Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2021

By Nina Flitman

Sustainability-linked issuance across the European leveraged finance markets has been focused on borrowers from a few select sectors, with environmental, social and governance-linked activity barely making an impact on issuers from the less-green industries.

Since the first emergence of a sustainability-linked high-yield bond structure in Europe in March, borrowers from 14 different sectors have issued bond transactions with a coupon step-up linked to ESG-related targets, according to LCD. Of the European sustainability-linked bond activity, three borrowers have come from the Metals & Mining sector, and three have come from the Real Estate industry. Meanwhile, there have been two ESG bond issues from each of the Utilities, Chemicals, Environmental Services and Manufacturing industries.

Auto shop

While there have been 14 and 13 European high-yield bonds issued in the year to July 31 from borrowers representing the Retailing and Automotive sectors, respectively, none of these have carried ESG-related pricing structures (LCD tracked one green bond issue from Faurecia, a maker of vehicle interiors and car seats, but this didn't carry an ESG-linked pricing mechanism).

While market participants stress that they do not want to see issuers mindlessly adding sustainability-linked components to their transactions just for the sake of it, citing the potential risk of "greenwashing" — whereby a borrower overstates its green credentials for its own advantage, for example to obtain better financing terms — there is a keenness to see sustainability-linked financing from sectors that are not traditionally green.

"The way we look at it, it's surely better to have a company that's a bit brown — one that’s perhaps not got a great ESG score already, for example — so it can change for the better to reduce its emissions or increase recycling," one investor said. "That’s how we can make a difference."

ESG loans

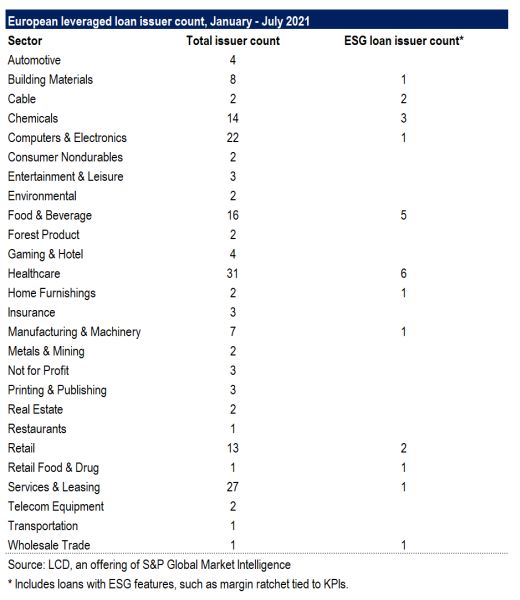

In the European leveraged loan market, borrowers from 12 different sectors issued a loan with an ESG component in the year to July 31, according to LCD. Six borrowers came from the Healthcare segment, five from Food & Beverage, and three from Chemicals.

Market participants say they are content to support ESG-linked issuance from firms representing sectors that are traditionally less green, where the imposition of sustainability targets could have the greatest impact, or from the other end of the scale, where companies have been able to demonstrate a long-standing commitment to sustainability. However, they emphasize that while borrowers from certain industries may easily identify ESG-related targets to reduce carbon emissions or increase the use of green resources, for other sectors setting meaningful and relevant sustainability targets may be more of a challenge.

"It’s a credibility issue," one senior banker said. "If a firm is already 100% sustainable, then how do they get better? For me, one of the biggest questions is around the likes of software firms, which are asset-lite companies that may already have very little impact."

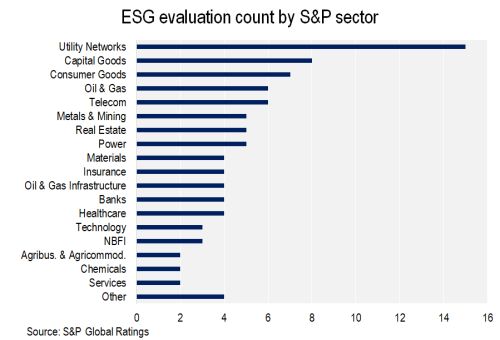

According to data from S&P Global Ratings, only two issuers from the Services sector and three from the Technology segment have sought out ESG scores. Indeed, the sectors that have shown the greatest engagement by requesting ESG evaluations are Utility Networks, Capital Goods, Consumer Goods, and Oil and Gas.

Green spaces

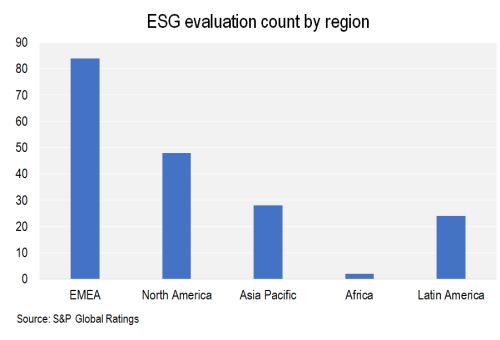

Notably, the majority of ESG evaluations have been provided to issuers hailing from EMEA, which accounts for more such evaluations than any other region, according to S&P Global Ratings.

This geographic concentration echoes the increased level of interest in sustainability-linked finance from issuers in Europe over the U.S.

In the year to date (through to Aug. 10), for example, there have been 15 sustainability-linked high-yield bonds issued in Europe compared to five in the U.S., while there have been 29 European leveraged loans with ESG-linked pricing features compared to seven in the U.S. market.