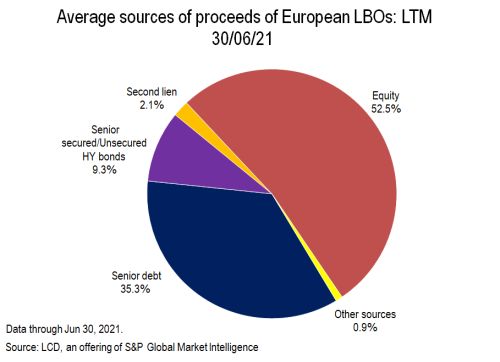

European private equity sponsors have traditionally shown a preference for the more-flexible leveraged loan product, but given the size of the debt required on many jumbo buyouts, these transactions have also included bond tranches in their financing packages, which has allowed them to take advantage of any pricing differential between the two markets. "Sponsors continue to see the benefits of competitive tension between bonds and loans this year," said a banker.

In the year to June-end, about 40% of European high-yield volume was sponsor-backed, which is a bigger share than that seen in any full-year period since 2006. This effort equates to €30.7 billion of sponsor-backed volume, the highest absolute figure on record.

On some of the transactions, the leveraged loan market took the lion's share of the financing — for example, Cerba's deal was backed by a €1.525 billion loan and €745 million bond offering. Similarly, the CHF 4.2 billion carve-out of Lonza Specialty Ingredients from the Swiss chemical group by Bain and Cinven was backed by term loans totaling roughly CHF 1.84 billion and a bond issue of CHF 823 million-equivalent.

Elsewhere though, sponsors turned to the high-yield market for the bulk of the debt. Asda raised an €845 million TLB supporting its takeover, with £2.75 billion coming from an offering of secured and unsecured notes.

Even more private equity-backed buyouts — particularly from Italian issuers — were funded solely through the high-yield market. Bank infrastructure software provider Cedacri S.p.A. backed its buyout by ION Investment Group with a €650 million offering of floating-rate notes, while footwear manufacturer Birkenstock GmbH & Co. KG's takeover by L Catterton was funded with a €430 million bond transaction.

Private lessons

While the volume of financings backing both corporate carve-outs and secondary acquisitions rose in the first half of the year, the proportion of transactions backing take-private deals slumped. Across the first half, only 12% of the buyout volume came from take-private transactions, with roughly €2.8 billion of public-to-private acquisition financings recorded across the loan market. This supply included the €950 million-equivalent term loan backing the bid for flooring company Tarkett SA by the Deconinck family and Wendel, and the €1.15 billion term loan and £228 million second-lien facility supporting EQT’s buyout of contract development organization Recipharm AB (publ). The public-to-private acquisition of ADVANZ PHARMA Corp. Ltd. by Nordic Capital was funded with a €305 million term loan, as well as secured bond offerings of €475 million and £335 million.

However, there is a swath of take-private transactions readying for launch in the second half of the year that are likely to significantly boost the proportion and volume of public-to-private deals for 2021 by the time the year is out. For example, TDR Capital and I Squared Partners have agreed on a £2.32 billion bid to buy Glasgow-based Aggreko PLC, while London-listed specialty packager UDG Healthcare PLC has been acquired by Clayton Dubilier & Rice. Elsewhere, tech- and telco-focused private equity group Siris has agreed to take payment specialist firm Equiniti Group PLC private, while TDR Capital is buying Arrow Global Group PLC.

While no new transaction in Europe's forward calendar can be fully confirmed until it is launched to syndication (note that Carlyle's acquisition of pharma group Vectura Group PLC was upended after Philip Morris swooped in with a rival bid), market participants are definitely looking forward to an active post-summer period. "The second half of the year is looking very promising," confirms one European investor. "We are looking forward to seeing some new deals, but more importantly some new names."

Other deals that could prompt jumbo financings remain under discussion, not least the potential take-private of London-listed asset management services provider Sanne Group plc by Cinven. The sponsor has until early August to present a firm offer, having submitted a £1.42 billion bid in June.

Supermarket sweep

The largest potential take-private, though, may emerge from the bidding war now underway for U.K. retailer Wm Morrison Supermarkets PLC. The supermarket chain announced in early July that it had agreed to a £6.3 billion take-private offer from a group consisting of Fortress, Canada Pension Plan Investment Board and Koch Real Estate Investments, having rejected a £5.5 billion takeover offer from Clayton Dubilier & Rice in June. CD&R now has until mid-August to submit a higher bid.

The accepted bid — which may yet be joined by Apollo Global, after that sponsor decided against an individual bid — will be backed by new financing including a £2 billion senior term facility (split into a £900 million term loan A and a £1.1 billion backstop facility); a £3 billion term loan B; and a £750 million multi-currency revolver.

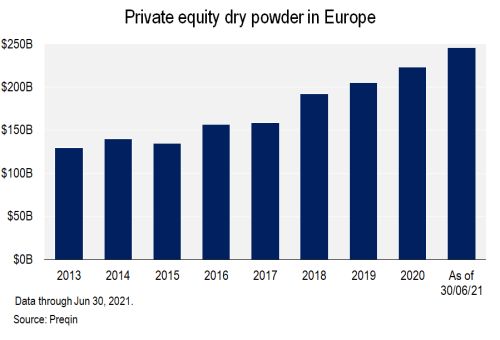

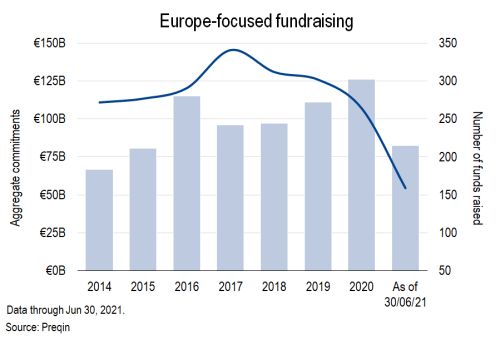

Sponsors certainly remain in a strong position for more public-to-private prospects to emerge as the second half unfolds, and if the pace of fundraising seen across the opening six months of 2021 continues, it will be a very strong year indeed for new sponsor funds. Illustrating the sheer scale of funds available for deals, the amount of dry powder available to acquisitive sponsors in Europe is edging close to a record $250 billion.