S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Mar, 2023

By David Hayes

Silicon Valley Bank and Signature Bank had some of the highest proportions of estimated uninsured domestic deposits across the entire industry.

Silicon Valley Bank ranked first among banks with more than $50 billion in assets, with 93.8% of its total deposits being uninsured, while Signature Bank ranked fourth, according to S&P Global Market Intelligence data as of year-end 2022.

The rate of uninsured deposits in this analysis is based primarily on bank subsidiary estimates made in regulatory call report filings, and it may include items such as intercompany deposits, collateralized deposits that are backed with securities and other deposits structured to qualify for insurance and can differ from parent company GAAP filings, which may exclude such items.

For some companies, the amount reported in call reports may be significantly higher than what is reported in GAAP filings due to these exclusions.

Not all uninsured deposits are equal

Some deposits that could be reported as uninsured in call reports are likely "stickier" than others.

A municipal deposit backed by pledged securities such as Treasurys would have collateral available to make up for any shortfall from deposit insurance.

Meanwhile, large corporate depositors that may have balances well above the Federal Deposit Insurance Corp.'s insured limit may use their deposit account to pay payroll, collect money from vendors, and for other regular corporate operations, and may be well-integrated with treasury management services provided by the bank, which would make moving deposit accounts to another financial institution a significant undertaking.

Aside from Signature and Silicon Valley Bank, only three other banks estimated uninsured domestic deposit rates above 80%. All three, Bank of New York Mellon, Northern Trust Co. and State Street Bank and Trust Co. are large trust/custodial banks. However, when compared to Silicon Valley Bank and Signature Bank, the trio had much lower ratios of total loans plus held-to-maturity, or HTM, securities to total deposits.

Based on that metric, Northern Trust had the highest ratio among the three trust/custodial banks at 54.5%, while Silicon Valley Bank was at 94.4% and Signature was at 93.3% at the end of 2022. Investors have expressed concern about banks' held-for-maturity portfolios because they contain debt instruments that started losing value when interest rates moved higher. Accounting rules do not require banks to mark the HTM portfolios to market, but regulators have openly worried about the capital hits banks would take if they were forced to sell underwater securities in a time of stress.

That scenario came to fruition when Silicon Valley Bank's parent, SVB Financial Group, announced on March 8 that it took a $1.8 billion after-tax loss after selling substantially all of its $21 billion available-for-sale securities portfolio. In the same announcement, SVB said it planned to raise $2 billion in equity, but that was not completed.

The reaction was harsh. SVB's shares plummeted 60% on March 9. On the same day, depositors initiated $42 billion in withdrawals, pushing the bank into a negative cash balance of almost $1 billion, according to a filing by California's Department of Financial Protection and Innovation.

Silicon Valley catered to tech startups and many held deposit balances well in excess of the Federal Deposit Insurance Corp.'s insured limit of $250,000. For instance, TV streaming platform Roku Inc. announced it had approximately $487 million at Silicon Valley at the time of the bank's implosion.

|

* Download the data * Access detailed data on failed banks. * Take part in S&P Global Market Intelligence's U.S. Bank Outlook Survey – The State of U.S. Banks & Fintech. * Read more about the liquidity crunch and the fallout for the financial sector in our new Issue in Focus. |

Only two banks with more than $50 billion in assets and at least half of their domestic deposits estimated as uninsured before exclusions in call report data had total loans plus held-to-maturity securities that exceeded deposits at year-end 2022. First Republic Bank had the highest, at 110.6%, while Western Alliance Bancorp.'s subsidiary, Western Alliance Bank, was at 101.7%. On March 13, Moody's placed First Republic and Western Alliance on review for possible downgrade and cited sensitive uninsured deposit funding, material unrealized losses in securities portfolios and level of capitalization.

However, First Republic and Western Alliance had much lower proportions of uninsured domestic deposits than Silicon Valley Bank and Signature Bank. About 53.4% of Western Alliance's domestic deposits were uninsured at year-end using GAAP data at the parent company, while First Republic was at 67.4%, using call report data. Regulators have said all depositors at Silicon Valley Bank and Signature Bank will have access to their funds.

Industry look

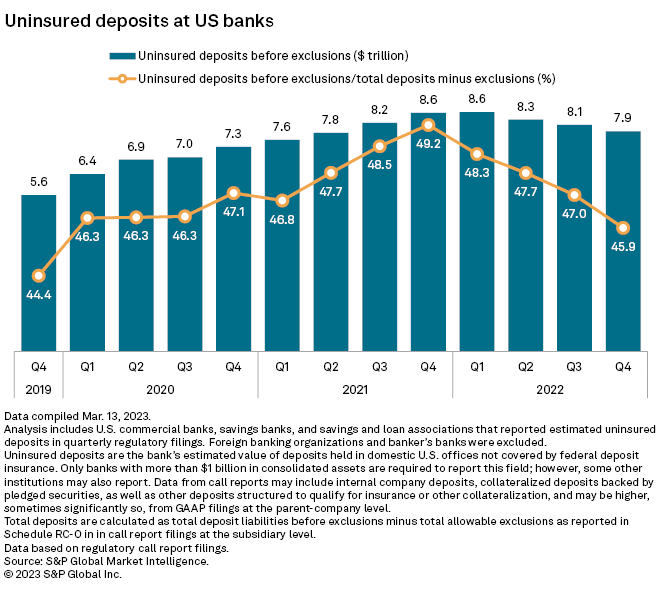

Like all deposits, estimated uninsured deposits grew significantly with the onset of COVID-19 and the accompanying stimulus. Large U.S. banks reported $7.888 trillion in estimated uninsured deposits before exclusions at year-end 2022, almost a 41% increase since the end of 2019, according to call report data.

However, as deposits have started to leave the banking system to seek higher rates, the proportion of uninsured deposits at large U.S. banks dropped to 45.9% of total domestic deposits from a peak of 49.2% in the fourth quarter of 2021. This is near the 44.4% ratio seen at the end of 2019.

Adding safeguards

Regulators hoped to instill more confidence in the banking system with their new Bank Term Funding Program. Under the program, the Federal Reserve said it would help financial institutions meet the needs of depositors by purchasing high-quality securities from banking institutions at par via a loan.

Regulators also said that depositors at Silicon Valley and Signature would have access to their funds. The moves have not completely taken the panic out of the system as bank stocks plunged March 13, but share prices were bouncing back in early trading March 14.