S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Jun, 2022

By Sydney Price

With the identities of participants in the upcoming 2.5 GHz spectrum auction now revealed, analysts are predicting which of the top telecom carriers will spend the most aggressively.

The bidding round the Federal Communications Commission's upcoming 2.5 GHz auction is set to begin July 29. The FCC earlier this month revealed lists of complete and incomplete bidder applications. Among those with completed applications are AT&T Inc., which will bid under the name "AT&T Auction Holdings"; T-Mobile US Inc.; and DISH Network Corp., which is reportedly bidding under the moniker Carbonate Wireless. Cellco Partnerships, a subsidiary of Verizon Communications Inc., is listed among the incomplete applicants. Prospective bidders with incomplete applications have until June 23 to complete required documents and payments.

Applicants are legally prohibited from discussing their bids or bidding strategies during the FCC's defined "quiet period," which starts when short-form applications are due and ends following the close of the auction when winners' down payments are due.

Analysts eyeing the auction expect T-Mobile to outbid its top competitors in the auction. The carrier already has a stockpile of 2.5 GHz spectrum from its purchase of Sprint, but T-Mobile could use the auction to fill in its current coverage gaps. Most of the available licenses cover rural areas.

"I am interested to see if T-Mobile is willing to let any of the rural areas go to the smaller wireless players, or whether they are planning to sweep the auction," said Brian Goemmer, president at Allnet Insights & Analytics, a spectrum ownership and analysis solutions company. "This will be noteworthy because it will define how T-Mobile truly feels about 2.5 GHz spectrum in rural areas."

Bidding strategy predictions

When 2.5 GHz spectrum was first distributed in the 1980s, the licenses were granted in 35-mile-radius circles, which left blank spaces in ownership. This is the spectrum that will be available in the upcoming auction.

Although Verizon had not completed its application as of June 9, the company is still likely to participate in bidding in some capacity, said Lynnette Luna, an analyst at Kagan, a media research group within S&P Global Market Intelligence.

"It's not clear to me what AT&T and Verizon will be doing, although they submitted applications to bid; but any time there is a chance to obtain more spectrum at a decent price, carriers don't want to lose out." Luna said.

Goemmer said AT&T and Verizon are not likely to benefit from the location of the spectrum and will likely be conservative with investments for rural licenses.

"I don't expect AT&T or Verizon to win any licenses unless they purchase licenses in rural areas overlapping or adjacent to areas where they provide fixed wireless broadband," Goemmer said. "In urban areas, where Verizon and AT&T would like to use the 2.5 GHz spectrum for mobile networks, all of the licenses cover small fractions of each market."

This is because the only available licenses in the upcoming auction will be county licenses, not market licenses. County licenses require that a minimum number of people are covered by a network in that county, while market licenses require a minimum number of people are covered by a network in that market. Market licenses can provide more flexibility because individual counties that are less populated can be left out of network construction if enough people are covered in the market's more densely populated counties, Goemmer said.

Tapped out

Another consideration ahead of the upcoming 2.5 GHz auction is how much each carrier has spent in other recent mid-band auctions. Mid-band spectrum is important for 5G networks because high-band spectrum cannot travel long distances or penetrate certain surfaces and low-band spectrum has become crowded due to 4G wireless services.

But both Verizon and AT&T have already spent heavily, including taking on debt, to shore up their mid-band holdings in the past two years.

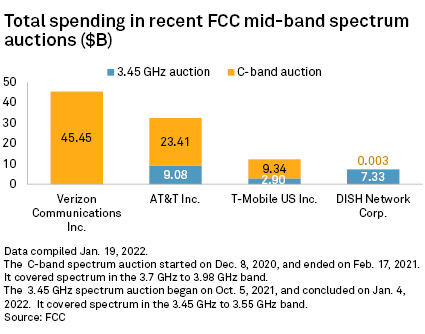

Verizon spent $45.45 billion in the C-band spectrum auction in 2021 when the FCC auctioned 280 MHz of spectrum in the 3.7 GHz-3.98 GHz band. AT&T dished out $23.41 billion in the C-band auction and then followed that up by shelling out an additional $9.08 billion in the subsequent 3.45 GHz auction, which ended in January 2022. All told, AT&T spent $32.49 billion on mid-band spectrum across the two auctions. After its massive C-band spend, Verizon opted to sit out the 3.45 GHz auction. T-Mobile spent $12.24 billion combined on the two earlier auctions, and DISH spent $7.33 billion.

The total debt loads of T-Mobile, AT&T and Verizon jumped in the first quarters of 2021 and 2022 following FCC spectrum auctions.

DISH and cable

DISH is also expected to be conservative in its approach to the 2.5 GHz auction as there is not enough available spectrum to include in its standard deployment mix, Goemmer said.

Larger cable operators are concentrating resources on other technologies, Luna said. Citizens Broadband Radio Service spectrum, also known as CBRS, is a band of radio frequency spectra from 3.5 GHz to 3.7 GHz. Cable operators are using CBRS in conjunction with Wi-Fi to off-load traffic from their mobile virtual network operator agreements with carriers. This lowers their interest in acquiring 2.5 GHz spectrum, said Luna.

Regional cable providers including Texas-based Coleman County Telephone Cooperative Inc. and North Carolina-based Carolina West Wireless, Inc. were listed on the FCC's approved applicant list with rural service provider bidding credits. The 15% bidding credits help rural carriers with less than 250,000 subscribers to compete more effectively for spectrum.

The FCC has had the right to carry out spectrum auctions since 1994, though that authority is set to expire Sept. 30 of this year unless extended by Congress.

On June 15, The House Energy and Commerce Committee Communications Subcommittee voted unanimously in favor of the Extending America's Spectrum Auction Leadership Act of 2022, which would extend the FCC's spectrum auction authority to March 21, 2024.

"U.S. innovation is ... fueled by efficient spectrum allocation from auctions. Spectrum availability acts like a magnet for network research and development, and translates into a strong hand for US intellectual property," Cisco Systems Inc. Senior Director of Government Affairs Mary Brown wrote in testimony for a House Subcommittee on Communications and Technology hearing in March.