Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jul, 2022

By Iuri Struta

As the European telecom sector forges ahead on reducing its direct carbon emissions, cleaning up the supply chain remains a challenge.

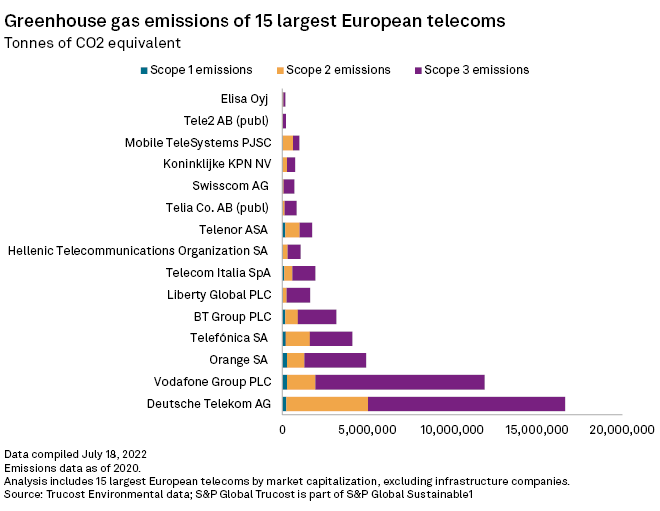

Scope 1 emissions, those emitted directly by a company's business, represent just 3.2% of the carbon footprint generated by the largest 15 telcos in Europe by market capitalization, according to data from S&P Global Market Intelligence. Scope 2, indirect emissions associated with the purchase of energy, represent about 24.6%. Most of the companies' emissions are Scope 3, emanating from the upstream and downstream operations across their supply chains, including emissions caused by customers' use of the companies' products or services.

Not only is Scope 3 the largest emissions source, it is also the hardest to measure and to mitigate, climate and industry experts said. "Telecom companies need robust models to consistently and accurately measure Scope 3 emissions across the value chain," said Praveen Shankar, UK and Ireland TMT Leader at global consultancy firm Ernst & Young.

Size and scope

Europe's 15 largest telecom operators emitted 36.6

"The biggest challenge is the vast supply chain. When you're using big pieces of technology that are produced by multiple suppliers, the key thing is to collaborate with those suppliers," said Dexter Galvin, global director of corporations and supply chains at CDP, a nonprofit that runs a global disclosure system through which companies report on their environmental targets and emissions.

Some suppliers are better equipped than others to make the investments necessary to go green.

"We have identified a 'long tail' of [small and medium-sized enterprise] suppliers that require support to measure and reduce their carbon emissions," said Steven Moore, head of climate action at GSMA, a telecom industry association. "The GSMA is working with members to encourage more industry suppliers to disclose their carbon emissions and set targets through the global CDP reporting platform."

