S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Mar, 2021

By Chris Rogers

Global supply chains have faced a mixture of rising costs and continued congestion in logistics networks. This report updates our earlier work, considering the sources of the challenges faced in light of companies' fourth-quarter 2020 earnings reports and conference calls held during the first quarter.

Shipping rates still high, short-term relief possible

Global container shipping rates started to surge in June 2020 as economies started to reopen after the initial round of coronavirus-related lockdowns. Careful capacity management by the container shipping companies compared to a jump in demand for stay-at-home consumer goods resulted in rates that increased to a peak of $4,570 per 40-foot equivalent unit, or FEU, on March 5 compared to $1,040 per FEU on June 1, 2020, according to S&P Global Platts data. That excludes a wide range of surcharges, as discussed in Panjiva's research of March 2.

There are some signs of a relief of pressure on rates, with China-outbound rates measured by the Shanghai Shipping Exchange dipping 4.9% on March 5 versus Feb. 19. However, this likely reflects the normal seasonal downturn after the Lunar New Year rather than being a sign of an overall relief in fundamentals.

No sign of demand declining

The key drivers of demand, including elevated consumer durables demand and supporting industrial recovery, are still very much in place. The passage of the U.S. stimulus package may offset the reopening of leisure activities and keep the demand side of the equation in place.

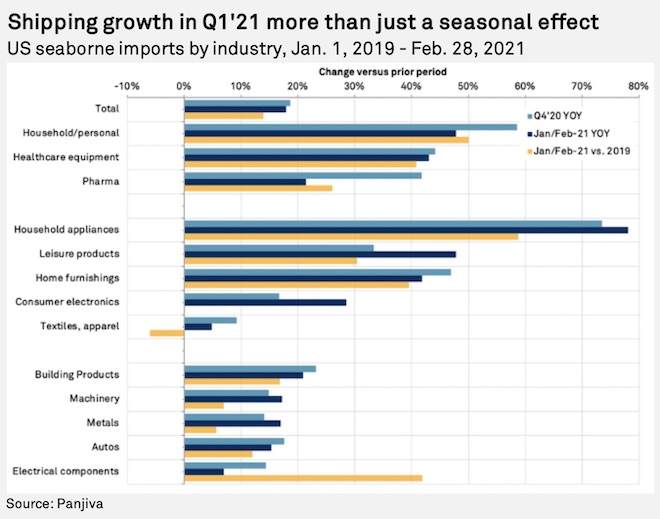

As of February, U.S. seaborne imports climbed 29.3% year over year and by 20.1% compared to the same period of 2019, Panjiva's data shows. When combining January and February to offset the timing of the Lunar New Year, the increase was 17.9% — with the growth versus the same period of 2019 being 13.9%.

Imports of consumer discretionary products climbed by 38.2% year over year in January and February combined and by 22.7% versus the same period of 2019. Imports of industrial products, including capital goods and components, rose by 19.2% year over year and by 15.2% compared to 2019.

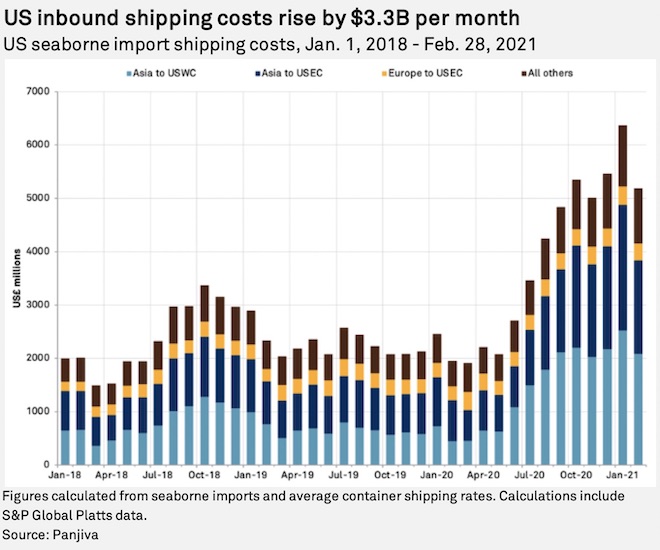

Container shipping costs rise by more than $3 billion per month

The mixture of higher costs per container shipped and an increased number of containers being transported has added billions of dollars to supply chain operating costs. In February, the container shipping costs for U.S. seaborne imports can be estimated at $5.19 billion compared to $1.95 billion a year earlier. That is based on S&P Global Platts route-specific rates and U.S. seaborne imports of containerized freight from Panjiva's data in Asia-U.S. West Coast, Asia-U.S. East Coast, Europe-to-U.S. East Coast and other routes.

