S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Feb, 2021

By Brian Scheid

U.S. Treasury yields remain well below historic levels, but their recent, rapid move up has analysts warning of a quick end to the rally in U.S. equities.

"The faster yields move up, the worse it would be for equities," said Andrew Brenner, head of international fixed income at National Alliance Securities, in an interview.

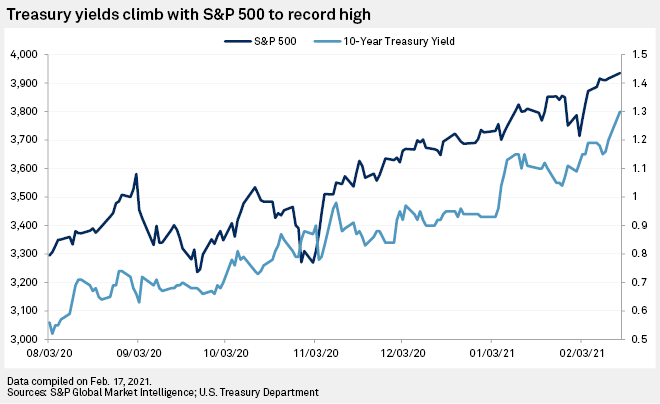

On Feb. 18, the 10-year Treasury yield settled at 1.29%, unchanged from Feb. 17, but up 14 basis points since Feb. 10. The 30-year yield has increased 16 basis points over that time, settling at 2.08% on Feb. 18. Since early August, the 10-year yield has increased 73 basis points, while the 30-year yield has jumped 85 basis points.

"If yields push onwards and upwards from here, then this could put some pressure on the stock markets," said Fawad Razaqzada, a market analyst with ThinkMarkets, in a Feb. 17 note.

Government bonds, which are largely viewed as a lower risk, lower reward investment than equities, tend to garner more demand during times of economic uncertainty. Before this week, increasing Treasury yields, which have an inverse relationship with bond prices, have corresponded with a rally in stocks. The S&P 500, for example, has increased 19.3% since early August as the 10-year Treasury yield climbed by 73 basis points. The large-cap index has remained relatively unchanged this week, declining less than 0.1% on the week, as bond yields have risen.

It would not take much more of an increase in yields to drive stock prices down, analysts said. It is simply a matter of how quickly the increase takes place.

"We look at it not just from an absolute level of yields," Tom Essaye, founder of Sevens Report, wrote in a Feb. 17 note,

There are too many factors at play to determine where, exactly, yields could become a hindrance for equities, said Michael O'Rourke, chief market strategist at JonesTrading. The velocity of the rise in yields is what matters, he said.

"If it is stable and steady, it is easier for equities to digest," O'Rourke said in an interview. "A quick spike has the potential to create a shock."

Brenner with National Alliance Securities said he expects such a spike to cause a correction of about 10% by late February or early March, with most of the decline occurring in the Nasdaq or large-cap tech stocks which outperformed in 2020.

The Nasdaq, which closed Feb. 18 down 0.7% from Feb. 17, remains up about 103% from its March 21 trough.

The recent increase in bond yields has been largely driven by the reflation trade, a bet on a return of inflation from a new wave of stimulus spending under President Joe Biden and a Democrat-controlled Congress.

"The reflation trade that has been good for stock markets as it's driven by optimism around the recovery," Craig Erlam, a senior market analyst with OANDA, said in a Feb. 17 note. "But that will only continue to a point and if yields start rising at a rate considered too fast, sentiment will quickly change in stock markets."

In a Feb. 17 note, Padhraic Garvey, a regional head of research with ING, said the 10-year yield has increased by 5 basis points per week since January, a pace he called "uncomfortably fast" for both risk assets and, potentially, the current, accommodative policy at the Federal Reserve.

"If the market starts to extrapolate that to 1.5% in the next few days then risk assets will likely have a severe hiccup along the way," Garvey wrote. "Should Treasury yields continue to rise too fast, it will bring everything else down with it."

But Paul Schatz, president of Heritage Capital, threw severe doubt on a 1.5% yield derailing either dovish Fed policy or the ongoing equity market bull market.

"It may force some wicked rotation, but value and cyclicals thrive in a gently rising yield environment," Schatz said in an interview.

In a note, Bilal Hafeez, CEO of Macro Hive, wrote that climbing U.S. Treasury yields are "good for equities," pointing to how the doubling of the 10-year yield since August 2020 has corresponded with a 20% increase in U.S. stocks.

"This positive correlation suggests that what matters for equities is the nominal growth expectations side of rates markets," Hafeez wrote. "Higher yields mean greater nominal growth expectations, which is positive for equities."