Multinationals

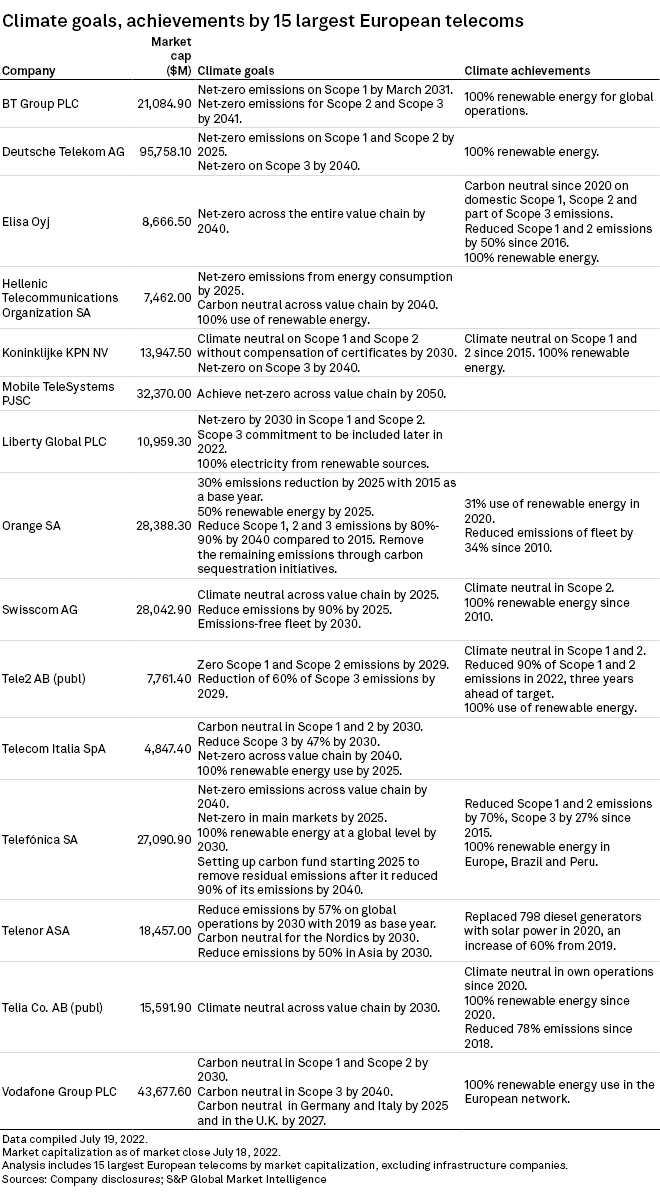

Companies with continent-spanning operations also face unique obstacles. Vodafone is already using 100% renewable energy to power its European network, and it aims to be carbon-neutral in many European countries before 2030. However, it could face bigger obstacles in Africa and Asia, regions that have moved more slowly to reduce the reliance on fossil fuels to power their electrical grids.

Telenor ASA aims to be carbon-neutral in the Nordics by 2030, but in Asia it has only pledged a 50% reduction in emissions.

"It is relatively easier to achieve carbon neutrality when the grid of the country is moving toward more renewable energy," Galvin said.

U.K.-based BT Group PLC, Finland-based Elisa Oyj and Netherlands-based Koninklijke KPN NV are among the few European telco operators satisfying 100% of their electricity needs from renewable sources. This has helped them to achieve climate neutrality in their own operations by offsetting some remaining Scope 1 emissions, like those from car fleets, through purchases of carbon credits or certificates.

Leading the way

A few companies are forging a path forward on measuring and reducing Scope 3 emissions.

A spokesperson for Swisscom told S&P Global Market Intelligence that the company intends to recover 1 million more tons of CO2 than it uses. "This target enables a positive CO2 contribution which is four times higher than our company emissions," Swisscom said in an emailed comment.

Sweden-based Telia Co. AB (publ) has pledged to become net-zero across the value chain by 2030.

Netherlands-based KPN has vowed to be net-zero in Scope 3 by 2040. The company has been climate-neutral on Scope 1 and Scope 2 since 2015. KPN's intermediary goal is to reduce Scope 1 and Scope 2 emissions to zero by 2030, eliminating the need for it to compensate for today's remaining carbon emissions with renewable energy certificates.

U.K.-based Liberty Global PLC, which has a big presence in European markets, is the only company among its peers that has not yet set a Scope 3 commitment, though it plans to establish one this year. Liberty Global aims to reduce its Scope 1 and Scope 2 emissions to net-zero by 2030.

Accelerating action

Broadly speaking, experts say that telcos are treating carbon emissions with increasing urgency. To reduce Scope 3 emissions, companies are pushing suppliers to adopt science-based targets and improve transparency around their emissions.

"Sustainability is becoming embedded in many projects of telecom companies," said Shankar of Ernst & Young. "It is starting to become an integral part of overall business strategy."

For instance, BT requires its suppliers to meet environmental and human rights procurement standards. BT suppliers with a contract value of over £25 million must set a science-based net-zero target. Contracts also have a carbon-reduction clause, with 10 BT suppliers already signing up and many more to come, the company said.

Deutsche Telekom includes sustainability criteria in the selection process for its suppliers, which is currently weighted at 10%, although the company wants to increase that to 20% for all tendering processes.

"There is always more that can be done, but it is apparent that there is a willingness across the sector to remain at the forefront of the debate, be a leader in the conversation and continue to push the boundaries to accelerate action," said GSMA's Moore.

S&P Global Trucost is part of S&P Global Sustainable1.