That followed costs of $6.37 billion in January compared to $2.46 billion a year earlier. That brought the average monthly year-over-year increase in costs to $3.33 billion in the October 2020 to February 2021 period.

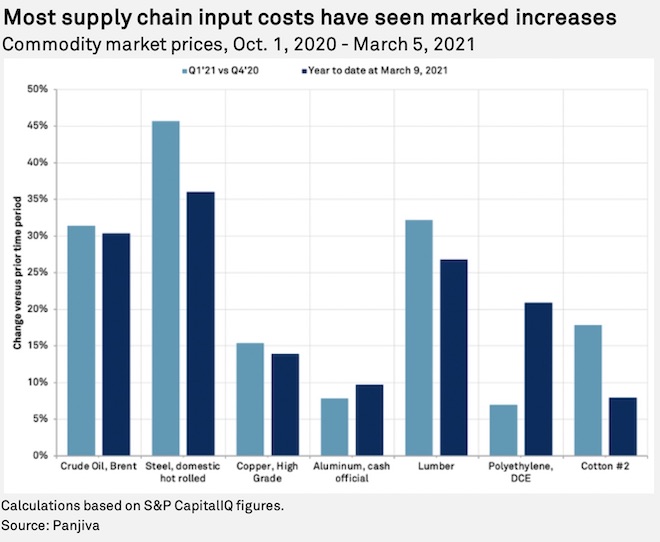

Commodity rates picked up too

Freight costs are not the only expanding expense that supply chains have faced in 2021. Panjiva's analysis of S&P Capital IQ data shows a basket of seven energy, metals and industrial commodities have increased by 21.7% year to date and by 23.5% in the first quarter compared to the fourth quarter of 2020 on average. The fastest rate of growth has been in steel supplies at 36.0% year to date, followed by a 30.3% rise in crude oil prices and a 26.8% rise in lumber.

While some of the increase may be due to temporary factors — polyethylene's 20.9% rise may be down to recent winter storms in Texas — the nature of commodity price hedging by many corporates could lock in higher costs for an extended period.

