S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Jul, 2021

By Sanne Wass

Global issuance of sustainability-linked loans has far surpassed that of green loans and bonds as companies in the U.S., including those in transition sectors, rapidly embrace the instrument as an alternative to traditional environmental, social and governance debt.

The product, which gives companies a discounted rate if they meet tailor-made sustainability targets, also continues to thrive in Europe, where uptake has been the highest to date. Sustainability-linked issuance skyrocketed in the European leveraged loan market in the first half of 2021 and is now poised for growth among mid-cap companies and small and medium-sized enterprises, according to the Loan Market Association.

Unlike green debt, which must be used to finance green projects, sustainability-linked loans carry no restrictions on how the proceeds can be used, which makes them a viable option for companies in a broader range of sectors.

The coronavirus pandemic caused a temporary slowdown in the growth of sustainability-linked loan issuance in 2020, as companies' attention turned to "more pressing matters," said Martin Hutchings, financing and capital markets partner at Freshfields Bruckhaus Deringer.

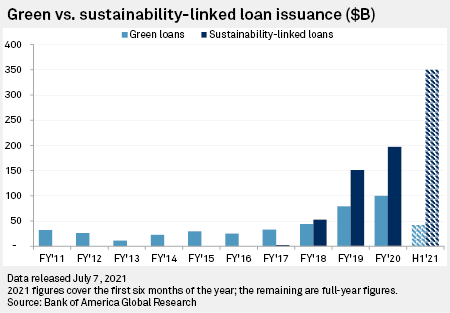

But issuance has seen "tremendous growth" in 2021, reaching $350 billion in the first six months of the year compared with the $197 billion of issuance in the full year of 2020, according to research by Bank of America. Meanwhile, the supply of green loans has largely "remained static" in recent years and totaled just $42 billion in the first half of 2021. Sustainability-linked loans have also outpaced green bond supply, which stood at $202 billion in the first six months of 2021, according to data from the Climate Bond Initiative.

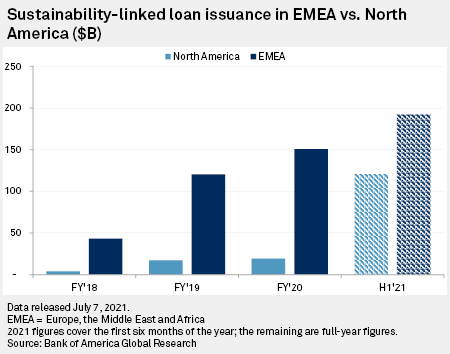

While Europe has been at the forefront of sustainability-linked loan issuance since the first such agreement was signed in 2017, the instrument's popularity has grown rapidly in North America this year. The region was behind $122 billion worth of supply in the first half of the year, up from just $19 billion in the full year of 2020, according to Bank of America.

HSBC Holdings PLC, for one, recently expanded its sustainability-linked loan offering to its U.S. business, saying it would tie loans to targets such as greenhouse gas emissions reduction, diversion of waste from landfills and reduced water use, as well as social and diversity metrics.

Banks under pressure

The need to fulfill corporate objectives related to impact financing within lending books is one of the key drivers for a "market acceleration" of sustainability-linked debt among banks, according to research by S&P Global Ratings. The financing of fossil fuel industries in particular is becoming an important issue for bank shareholders, with lenders also facing scrutiny from governments, regulators and environmental groups.

The flexibility of sustainability-linked loans makes them particularly attractive to so-called hard-to-abate borrowers, such as those in the transportation, chemicals and heavy industries sectors, who have taken up the product to a greater extent than anticipated, said Kevin Ranney, director of advisory services at Sustainalytics, which advises issuers on such loans. These sectors are among the top users of sustainability-linked loans, according to Nordea Research, which called the instrument "a relevant alternative for entities within sectors that are not green by nature."

Oil and gas majors have also sought to obtain ESG debt through sustainability-linked instruments, with Royal Dutch Shell PLC in 2019 signing one of the largest sustainability-linked loans to date, tying interest and fees paid on a $10 billion revolving credit facility to its progress against a short-term net-carbon footprint intensity target. It involved a syndicate of 25 banks, including the likes of Bank of America Corp., Barclays PLC, JPMorgan Chase & Co. and Industrial & Commercial Bank of China Ltd.

Italian oil company Eni SpA recently published a sustainability-linked financing framework in order to fully integrate the United Nations Sustainable Development Goals across various funding solutions, while its French peer TotalEnergies SE announced in February that all of its new bond issues would be linked to measurable targets.

New markets

In Europe, the sustainability-linked loan has started to grow beyond the initial focus of investment-grade companies. More than a quarter of European leveraged term loans now have a pricing mechanism with ESG language included, according to data by LCD, an offering of S&P Global Market Intelligence.

The next growth opportunity will be within the mid-cap and SME loan markets, said Gemma Lawrence-Pardew, legal director at the Loan Market Association.

The Europe-based body hopes the updated sustainability-linked loan principles, which it released in May together with other global lending associations, will support additional growth in the market worldwide, as they may make lenders more comfortable with the product and its integrity, Lawrence-Pardew said. The principles also provide more guidance and clarity on the expectations for new borrowers entering the market, which may encourage engagement from companies that may only be starting on their ESG or transition journey, she added.

Better transparency

The updated sustainability-linked loan principles promote greater transparency and integrity of the product and an increased sophistication in how key performance indicators, or KPIs, are being set, said Andrew Stanfield, counsel at Linklaters.

Most importantly, borrowers are now required to obtain independent and external verification of their performance against each sustainability target, said Caroline Courtney, a banking partner at Linklaters. This will aid banks in ensuring goals are still relevant to the borrower's business and sector, and remain ambitious, she said.

While it was common in early transactions to use an overall ESG rating as the sole KPI, the market has been moving toward using more specific and targeted KPIs, Courtney said. The updated principles further support this trend, as they require borrowers that use an overall ESG score to explain why this approach is considered the best indicator of the challenges faced, she added.

The publication of the new principles has "raised the bar" for sustainability-linked loans, said Sustainalytics' Ranney. This may make it harder for some companies to meet the requirements initially, but he expects them to rise to the challenge in the long term.

Hutchings from Freshfields said many companies may not have used the sustainability-linked loan instrument so far because they have not yet developed an ESG agenda or because they lack confidence in how they monitor or report their targets. But businesses will inevitably overcome that challenge amid the growing investor and stakeholder pressures they face to report their ESG efforts, he said.

"If they're doing that anyway, they may as well look to benefit from it financially [through the sustainability-linked loan]," Hutchings said. "I see over the next 12 months, two years, that most loans, most corporate revolving facilities at least, will start to include an ESG adjustment."