S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Jun, 2021

By Sanne Wass

As companies across a broad range of sectors increasingly look to access the environmental, social and governance debt market, analysts expect accelerated growth in issuance of a nascent type of bond that links the coupon to the issuer's sustainability performance.

For TotalEnergies SE, the so-called sustainability-linked bond has become the new normal. The French oil and gas company, formerly known as Total, announced in February that all of its new bond issues would be tied to climate key performance indicators, or KPIs.

That means the coupon TotalEnergies pays investors will be dependent on its performance against measurable targets such as its scope 1 and 2 emissions, that is, all direct and indirect emissions under the company's control. As CEO Patrick Pouyanné described it on an earnings call: "If we don't reach our target, we will be punished by a higher cost of debt, and [bondholders] will be rewarded."

Unlike traditional green and social bonds, a sustainability-linked bond comes with no restrictions on how the proceeds can be used. This flexibility allows a broader universe of issuers to obtain sustainable financing, such as those that may not have enough green or social capital expenditure to issue a sustainable use-of-proceeds bond or that lack the capacity to effectively track or report practices required for such instruments, said Lori Shapiro, an associate in S&P Global Ratings' sustainable finance team.

Issuers of sustainability-linked bonds pledge to improve their performance against tailor-made ESG targets and link this commitment directly to the coupon paid to investors. Italian energy group Enel SpA issued a first-of-its-kind $1.5 billion five-year bond in September 2019, which had a 2.65% annual coupon if the company reached a target of 55% renewable energy installed capacity by 2021. If it fails, the coupon will increase by 25 basis points until the bond matures.

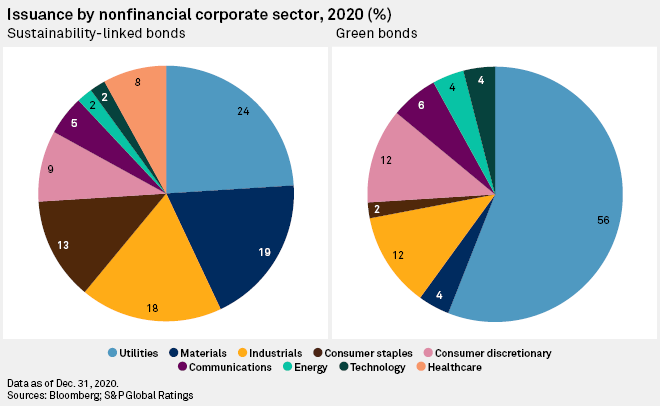

A diverse range of companies have since followed in issuing sustainability-linked bonds, with hard-to-abate sectors such as industrials and materials being "far more prominent" in this market than in green bonds, according to S&P Global Ratings research published in April.

While 84% of 2020 sustainability-linked bond issuance happened in the Europe, Middle East and Africa region, more recent figures indicate the instrument is also gaining momentum in Asia-Pacific and North America, according to the research. As of April 9, EMEA accounted for just 68% of 2021 issuance.

Shapiro expects "rapid growth" for the sustainability-linked bond market "as issuers' attention shifts more and more toward sustainability on a broader scale."

On the investor side, too, interest in the ESG financing market is on the rise. Demand continues to exceed supply, and investors are increasingly focused on company-level sustainability performance rather than just use of proceeds, said Matthias Dax, an analyst in UniCredit's financials credit research team.

Among the buyers of this new instrument is the ECB. Since January 2021, it has deemed sustainability-linked bonds eligible for its asset purchase program, providing a key boost to the market, said Dax.

UniCredit expects sustainability-linked bond issuance to grow sixfold in 2021 to $60 billion from $10 billion last year.

Green taxonomy KPIs

While investors are becoming more familiar with sustainability-linked bonds, there is still some skepticism, in particular over the so-called coupon step-up, which imposes a penalty on the issuer if it fails to reach its target.

"The coupon step-up is still something which is not accepted by the investors in general because when the company fails to achieve its targets, then, as an investor, you have a monetary benefit. And they say that's not how it should be when you are a responsible investor," Dax said.

Innovation in pricing structures could help overcome such barriers as bondholders seek to avoid the potential reputational harm that could come with profiting from a pricing adjustment by committing to allocate the penalty to ESG-related projects, according to S&P Global Ratings.

Investors have also raised concerns over labeling inconsistencies, the potential for greenwashing and the lack of ambition in the targets of sustainability-linked bonds being issued. American asset manager Nuveen warned in a recent note that "the credibility and robustness of these deals remain highly variable," pointing to several recent bonds in which the KPIs were "gamed to make them relatively easy to achieve," and called for targets and reporting frameworks to become more science-based and aspirational.

While the Sustainability-Linked Bond Principles, published by the International Capital Market Association in June 2020, are helping to promote market discipline, the introduction of new disclosure frameworks such as the EU's green taxonomy will further accelerate standardization in the instrument over time, according to Shapiro.

Due to come into effect in 2022, the taxonomy defines the criteria for a project or financial product to be labeled as "green." The European Commission in April published the first version of this rule book, covering sectors such as energy, forestry, manufacturing, transport and buildings.

Using the taxonomy as a reference point for KPIs in a sustainability-linked bond, a real estate company or mortgage provider may choose targets around the share of taxonomy-aligned buildings in its portfolio, while a utility company could do the same for taxonomy-aligned energy sources and a bank for its green asset ratio, Dax said.

Such moves will help to support the credibility of the sustainability-linked bond market but may also lead to some loss of flexibility, he added. Experts have deemed flexibility an important characteristic in enabling the growth of sustainability-linked debt as it allows the targets to be meaningfully tailored to the company's particular business.

One limitation of the taxonomy is that it covers only environmental themes, but this scope may well expand over time if the EU decides to also launch taxonomies for social or transition activities, said Michael Wilkins, a managing director in S&P Global Ratings' sustainable finance team.

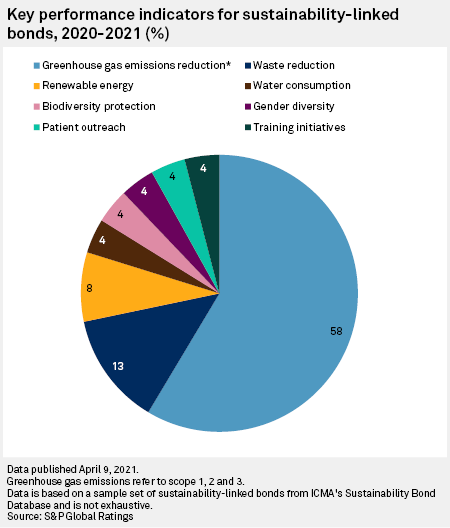

So far, 85% of the KPIs used in sustainability-linked bonds have been related to environmental targets such as greenhouse gas reduction, renewable energy and waste consumption, according to the rating agency.

While the sustainability-linked debt market is growing fast, it is still nascent compared with traditional use-of-proceeds ESG bonds, and the two types of instruments will continue to grow "in tandem," said Wilkins.

S&P Global Ratings expects green and social bond issuance to reach about $650 billion in 2021 compared with the $50 billion forecast for sustainability-linked bonds.

"We don't see the linked market as cannibalizing the use-of-proceeds market or vice versa," said Shapiro.