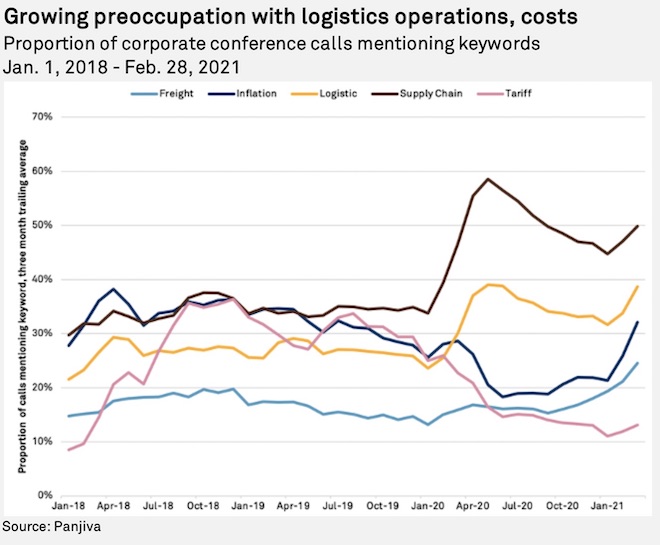

Corporations, investors increasingly preoccupied with freight and inflation

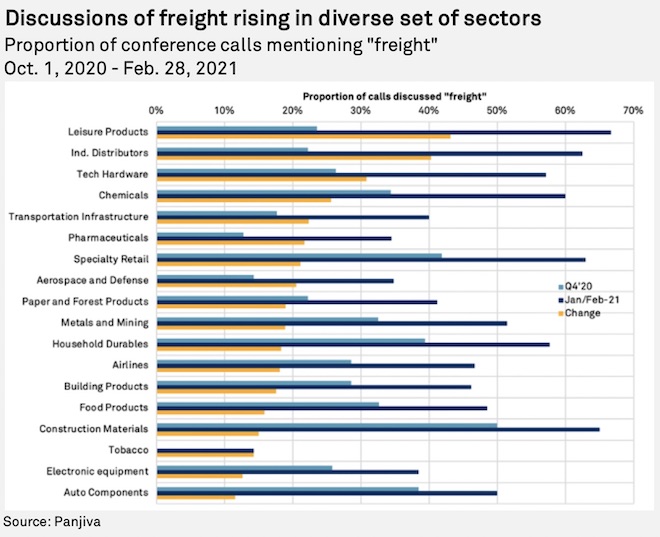

Panjiva's analysis of company earnings call transcripts for keywords and phrases can provide a guide to the preoccupations of senior management teams. The proportion of calls held in January and February mentioning "freight" and "inflation" increased 41.0% and 44.8%, respectively, versus calls held in the fourth quarter of 2020. In aggregate, 25.4% of calls mentioned "freight" while 31.7% of calls included mentions of inflation. That likely reflects a growing focus by investors, in Q&A, and management during scripted remarks with the rising costs identified above.

There was also a growing number of mentions of "logistics" (37.0% of calls from 33.2% in the fourth quarter of 2020) and "supply chain" (50.1% from 46.7% in the fourth quarter of 2020), suggesting concerns regarding the operation of supply chains as well as the costs of them.

Discussions of "tariffs," in the meantime, were unchanged (13.4% of calls versus 13.0% in the fourth quarter of 2020). The lower level of mentions versus other topics likely reflects companies having already implemented strategies to deal with the Trump administration tariffs. The potential for reduced tariffs under the Biden administration has yet to surface.

At a sector level, the fastest rate of a pickup in mentions of "freight" have occurred in leisure products (ranging from toys to fitness equipment and including companies such as Callaway Golf Co.), with 66.7% of calls mentioning the phrase in January and February compared to 23.5% in the fourth quarter of 2020. That was followed by industrial distributors, which increased to 62.5% from 22.2%.

The second-highest number of mentions in January and February was in the specialty retail sector, with 63.0% of companies discussing the topic of freight, up from 41.9% in the fourth quarter of 2020. There have been concerns expressed across the retail industry no matter the consumer sector, with both Qurate Retail Inc. (home retail) and Urban Outfitters Inc. (store and e-commerce) discussing rising freight costs.

A pickup in mentions of freight in technology hardware (57.1% from 26.3% in the fourth quarter of 2020) has come at the same time as an emergent shortage of specialty semiconductors, which has started to afflict consumer electronics companies as well as automobile manufacturers. Perhaps unsurprisingly, there was also a pickup in mentions of freight (40.0% from 17.6% in the fourth quarter of 2020) in the transportation infrastructure space given the impact on costs of port congestion.

Products needed to tackle the pandemic have run into the same challenges as other sectors. That has resulted in increased discussions of freight in pharmaceuticals (34.5% from 12.8% in the fourth quarter of 2020) as vaccine rollouts start, and in paper/forest products (41.2% from 22.2% in the fourth quarter of 2020) as products as basic as tissues continue to face distribution challenges.

Plenty of solutions, very few cutting back shipments

Few companies have discussed explicitly what their plans are for offsetting cost increases among the options of rising prices for customers, accepting a diminution of profits, restructuring their supply chains, renegotiating with suppliers, and temporarily cutting back shipments and run-down inventories. Further research is needed to investigate those topics on a programmatic basis.

It is clear, however, that cutting back shipments and running down inventories is not a popular strategy. This is perhaps unsurprising given the strength of demand in many sectors and challenges in fulfilling demand previously — nobody likes losing market share.

Out of the 28 companies where Panjiva Research has carried out deep-dive analyses in the past two months, 64.3% are still increasing their U.S. seaborne imports on a year-over-year basis in January and February combined.

That compared to 75.0% of companies increasing shipments in the fourth quarter of 2020. However, only 35.7% of companies either slowed the rate of growth in shipments or raised the rate of decline. Only 21.4% of the companies analyzed this quarter have cut their imports on a year-over-year basis in January and February after increasing them in the fourth quarter of 2020.

The companies with the fastest rate of momentum (growth in January and February less growth in the fourth quarter of 2020) were Energizer Holdings Inc. and Crocs Inc., with growth rates in January and February of 88.3% and 39.5% year over year, respectively. The fastest turnaround was seen in shipments linked to HNI Corp., which rose 48.6% in January and February versus a 13.8% decline in the fourth quarter of 2020.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.