Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 May, 2021

By Michael Copley and Camille Erickson

| Workers move batches of copper sheets in Zambia. The cost of copper and other raw materials is emerging as a key concern as the world tries to transition away from fossil fuels. Source: Per-Anders Pettersson/Getty Images News via Getty Images |

Soaring raw-material costs are putting a damper on the renewable energy industry, which rocketed into 2021 on the back of record growth forecasts and new commitments from governments and businesses to limit climate change.

Rebounding economic activity and government stimulus spending have lifted prices for steel, copper and other metals used in wind turbines and solar panels. Manufacturers, in turn, are raising equipment prices, which is threatening construction schedules and investment returns for project backers. A jump in shipping costs and port congestion following the blockage of the Suez Canal in March and a February storm in Texas have created further headwinds.

"Unfortunately, at the same time as we are seeing record demand for solar, our industry is contending with increases in steel and shipping costs that are unprecedented both in their magnitude and rate of change," James Fusaro, CEO of Array Technologies Inc., which makes tracking systems for solar plants, said on an earnings call May 11.

The cost of raw materials is emerging as a key concern as the world tries to transition away from fossil fuels. Energy systems that run on wind, solar and battery resources are much more mineral-intensive than those fueled by hydrocarbon resources, the International Energy Agency said in a recent report. An onshore wind farm, for example, requires nine times more minerals than a natural gas plant, the agency said.

While activity remained strong in the U.S. renewable energy market during the first quarter, executives and analysts are warning of potential disruptions as prices for iron ore and copper hit record highs. Analysts at Roth Capital Partners LLC on May 16 said 15% of utility-scale solar projects could be delayed this year.

Solar project developers are trying to put off procurement in hopes that equipment and freight prices will be lower in 2022, Edurne Zoco, executive director of clean technology and renewables at IHS Markit, said in an email. However, she said a "significant part" of the project pipeline has contracts that require construction to be completed this year.

"In the U.S., in particular, the projects that people have bid are under significant pressure really from all dimensions," Mark Widmar, CEO of solar panel manufacturer First Solar Inc., said on an earnings call April 29. "There's going to be a number of these projects that are just not going to happen."

In addition to surging metals prices, solar companies are also facing shortages of semiconductor chips and higher costs for polysilicon, a key ingredient in most solar panels, while the wind industry is paying more for resins that are used in rotor blades.

"I don't think any customers call you and ask for a price increase. And I don't think in our partnership and our relationship with customers that we underestimate the hassle and ... potentially the negative effect when some of the components [change]," Henrik Andersen, CEO of Vestas Wind Systems A/S, one the world's leading wind turbine manufacturers, said on an earnings call May 5.

"But the art of this technology is that it contains quite [a lot of commodities] and underlying components," Andersen said. "When that goes up in price, there isn't a magic thing that can just take that price increase away."

| Wind turbines at the Rim Rock Wind Farm in Montana. According to the International Energy Agency, an onshore wind farm requires nine times more minerals than a natural gas plant. Source: William Campbell/Corbis News via Getty Images |

'Looming mismatch'

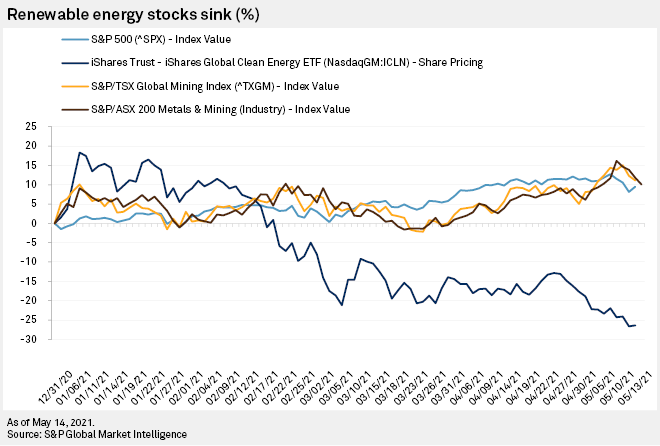

Renewable energy investors are worried by what they see. As of May 14, the iShares Global Clean Energy ETF was down 23.5% year to date compared to an increase of 11.1% in the value of the S&P 500. That is a sharp reversal from 2020, when renewable-energy indexes outperformed the broader market by wide margins.

Philip Shen, a managing director and senior research analyst at Roth Capital Partners, said the weakness in renewable energy stocks is primarily due to "the steady [and] unrelenting increase in prices of raw materials and components."

"Despite continued policy support and a robust global demand outlook for renewables, the market is basically saying whatever demand or margin companies end up realizing may be worse than expected," Shen said in a note May 11. "[Many] investors appear to be ignoring any upside signs ... because they may not believe the companies can fully realize that demand or margin given supply constraints."

Renewable energy executives can only guess when metals prices will ease.

"It's just a matter of time, it always happens," Antonio Carrillo, president and CEO of Arcosa Inc., which makes towers for the wind industry, said on an earnings call April 30. "Is it going to be in three months or six months? I cannot tell you. But I'm optimistic that by the end of the year, we're going to see trends in a better direction."

Mark Ferguson, head of mining studies for S&P Global Market Intelligence's Metals & Mining Research Division, said there has been "some traction" in mining companies' exploration budgets in recent years, "and these types of prices are going to start encouraging companies to commit to building some of those mines."

However, "the overall narrative is that there has been a lack of discoveries, particularly for copper," he said. And unlike past periods of inflation in metals markets, the mining industry is facing a new source of demand now from the renewable energy and electric vehicle markets.

"The [economic] rebound that's been happening … coming out of the pandemic is one thing, but then thinking about that energy transition, the electrification of grids and EV infrastructure" adds more variables, Ferguson said, noting that the speed of the transition will likely dictate the level of demand for essential commodities.

Fatih Birol, executive director of the IEA, has raised similar concerns, saying policymakers need to send strong signals to the market to avoid a "looming mismatch" between the world’s climate targets and the availability of critical minerals.

"I don't think any transition was going to be smooth," Ferguson said.

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.