S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 May, 2022

By Sanne Wass

Sweden's largest lenders recorded higher net interest income in the first quarter of 2022 and can look forward to a further uplift after the country's central bank brought interest rates back into positive territory for the first time since 2014.

The Riksbank, responding to high inflation, raised its key interest rate to 0.25% from 0% on April 28 and plans to hike it again a further two or three times this year, forecasting that it will reach 1.8% in three years.

Swedbank AB (publ), as the leading retail bank in Sweden, ought to be the main beneficiary among the large banks from higher interest rates, UBS analysts said in a May 3 research note. As rates rise, banks generate more net interest income, or NII — revenue from loans minus expenses on deposits — as they pass on higher rates to borrowers.

Swedbank said April 28 that a 50-basis-point rate increase would boost its NII by 3.07 billion kronor annually. A 100-basis-point rise would generate a 6.86 billion kronor uplift, which would represent a 26% increase compared to 2021 full-year NII of 26.26 billion kronor.

Skandinaviska Enskilda Banken AB (publ), or SEB, estimated that NII sensitivity to a 25-basis-point interest rate hike is "slightly north of 1 billion kronor," CFO Masih Yazdi said during an earnings call April 27. Svenska Handelsbanken AB (publ), which released its first-quarter results on the same day, has not provided a sensitivity figure, but it is likely to be between those of Swedbank and SEB, according to UBS analysts.

SEB's full-year 2021 NII amounted to 26.10 billion kronor, while Handelsbanken's totaled 30.32 billion kronor.

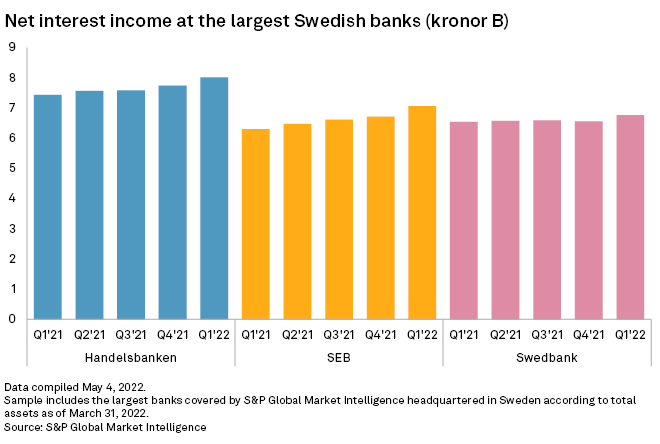

The three largest Swedish banks by assets saw NII improve in the first quarter of 2022, with SEB recording the highest year-over-year growth of 12.1%. Handelsbanken and Swedbank recorded increases of 7.9% and 3.4%, respectively.

Handelsbanken's NII benefited from central bank rate increases in Norway and the U.K., according to CFO Carl Cederschiold. At Swedbank, higher mortgage and corporate lending volumes drove a slight increase in NII. SEB's NII was supported by lending volumes related to bridge financing activity, which is likely to come off the books in the next couple of quarters, Yazdi said.

Swedish banks generally have limited direct exposure to Russia and Ukraine and have therefore been sheltered from the worst impacts of the war. Handelsbanken and SEB posted a year-over-year rise in net profit of 29.0% and 6.4%, respectively, in the first quarter. Only Swedbank's net profit declined, by 7.2%, as market turbulence negatively affected net commission income and caused losses on financial items.

A deteriorating macroeconomic outlook in light of the conflict also impacted provision levels. SEB recorded the highest loan loss charges in the quarter, corresponding to a cost of risk of 8 basis points, which it said was due to less favorable macroeconomic scenarios, uncertainty related to higher energy prices and the war in Ukraine.

As of May 4, US$1 was equivalent to 9.85 Swedish kronor.